Kisan Credit Card (KCC)

The Kisan Credit Card scheme provides farmers and allied sector workers with timely, flexible credit through banks to meet cultivation, post-harvest, marketing, consumption, and investment needs under a single window system.

Quick facts

- Purpose: To meet the financial requirements of farmers at various stages of farming.

- Implementing agency: Commercial Banks, RRBs, Small Finance Banks and Cooperatives.

- Eligibility: Farmers - individual/joint borrowers who are owner cultivators; Tenant farmers, oral lessees & share croppers; Self Help Groups (SHGs) or Joint Liability Groups (JLGs) of farmers including tenant farmers, share croppers etc.

- Allied sectors coverage: Animal husbandry and fishery related

Objectives

- Adequate and timely credit support from the banking system under a single window with flexible and simplified procedure for:

- To meet out the short term credit requirements for cultivation of crops,

- Post-harvest expenses,

- Produce marketing loan,

- Consumption requirements of Farmer Household,

- Working Capital for maintenance of farm assets,

- Investment credit requirement for agriculture and allied activities.

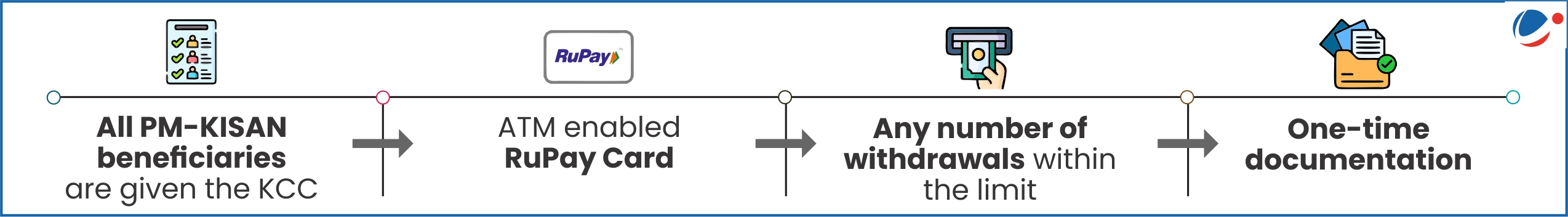

Salient features

|