National Highways Authority of India’s Asset Monetization strategy aligns with Assets Monetization Plan - 2025-30.

Key provisions of Strategy:

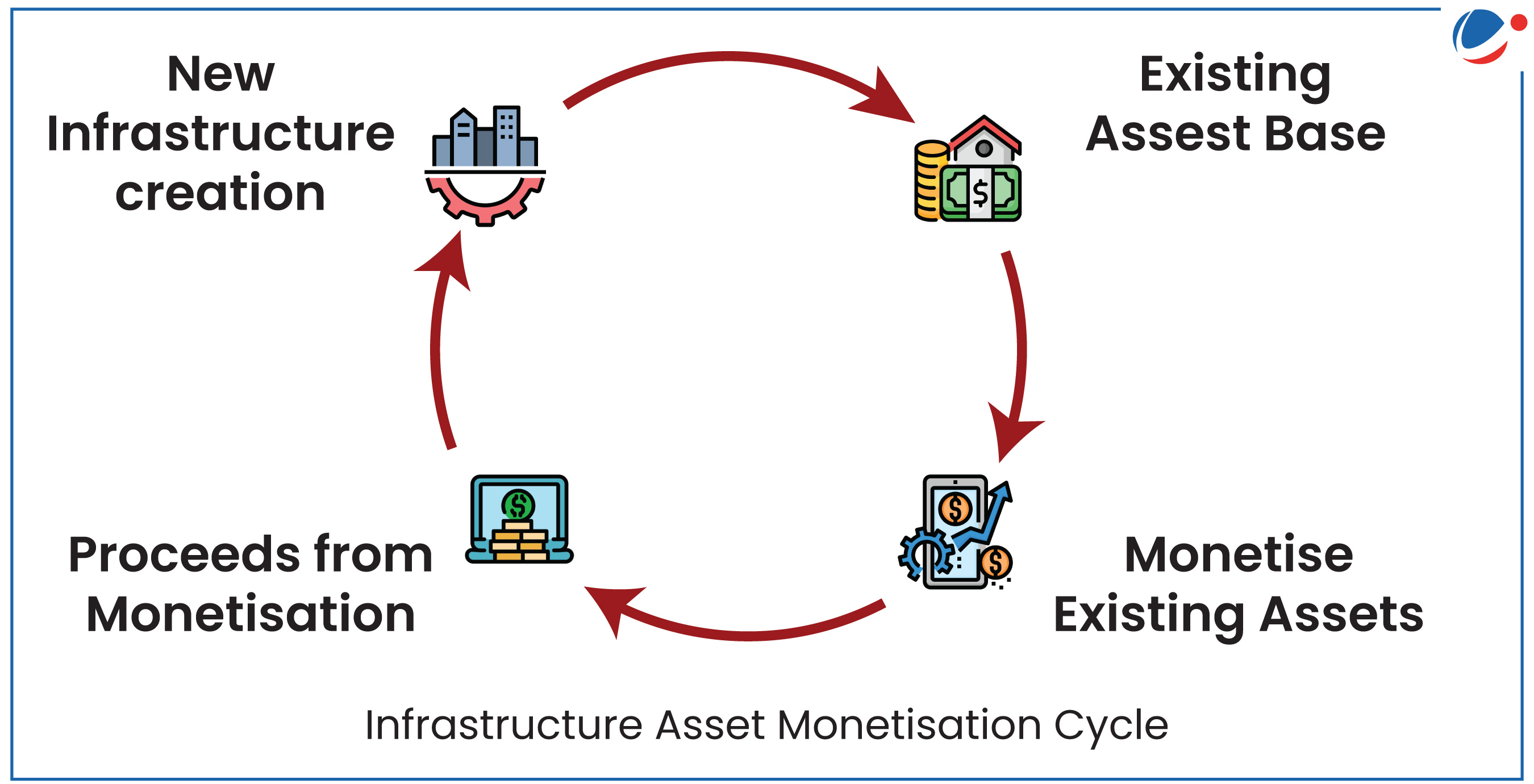

- Aim: To unlock value of operational National Highway assets and increase Public Private Partnership in India’s infrastructure development.

- Three core pillars: Value Maximization of Assets, Transparency of Processes, and market development.

- Three modes of asset mobilization: Toll-Operate-Transfer (ToT), Infrastructure Investment Trusts (InvITs), and securitization models.

- Toll-Operate-Transfer (ToT): Concessionaires by paying lump sum amount take rights to maintain and operate the road; in lieu of this, s/he will collect user fees (toll) for these roads for the duration of the concession period.

- Infrastructure Investment Trust (InvIT): It is like a mutual fund, which enables direct investment of money from individual/institutional investors in infrastructure.

- Earn income through tolls, rents, interest or dividends from their investments.

- Introduced in India in 2014 and regulated by Securities and Exchange Board of India (SEBI).

- Securitization model: Securitization is the process in which certain types of assets are pooled so that they can be repackaged into interest-bearing securities.

- The interest and principal payments from the assets are passed through to the purchasers of the securities.

Asset Monetization

|