Draft Greenhouse Gas (GHG) Emission Intensity Target Rules, 2025 are issued under the compliance mechanism of CCTS.

About Draft Rules

- Defines Greenhouse gas emission intensity (GEI) as tonnes of CO2 equivalent emitted per unit of output or product.

- Proposes legally binding GHG emission targets for over 400 industrial units.

- Bureau of Energy Efficiency (BEE) will determine the emission targets.

- Applies to sectors such as aluminium, iron and steel, petroleum refining, petrochemicals, and textiles.

- Failure to comply will result in financial penalties under the Environment (Protection) Act, 1986 (EPA 1986).

About CCTS

- Goal: Lower GHG emissions by promoting carbon pricing (i.e., imposes a cost on GHG emissions)

- Legal Backing: Energy Conservation Amendment Act (ECA), 2022 empowers the Central Government, in consultation with BEE, to specify the CCTS.

- Key elements:

- Compliance Mechanism (For Obligated Entities): Obligated entities that emit less than their target get Carbon Credit Certificates.

- Voluntary Offset Mechanism: Enables other sectors to register their projects for GHG emission reduction, removal, or avoidance, in exchange for the issuance of Carbon Credit Certificates.

- Administrator: BEE

- Regulator of Carbon Trading: Central Electricity Regulatory Commission (CERC)

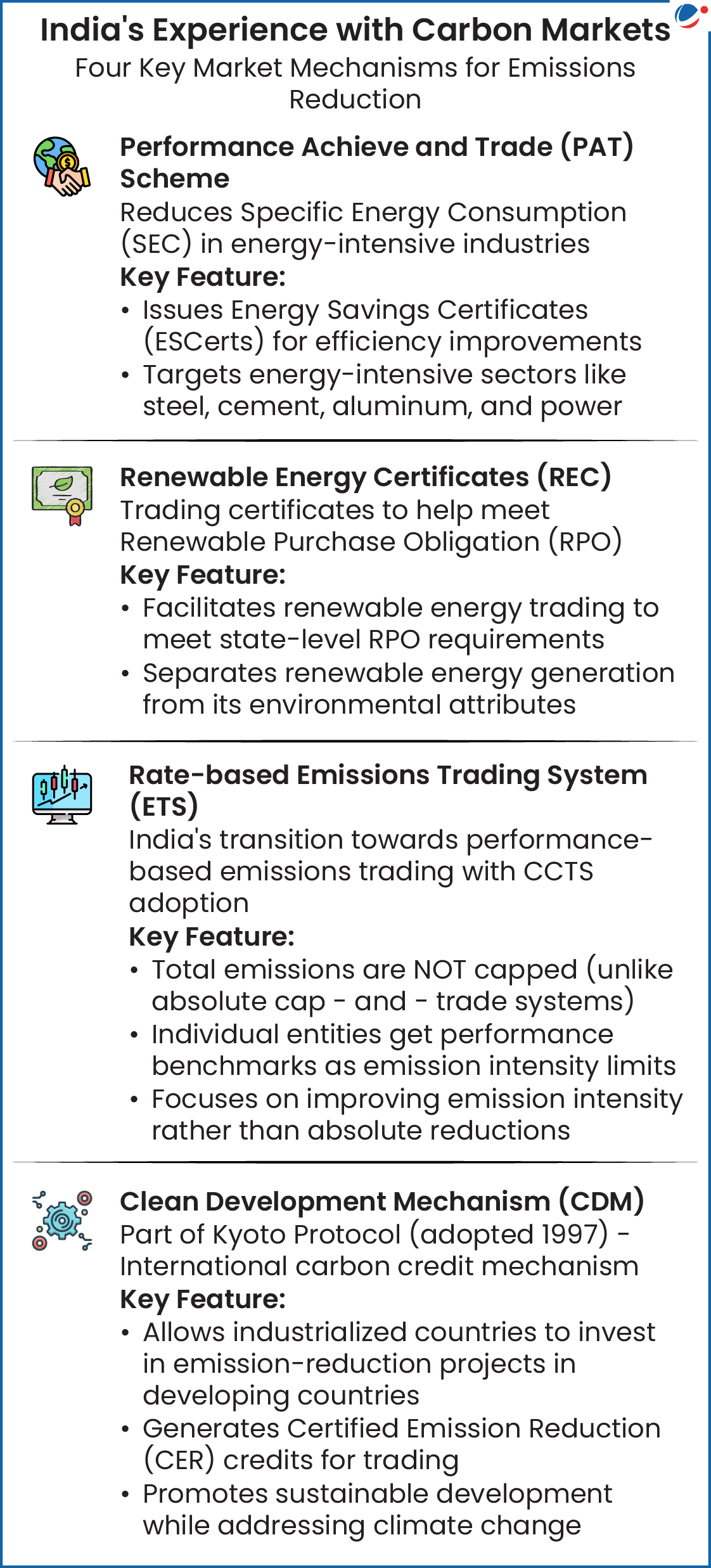

- Significance: Stepping stones for Indian Carbon Market (refer to the infographic) and aligns with India’s obligations under UNFCCC and Paris Agreement.

World Bank’s “State and Trends of Carbon Pricing 2025” report has recognized India’s growing role in shaping global climate finance and carbon pricing frameworks.