RBI committee unveils Framework for Responsible and Ethical Enablement of Artificial Intelligence (FREE-AI) to balance innovation with risk management in financial services.

About FREE-AI Vision

- Aim: Ensuring safe, fair and accountable AI adoption in India’s financial sector

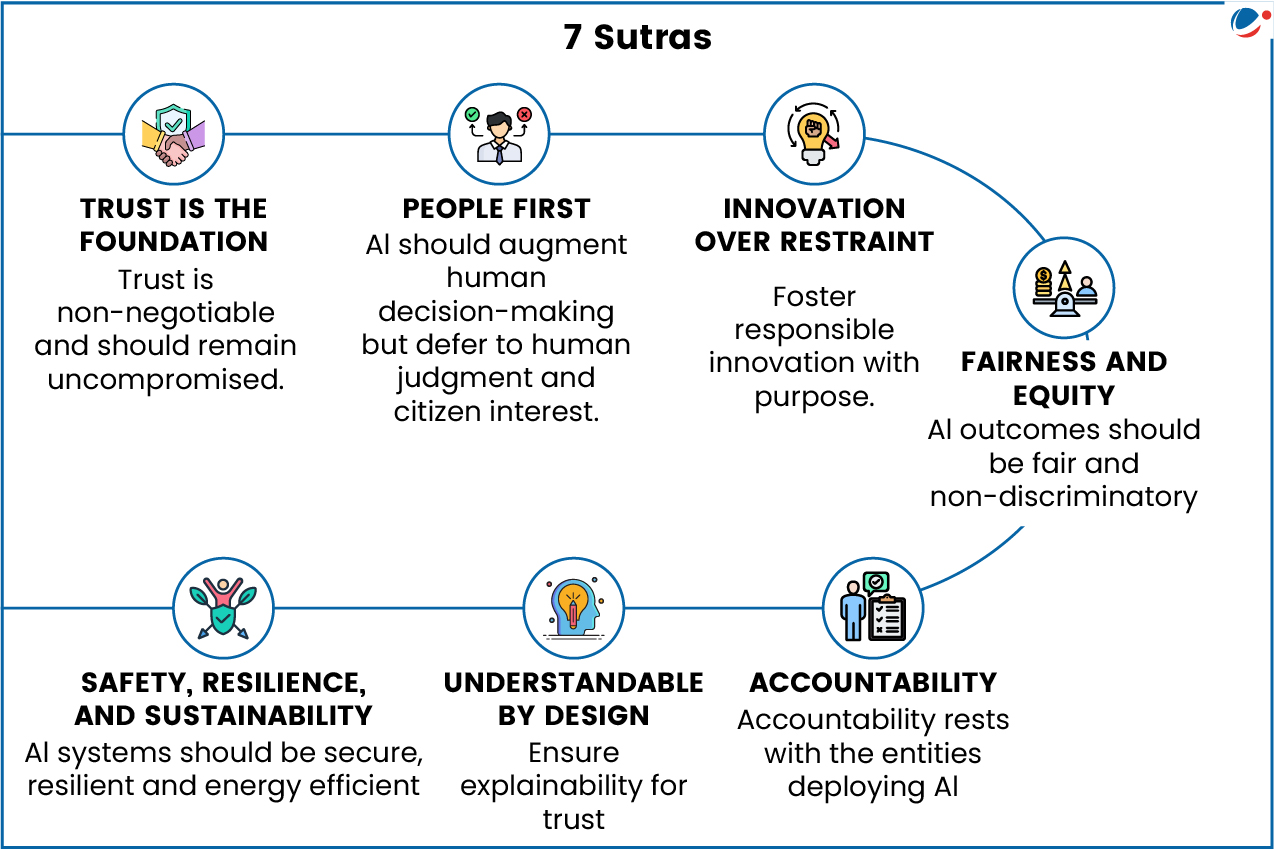

- 7 Sutras: Foundational principles for AI adoption (refer to the infographics)

- Dual Approach:

- Fostering Innovation

- Shared infrastructure for democratized data and compute access, which may be integrated with the AI Kosh established under the IndiaAI Mission.

- AI Innovation Sandbox for testing and Indigenous financial AI models

- Create AI policy for regulatory guidance

- Institutional capacity building (boards and workforce)

- Relaxed compliance for low-risk AI solutions to facilitate inclusion and other priorities

- Mitigating Risk:

- Board-approved AI policies by Regulated Entities

- Inclusion of AI-related aspects in product approval processes, consumer protection frameworks and audits

- Strengthened cybersecurity and incident reporting

- Robust AI lifecycle governance

- Consumer awareness when they interact with AI

- Fostering Innovation

Why FREE-AI Vision Matters?

- AI's Growing Impact: The financial sector's AI investment is projected to reach:

- ₹8 lakh crore ($97 billion) by 2027 across banking, insurance, capital markets, and payments

- ₹1.02 lakh crore ($12 billion) by 2033 for GenAI alone, growing at 28-34% annually

- Emerging Complex Risks: AI introduces data privacy, algorithmic bias, market manipulation, cybersecurity vulnerabilities, and governance failures that traditional risk frameworks struggle to address.

- These risks could undermine market integrity, erode consumer trust, and create systemic vulnerabilities without proper management.