National Highways Infra Trust (NHIT) raised about Rs.18,380 crore in the 4th round of fundraising.

- NHIT is the InvIT set up by National Highways Authority of India (NHAI) in 2020 to support India's Monetization programme.

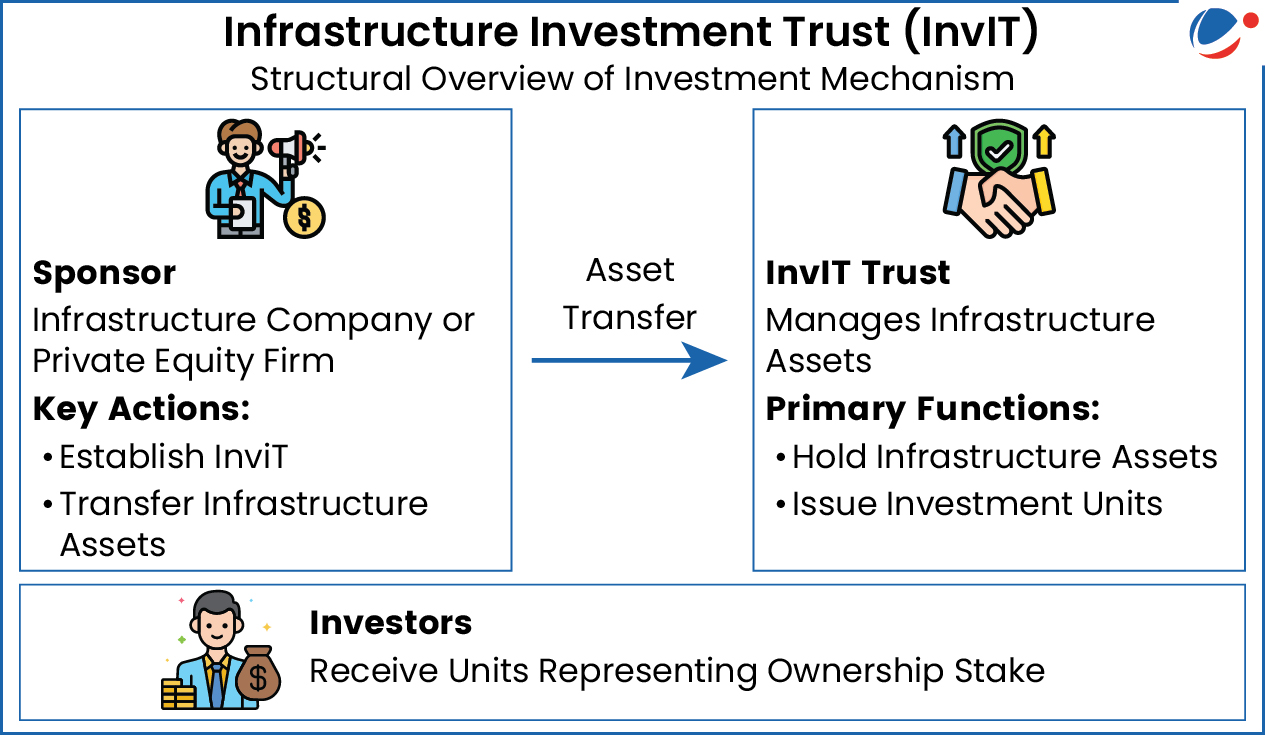

Infrastructure Investment Trust (InvIT)

- Definition: It is an investment vehicle, like a mutual fund or Real Estate Investment Trusts (REITs).

- InvITs enable direct investment of money from individual and institutional investors in infrastructure projects.

- Investments can be made directly or through SPV (Special Purpose Vehicle)/Holding Company by the InvIT.

- InvITs earn income through tolls, rents, interest or dividends from their investments.

- The interest, dividend, and rental income are taxable in the hand of the unitholder.

- Regulation: InvIT are regulated by the SEBI (Infrastructure Investment Trusts) Regulations, 2014.

- SEBI requires InvITs to distribute at least 90% of their income to investors.

- InvITs are recognized as borrowers under the ‘Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002’.

- Types of InvITs: Public InvITs, Private listed InvITs and Private unlisted InvITs.

- Advantages of InvITs: Access to retail investors to invest in large infrastructure projects, low ticket size, liquidity (as units are listed on stock exchanges), etc.

Asset Monetization (AM)

|