RBI has amended the Master Directions on PSL, which applies to every Commercial Bank (including Regional Rural Bank (RRB), Small Finance Bank (SFB), Local Area Bank), and Primary (Urban) Cooperative Bank (UCB).

New PSL Guidelines

- To address regional disparities, districts will be ranked based on per capita credit flow to the priority sector.:

- It aims to build an incentive framework with higher weight (125%) for districts with comparatively lower credit flow and a disincentive framework with lower weight (90%) for districts with comparatively higher credit flow.

- Effective Period: From FY 2024-25 to FY 2026-27.

- All bank loans to MSMEs shall qualify for classification under PSL.

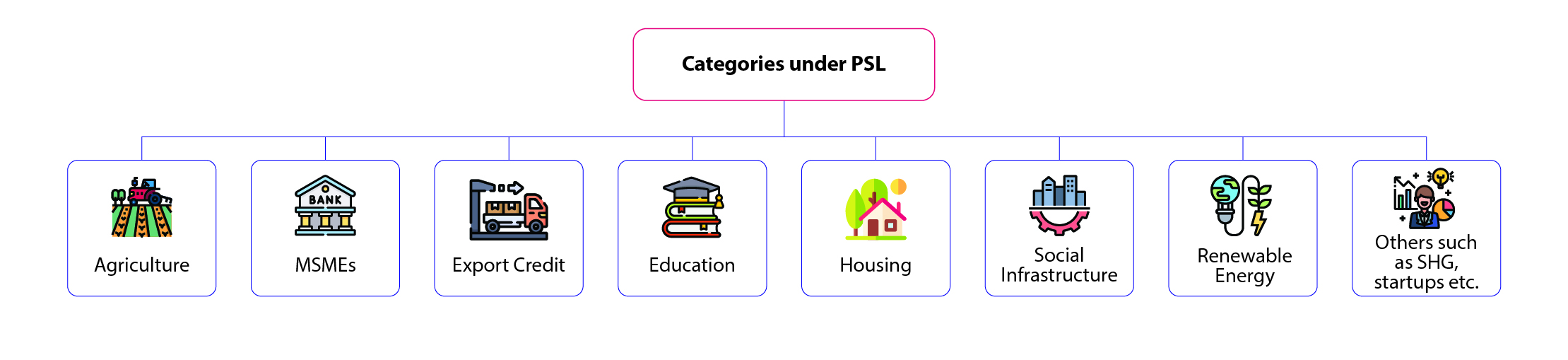

About Priority Sector Lending (PSL)

- PSL was formalised in 1972 to facilitate flow of credit to such sectors, which though creditworthy, are unable to access credit from formal financial institutions.

- PSL Targets: Banks have to mandatorily allocate a portion of their Adjusted Net Bank Credit (ANBC) or Credit Equivalent of Off-Balance Sheet Exposure (CEOBE), whichever is higher, towards PSL.

- Mandated target differs for different banks and is 40% for Scheduled commercial banks and foreign banks (with 20 or more branches) while it is 75% for RRBs and SFBs.

- UCBs have to allocate 65% to PSL in FY 2024-25 but increasing it to 75% in FY 2025-26.