Recently Sebi imposed a fine on some individuals for allegedly operating a ‘pump and dump’ scheme.

- It was operated by recommendations shared through Telegram channels, resulting in public shareholders purchasing stock at inflated prices.

About Pump and Dump Scheme:

- A manipulation activity involving artificially inflating a stock’s price through false and misleading information/ recommendations.

- It is done only to sell stock at an inflated price.

- Prevalent in micro-cap and small-cap sectors due to limited public information and lower trading volumes.

- Impact: Undermine confidence in financial markets, and substantial losses to investors.

- Regulation: Under SEBI’s guidelines, it is completely banned.

The new norms allow for the issuance of subordinate units by privately placed InvITs only to the sponsors on acquisition of an infrastructure project.

- The move aims to bridge the difference in valuation done by the sponsor (as a seller) for an asset and that by the InvIT (as a buyer).

About InvITs

- A type of investment vehicle similar to a mutual fund that allows investors to invest in infrastructure projects like toll roads, power lines and pipelines etc.

- The sponsors (infra companies) set up the InvITs through SEBI and are recognized as borrowers under the SARFAESI act 2002.

- Parties to an InvIT include its trustee, sponsor, investment manager and project manager.

- InviTS earn income through tolls, rents, interest or dividends from their investments, which in turn is distributed to the investors as their taxable earnings.

Significance of InvITs

- Low ticket size: The investor can invest small amounts

- Liquidity: Listed on stock exchanges and can be exit at any point

- Transparency: investors are informed about where their money is invested

- Low Risk: as the trusts are regulated by SEBI

Challenges of investing in InvITs include operational risk, refinancing risk, return risk etc.

SEBI has formed a committee under Usha Thorat to review ownership and economic structure of clearing corporations.

Clearing Corporation (CC)

- It is an entity which handles the activity of clearing and settlement of trades in securities or other instruments that are traded on stock exchanges.

- CCs along with stock exchanges and depositories constitute Market Infrastructure Institutions.

- CCs are significant as central risk management institutions and as a first line regulator.

- Securities Contracts (Regulation) (Stock Exchanges and Clearing Corporations (SECC)) Regulations, 2018 lays down norms for ownership and governance framework of CCs.

National Stock Exchange (NSE) chief cautioned retail investors against derivatives trading.

About Derivatives

- Definition: Derivatives are financial contracts that draw their value from an underlying asset.

- The underlying asset can be a commodity, security, currency, or index.

- Purpose: Can be used for hedging purposes or speculation.

- Types: Common types of derivatives include futures, options, and swaps.

- Derivatives Market

- In India, the derivative market is regulated by the Securities and Exchange Board of India.

- India has two types of derivative markets:

- Exchanges-traded: Standardised contracts are traded on an exchange.

- Over-the-Counter (OTC): It is decentralised. Contracts are negotiated directly between two parties.

Recently, a Mutual Fund was alleged to have indulged in Front- Running.

About Front Running

- Front Running refers to usage of non-public information to directly or indirectly buy or sell securities, or enters into options or futures contracts, in advance of a substantial order. (Securities and Exchange Board of India (SEBI))

- It is illegal in India.

- It undermines confidence in the financial markets and creates an uneven playing field for other investors.

- In 2022, Securities and Exchange Board of India (Mutual Funds) Regulations, 1996 was amended to incorporate provisions to counter front running.

It is prepared and released by the Food and Agriculture Organization (FAO).

- The report’s special focus is on “Blue Transformation in Action”.

Key findings of the report

- World fisheries and aquaculture production hit a new high in 2022 at 223.2 million tonnes.

- With 8 percent of total production, India ranked second in aquatic animals production.

- For the First time, aquaculture surpassed capture fisheries as the main producer of aquatic animals.

- With 1.9 million tonnes, India ranked first in Inland fisheries production.

Role of Aquatic Foods in Climate Action

- The 2023 United Nations Framework Convention on Climate Change (UNFCCC) Ocean Dialogue recognized the potential of aquatic foods for providing critical climate solutions.

- FAO integrates traditional knowledge for adapting to climate change in specific areas, like local species suited for evolving conditions.

Blue Transformation in Action

- FAO introduced its “Blue Transformation” vision in 2021, It aims to leverage aquatic food systems, to enhance food security, improve nutrition, etc

- Objectives:

- Sustainable aquaculture expansion to meet global demand, with equitable benefit distribution.

- Effective fisheries management for healthy stocks and fair livelihoods.

- Upgraded aquatic value chains ensuring social, economic, and environmental sustainability.

Fisheries and aquaculture in the context of Global Biodiversity Agreements

|

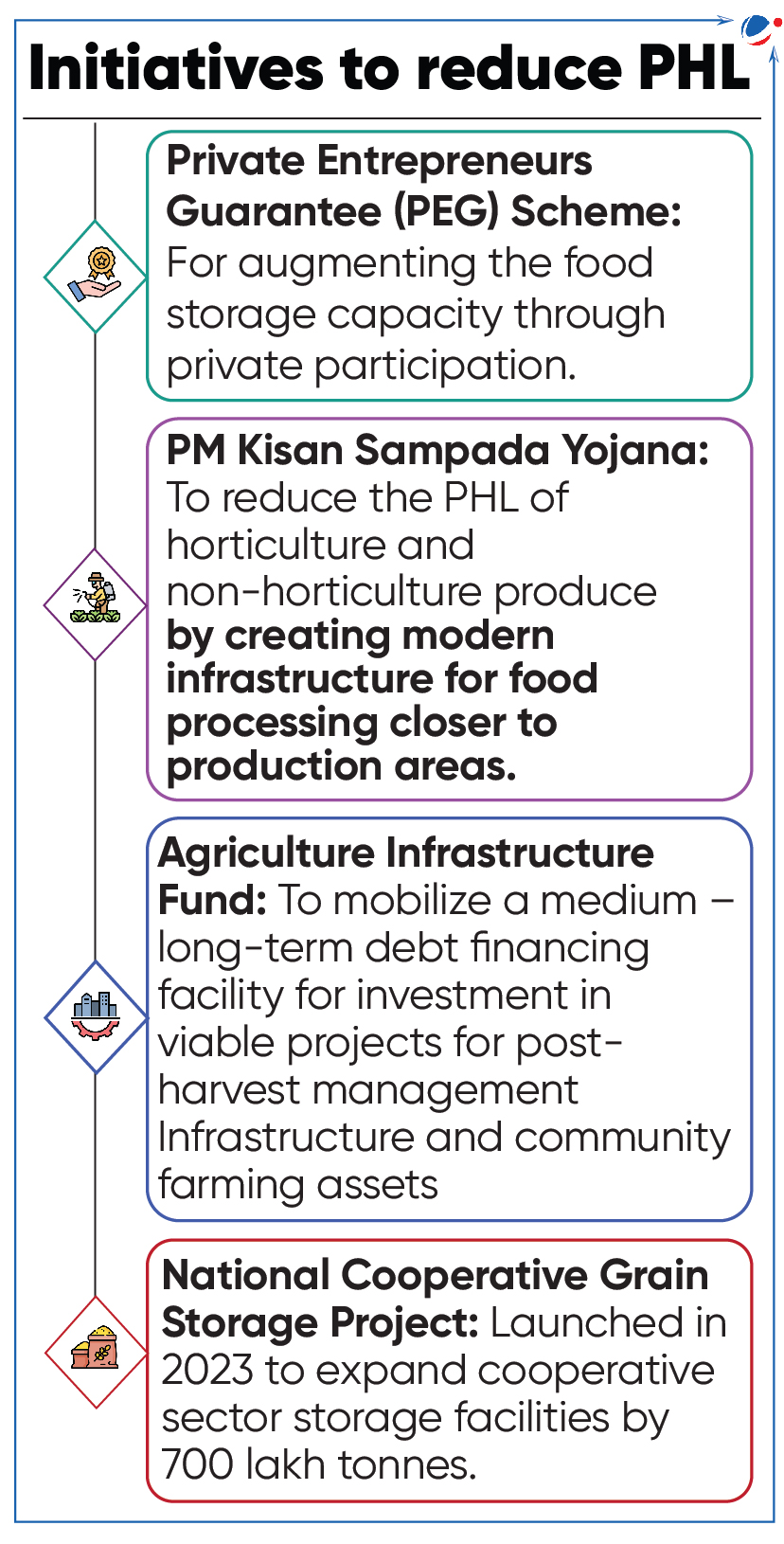

The policy brief highlights the triple win of reducing PHL:

- benefiting farmers (enhanced income),

- enhancing food security, and

- ensuring sustainability (less resource exploitation) in agri-food systems.

Key highlights

- Production in India

- Food Grain: Increased from 74.23 million metric tonnes (MMT) in 1966-67 to 330.5 MMT in 2022-23.

- Horticulture: Increased from 96.6 MMT in 1991-92 to 355.25 MMT in 2022-23.

- India’s Storage capacity: Expanded from 108.8 MMT in 2010 to 219.4 MMT in 2021

- PHL: Globally, around 30% of food produced never reaches consumers (FAO, 2021).

- India faces higher PHL in cereals, pulses, and oilseeds than global levels.

- Annual loss of US $18.5 billion from 2020 to 2022, despite some reduction in PHL from 2012 to 2022.

Key factors behind PHL in India

- On-Farm Operations: Low farmer education and skill levels, weather conditions, and the use of defective machinery.

- Marketing Channels: En-route leakages from open lorry transport, poor quality packaging, use of iron hooks, improper storage practices, etc.

- Policy Issues: Jute Packing Material Act (1987) mandates using jute bags, which are susceptible to pests, insects, and contamination.

Way forward

- Mechanization in agriculture,

- reforming the Public Distribution System (PDS) and boosting direct cash transfer, etc.

Nine of Indian ports have found their position among top 100 global ports in CPPI in 2023.

About CPPI (2023)

- It is developed by the World Bank and S&P Global Market Intelligence.

- The Index is a comparable assessment of performance based on vessel time in port.

- It helps to identify opportunities to improve a terminal or a port that will ultimately benefit all public and private stakeholders.

- Top-ranked container port in the CPPI 2023 is Yangshan Port (China).

As per data released by Department for Promotion of Industry and Internal Trade (DPIIT), FDI inflows in 2023-24 contracted by 3.49% to $44.42 billion as compared with 2022-23.

Other Key Highlights

- Maharashtra received highest FDI followed by Gujarat and Karnataka in FY 2023-24.

- Singapore was the top source of foreign inflows followed by Mauritius and USA in FY 2023-24.

- Top 5 countries for FDI equity inflows into India during 2000-24 are Mauritius followed by Singapore, USA, Netherland, Japan.

- Computer software & Hardware, followed by Service sector and Construction Activities received highest FDI in FY 2023-24.

- Top 5 sectors receiving highest FDI equity inflow during 2000-2024 are Services Sector, Computer Software & Hardware, Trading, Telecommunications, Automobile Industry.

About FDI

- It is an investment made by a company or an individual in one country into business interests located in another country.

- DPIIT is nodal Department for formulation of FDI policy in India.

- FDI is permitted through Automatic route (Government approval not required) or Government route (approval required).

- Foreign Currency Convertible Bonds, Foreign Institutional Investment with certain conditions and Global Depository Receipts are included in FDI.

- FDI is prohibited in Lottery Business, Gambling and Betting, Chit funds, Nidhi company, Trading in Transferable Development Rights etc.

Significance of FDI

Concerns regarding FDI in India

|

S&P Global Ratings revised its outlook on India to positive from stable and affirmed its ‘BBB-‘ long-term and ‘A-3’ short-term unsolicited foreign and local currency sovereign credit ratings.

Sovereign Credit Ratings

- Definition: A sovereign credit rating is a measurement of a government’s ability to repay its debt.

- Credit ratings map the probability of default and therefore reflect the willingness and ability of borrower to meet its obligations.

- Parameters: Typically, rating agencies use various parameters to rate a sovereign including growth rate, inflation, government debt, short-term external debt as a percentage of GDP, and political stability.

- Ratings: Sovereign credit ratings broadly rate countries as either investment grade or speculative grade, with the latter projected to have a higher likelihood of default on borrowings.

- The ratings vary from AAA (highest rating) to D (lowest rating) and the threshold of Investment grade is considered to be BBB- for S&P and Fitch and Baa3 for Moody’s.

- Significance: When favorable, these ratings can facilitate countries to access global capital markets and foreign investment.

World Bank released ‘Global Economic Prospects Report’

- Report called for a significant acceleration in public investments by Emerging Markets and Developing Economies (EMDEs) to meet their development goals.

Key highlights

- Investment Level:

- Public investment averages about 25% of total investment in the median EMDE.

- Public investment in these economies has experienced a historic slowdown in the past decade

- Benefits

- Economic growth: Increasing public investment by 1% of GDP can boost GDP by over 1.5% and raise private investment by 2.2% in the medium term.

- However, public investment may also crowd out private investment, especially when fiscal space is limited and additional fiscal stimulus raises sovereign risk and borrowing costs for the private sector

- Sustainability of growth: Public investment can be critical in delivering public goods or services that may not be privately profitable, such as public health care and education.

- Economic growth: Increasing public investment by 1% of GDP can boost GDP by over 1.5% and raise private investment by 2.2% in the medium term.

Recommendations (“three Es” package of policy priorities) to harness the benefits of public investment

- Expansion of fiscal space: Improve tax collection efficiency, enhance fiscal frameworks, and curtail unproductive spending.

- Efficiency of public investment: Tackling corruption, and poor governance, facilitating public-private partnerships, etc.

- Enhanced global support: Coordinated financial support and effective technical assistance are imperative for structural reforms.

About public investment

|

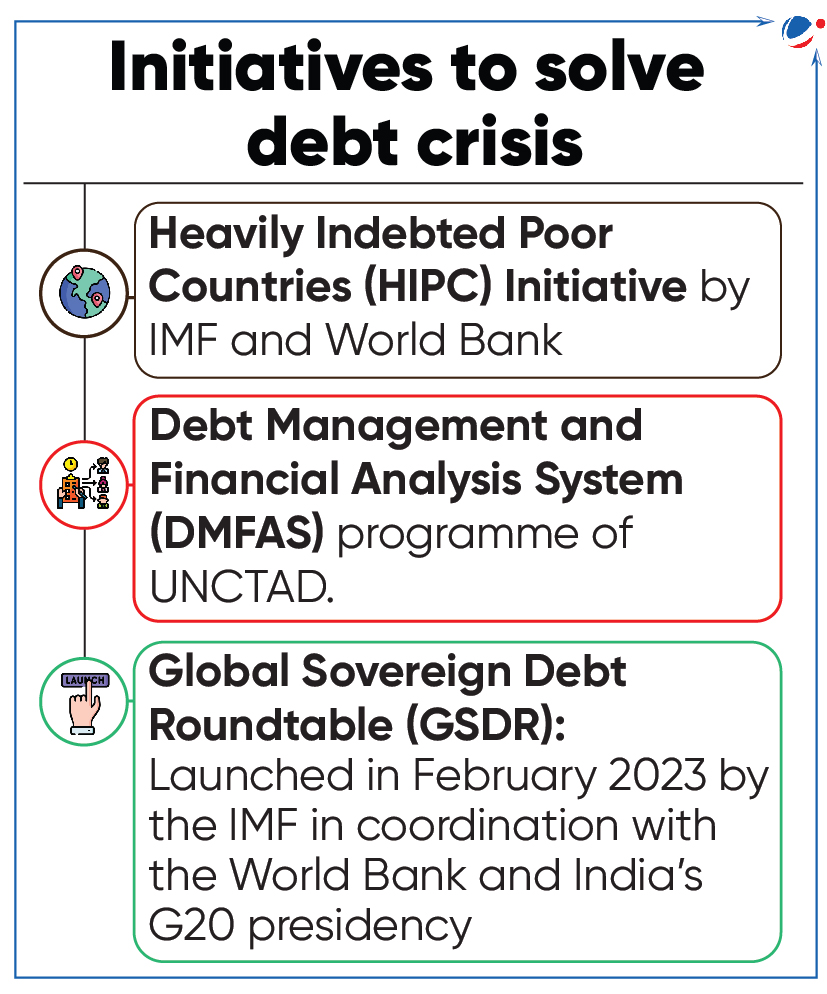

‘A World of Debt Report 2024: A growing burden to global prosperity’ released by UN Trade and Development (UNCTAD). Report highlights alarming surge in global public debt and proposes a plan to revamp global financial system to tackle current debt crisis.

- Public debt refers to general government domestic and external debt.

Key highlights of Report

- Debt surge: In 2023, global public debt reached historic peak of $97 trillion.

- Drivers: Cascading crises and sluggish and uneven performance of global economy.

- Regional Disparity: Public debt in developing countries (accounting for 30% of global total) is rising at twice the rate of developed countries.

- In 2023, India’s public debt reached US$ 2.9 trillion, accounting for 82.7% as a share of GDP.

Implications of high public debt:

- High fiscal burden: More than half of developing countries allocate at least 8% of government revenues to interest payments.

- Decreased developmental spending: 3.3 billion individuals reside in nations where interest payments exceed spending on education and health combined.

- Climate inaction: Interest outweighs climate investments in emerging and developing countries.

Roadmap to finance sustainable development:

- Inclusive International Financial Architecture with increased participation of developing countries in its governance.

- Provide greater liquidity in times of crisis expanding contingency finance through IMF instruments.

- Scaling up affordable long-term financing through transformation and expansion of Multilateral Development Banks.

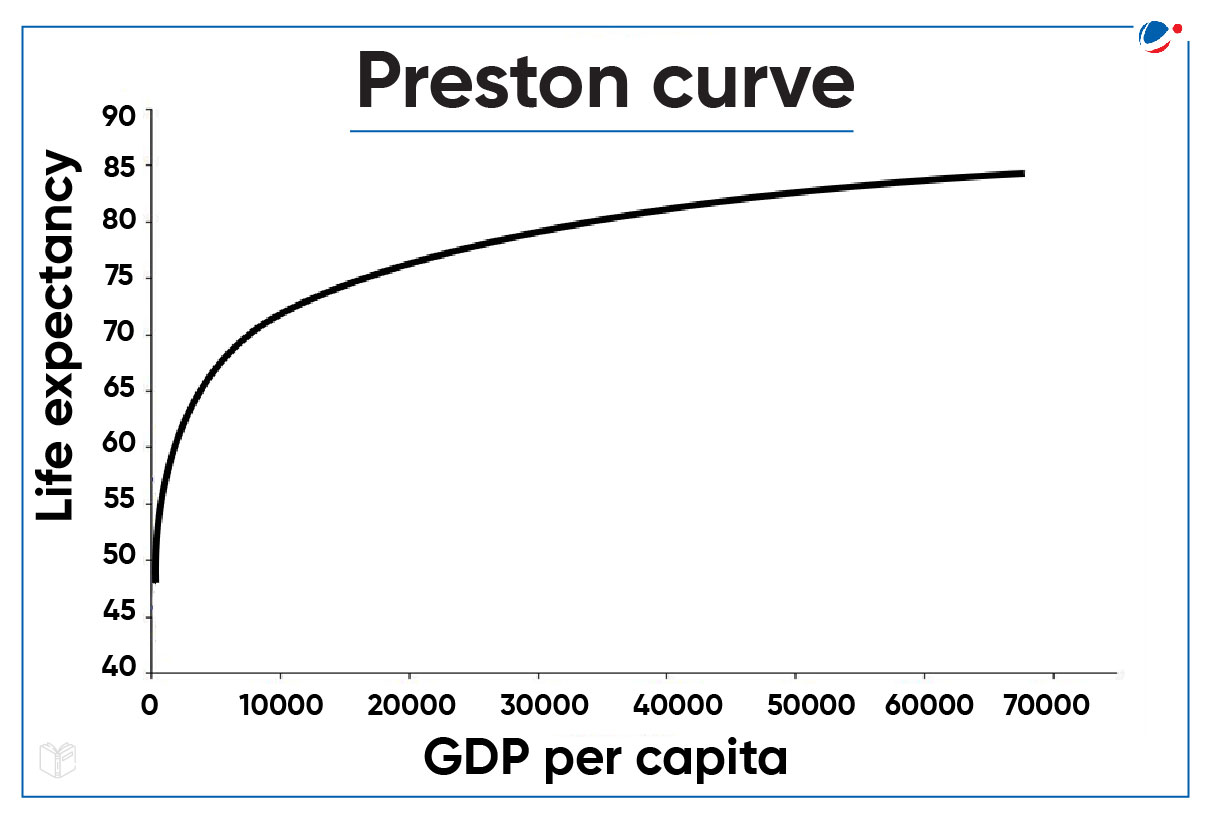

It was first proposed by American sociologist Samuel H. Preston in 1975.

- It highlights that an increase in per capita income of a country does not cause much of a rise in the life expectancy of its population beyond a point.

- When a poor country begins to grow, its per capita income rises and causes increase in life expectancy initially due to nutrition, sanitation and access better healthcare.

- However, it begins to flatten out after a certain point.

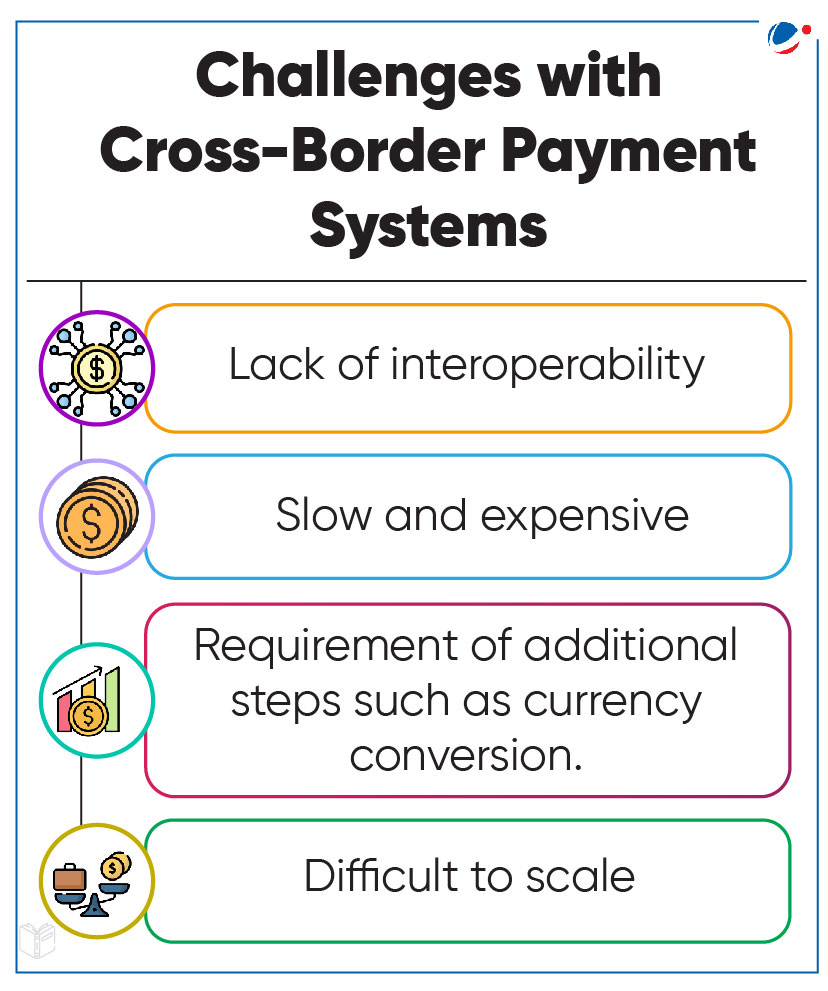

Nexus is a multilateral international initiative to enable instant cross-border retail payments by interlinking domestic Instant Payments Systems (IPS).

- An IPS is an electronic payments system which facilitates inter-bank fund transfer and sends confirmation of payment to the receiver and originator within a minute or less. E.g. Unified Payments Interface (UPI).

About Project Nexus

- Conceptualized by the Innovation Hub of the Bank for International Settlements (BIS).

- BIS was established in 1930 with its head office in Basel, Switzerland and is owned by 63 central banks, including RBI.

- It will connectIPS of four ASEAN countries (Malaysia, Philippines, Singapore, and Thailand) and India and is expected to go live by 2026.

- Nexus is designed to standardize the way domestic IPS connects to one another.

- Rather than an IPS operator building custom connections for every new country to which it connects, the operator only needs to make one connection to Nexus.

- It aims to achieve G20 targets of enabling cheaper, faster, more transparent and accessible cross-border payments.

Benefits of Project Nexus

- Simplifies cross-border payments, reducing complexity, cost, and transaction time.

- It offers complementary low-cost and scalable rail for all payment service providers.

- It bridges gaps in interoperability by fostering standardisation and harmonisation across diverse systems.

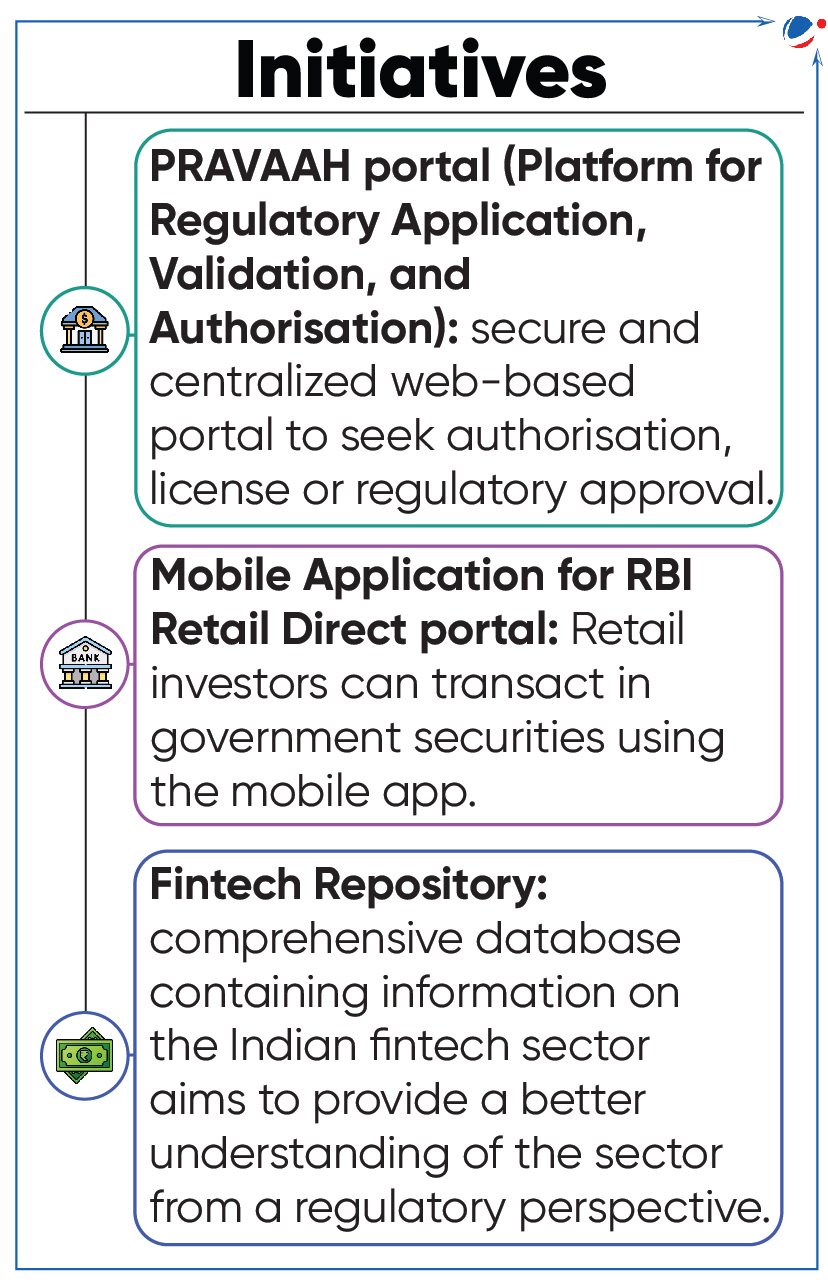

Reserve Bank of India (RBI) has launched three initiatives to enhance public access to the central bank and facilitate regulatory approvals.

The recent VRR auction by Reserve Bank of India (RBI) witnessed a good response from banks.

About VRR

- When RBI desires to infuse liquidity in the economy but Banks are not eager to borrow from RBI at Repo Rates as interest rates in economy may already be lower, in that case RBI allows Banks to borrow at VRR decided by market generally lower than Repo Rate (though not less than Reverse Repo Rate) for duration more than One Day.

- Repo Rate is the rate at which Banks borrow money from RBI which is fixed by RBI.

- The borrowing duration is more than One Day and usually up to 14 days.

- It is a tool to inject short-term liquidity into the banking system.

- Similarly Variable Rate Reverse Repo (VRRR) is conducted to absorb the excess liquidity from the system.

SBI raised 100 million dollar through its London branch by selling 3-year senior unsecured floating-rate bonds above the Secured Overnight Financing Rate (SOFR).

About SOFR

- It is the overnight interest rate for US dollar-denominated loans and derivatives.

- It sets the rate at which banks can borrow cash from individuals or other banks overnight.

- It is collateralised by the US treasury securities market.

- It is the US replacement for London Interbank Offered Rate (LIBOR).

- LIBOR provided loan issuers with a benchmark for setting interest rates on different financial products