Why in the News?

Recently, Prime Minister felicitated 11 lakh new 'Lakhpati Didis' in a function organised at Jalgaon in Maharashtra.

More on the news

- The PM also released a Revolving Fund of ₹ 2,500 crore, benefiting about 48 lakh members of 4.3 lakh Self-Help Groups (SHG).

- The Revolving Fund is a mechanism to accelerate the process of internal lending and increase the size of the corpus in the development of Self-Help Groups.

- The main purpose of providing Revolving Fund to SHG is to inculcate the habit of thrift and credit among the SHG members and build their institutional capacities on the management of external funds.

- It is a permanent fund of the SHG.

- He also disbursed bank loans of Rs 5,000 crore which will benefit 25.8 lakh members of 2.35 lakh SHGs.

About Lakhpati Didi Initiative

- Lakhpati Didi is not a scheme but an output of the Deendayal Antyodaya Yojana – National Rural Livelihoods Mission (DAY-NRLM) scheme of the Ministry of Rural Development (MoRD).

- DAY-NRLM aims to bring at least one woman member from each rural poor household into the fold of SHGs and to support them to take economic activities.

- DAY-NRLM is being implemented since 2011 in a mission mode.

- A Lakhpati Didi is a SHG member who earns an annual household income of Rupees One Lakh or more.

- This income is calculated for at least four agricultural seasons and/or business cycles, with an average monthly income exceeding Rs. 10,000, so that it is sustainable.

- Launched in 2023

- Target: Enabling three crore Lakhpati Didis

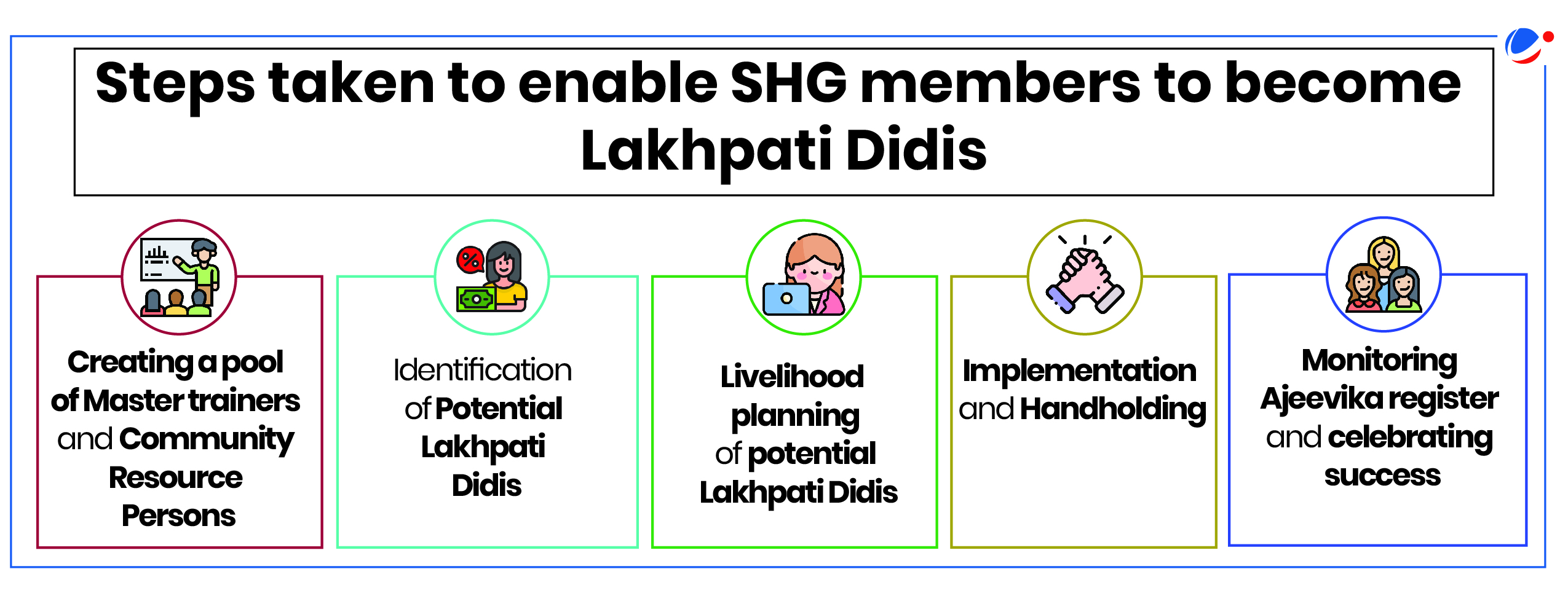

- It focuses on diversified livelihood activities, district-level planning, household support, Government department convergence, and capacity building of staff and community members.

Criteria for identifying potential Lakhpati Didis

- A SHG member who has completed a minimum of two years and has availed of the Community Investment Fund (CIF).

- A beneficiary of livelihood intervention through the mission and practising at least two livelihood activities.

Financial support available to Self Help Groups and its members

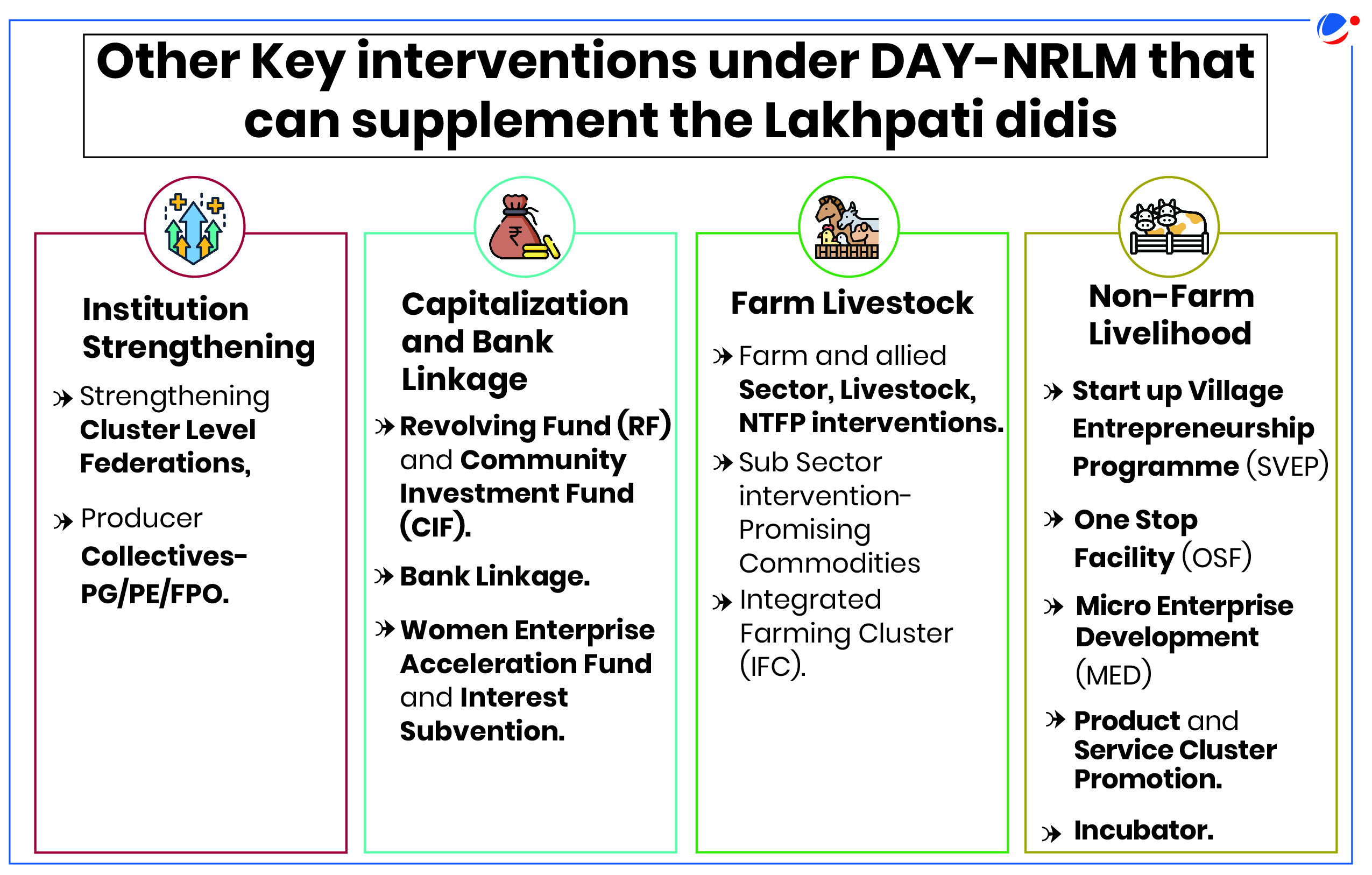

- Capitalization Support:

- Revolving Fund: Rs. 20,000 to Rs. 30,000 per eligible SHG to catalyze the process of internal lending and to enable them to meet the immediate credit needs of the members.

- Community Investment Fund (CIF): This financial support is provided only to SHGs and their federations to advance loans to enable members to undertake socio-economic activities as per micro-credit/ investment plans.

- The maximum amount admissible for Community Investment Fund is Rs. 2.50 lakh per SHG.

- Bank Loan

- Collateral-free bank loan up to Rs. 20 lakh for SHGs.

- Interest Subvention: Interest subvention, to cover the difference between the Lending Rate of the banks and 7%, on all credit from the banks/ financial institutions availed by women Self Help Groups, for a maximum of Rs. 3,00,000 per Self Help Group.

- Overdraft Facility: Every SHG women member having a Jan-Dhan Account is eligible for an Overdraft (OD) limit of Rs. 5,000.

- Aajeevika Grameen Express Yojana (AGEY): Loans are provided at subsidised rates as an incentive for entrepreneurs to provide rural transport services for people and goods.

- For Individuals, loans up to Rs. 6.5 lakhs and for Groups (SHG/VO/CLF/PG/PE) Loans up to Rs. 8.5 lakhs are provisioned.

- Vulnerability Reduction Fund (VRF): It is a fund given to the Village Organisations (VOs) as a Revolving Fund given by the Cluster Level Federations.

- The provision of fund is Rs. 1,50,000/- to each VO.

- Vulnerability Reduction Fund is a fund (corpus fund) given to address the vulnerabilities like food insecurity, health risk, sudden sickness/hospitalization, natural calamity, etc., faced by the household(s) or community.

- Women Enterprise Acceleration Fund:

- For individual enterprises

- Credit Guarantee Support: Credit guarantees to individual women entrepreneurs for loans up to Rs. 5 lakh for a maximum period of 5 years.

- Interest Subvention on prompt payment: 2% interest subvention to incentivise good repayment behaviour for loans up to Rs. 1.5 lakh for a maximum duration of 3 years.

- For enterprise collectives/ FPOs

- Collateral Support to Enterprise Collectives/ FPOs: The fund will be used to provide collateral up to 50% of the total credit extended (or up to Rs. 2 crore, whichever is less) to lending institutions.

- For individual enterprises

Significance of Women-led SHGs: Lakhpati Didi

- Shifting focus: There is a shifting focus from SHGs being mere channels of social and financial inclusion to empowering them to pursue entrepreneurial ventures and move towards higher income brackets.

- Increasing Bargaining power of Women: Through increased involvement in financial decision-making, strengthened social connections, ownership of assets, and diversification of livelihoods.

- Economic development: Women-SHGs are pioneering the growth of micro enterprise and creating jobs especially in rural areas.

- Credit Quality: The gross Non-Performing Assets (NPAs) for the loans taken by women Self-Help Groups (SHGs) is 1.6%.

- Access to public service delivery: SHGs act as a medium of delivering benefits of various government schemes like DAY-NRLM, MGNREGA, ICDS etc.

- E.g. Tribal women SHGs in Gumla, Jharkhand handled the supply chain from procurement to marketing under Mission Ragi. It helped tackle anaemia and malnutrition with improving farmers' income.

- Poverty alleviation and Social mobility: 65% of rural SHG members have moved upwards in terms of relative income in between FY19 and FY24 (SBI report).

- Pressure Groups and Political participation: Their participation in governance process enables them to highlight issues such as dowry, alcoholism, open defecation, primary healthcare etc. and impact policy decision.

Challenges faced by Women-led SHGs

- Socio-cultural rigidities: Patriarchy, caste dynamics, lack of exposure and literacy etc. limit participation and growth of women-led SHGs.

- Lack of digital empowerment: Women SHGs lack the knowledge and skills related to digitization with low access to technology and internet.

- Lack of quality training and skilling: It hinders the growth of Women SHGs-led micro-enterprises due to poor marketing strategies, product quality issues etc.

- Regional disparities: The Status of Microfinance Report (2019–20) published by the National Bank for Agriculture and Rural Development (NABARD) reports that around 68.56% of total SHGs are located in south.

- Lack of awareness: The poor women have limited access to knowledge and guidance about benefits of SHGs and often, elite capture of SHGs is prevalent, undermining the original purpose.

Way Forward

- Training and skilling: Quality training and skill development are essential for empowering SHG members as agents of social change.

- Technological advancement: Promote the use of technology in SHG operations by enhancing digital literacy and access. E.g., Project EShakti by NABARD.

- Regional focus: Target initiatives like the scheme for promoting Women SHGs (WSHGs) in backward and LWE-affected districts.

- Monitoring, Evaluation, and Learning (MEL): Implement a robust system to assess internal processes and effectiveness, ensuring transparency and accountability.

- Coordination with stakeholders: Link SHGs with corporates and civil society organizations to provide support and scale up their enterprises.