Why in the News?

Financial Action Task Force (FATF) in its recent Mutual Evaluation Report for India titled 'Anti-Money laundering and Counter Terrorist Financing (AML/CTF) Measures' lauded India's efforts to implement measures to tackle illicit finance including money laundering and terror funding.

Key Highlights of the Report

- It emphasizes that India has achieved a high-level of technical compliance across the FATF Recommendations.

- India has been placed in "regular follow-up" which is the highest rating category by FATF.

- UK, France, and Italy are among the only G20 countries which have been placed in this category.

- India has made significant progress in financial inclusion, more than doubling the proportion of the population with bank accounts, encouraging greater reliance on digital payment systems.

- India also achieved positive results in international co-operation, asset recovery and implementing targeted financial sanctions for proliferation financing.

About Financial Action Task Force (FATF)

|

What is Money Laundering and Terrorist Financing (ML/TF)?

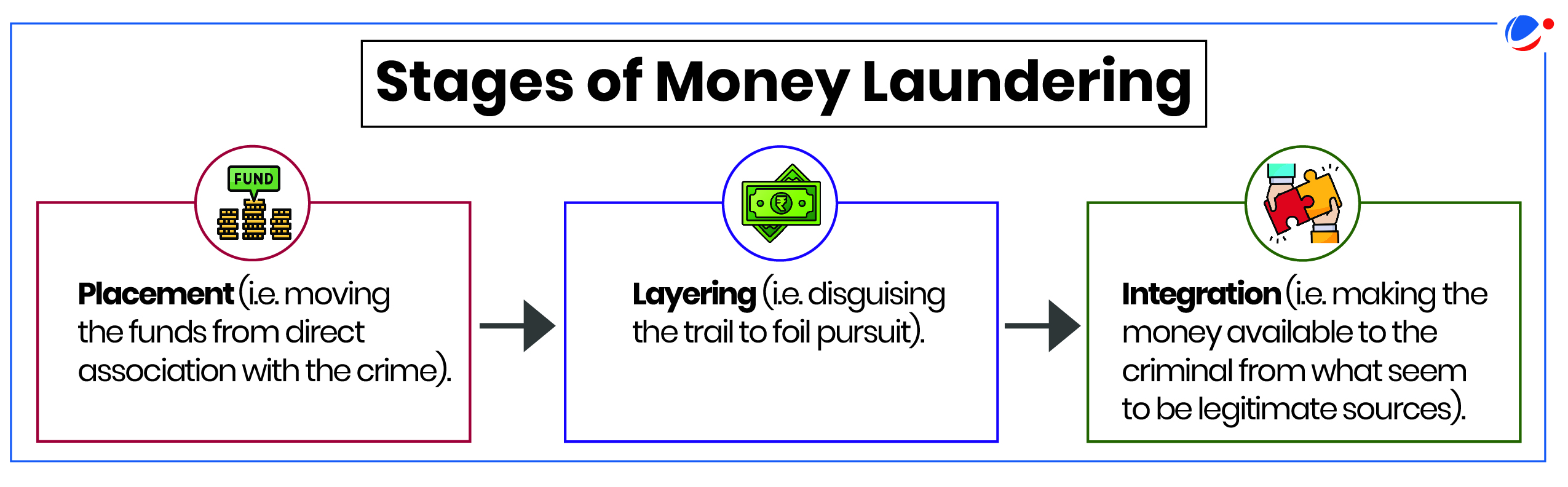

Money Laundering (ML)

- It is the processing of criminal proceeds to disguise their illegal origin. It enables the criminal to enjoy these profits without jeopardizing their source.

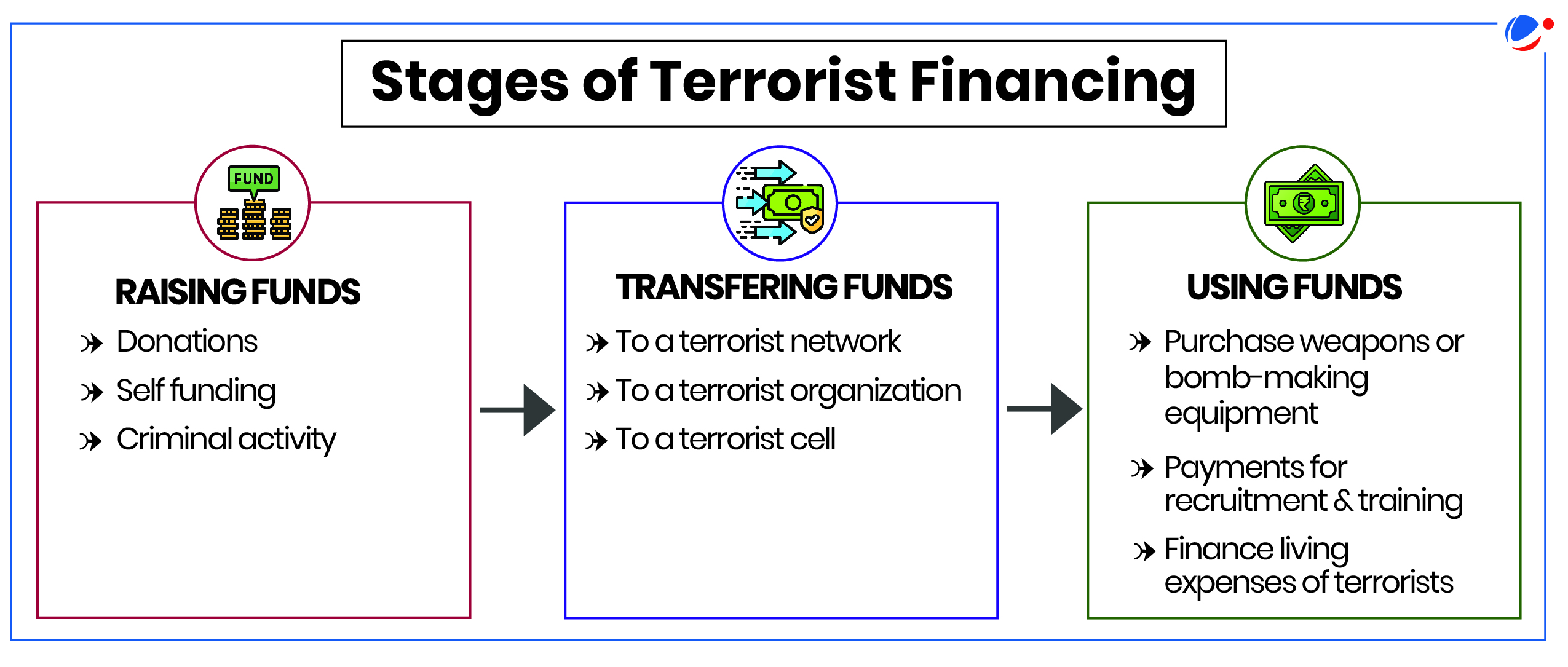

Terrorist Financing (TF)

- It encompasses the means and methods used by terrorist organizations to finance activities that pose a threat to national and international security.

- It can come from both legitimate (i.e. profits from businesses and charitable organizations) and criminal sources (i.e. Drug trade, weapon smuggling, kidnapping for ransom).

Concerns highlighted in report related to ML/TF in India

- Main sources of ML: Illegal activities committed within country including cyber-enabled fraud, corruption, and drug trafficking.

- Security Threats: Islamic State in Iraq and the Levant (ISIL) and Al-Qaeda linked groups are active in and around Jammu and Kashmir.

- Also, regional insurgencies in the Northeast and North of India; and left-wing extremist groups, etc.

- Legal systems and operational issue: Number of ML convictions has been significantly impacted by a series of constitutional challenges (settled in 2022) with many cases pending trial and the saturation of the court system.

- There have been only 28 ML convictions over the last five years.

- Lack of supervision: For the Designated Non-Financial Businesses and Professions (DNFBPs) sector, supervision is less developed or yet to commence, including in high-risk sectors.

- The ML/TF risks of the Dealers in Precious Metals and Stones (DPMS) sector are not sufficiently mitigated by a prohibition on cash transactions under tax law.

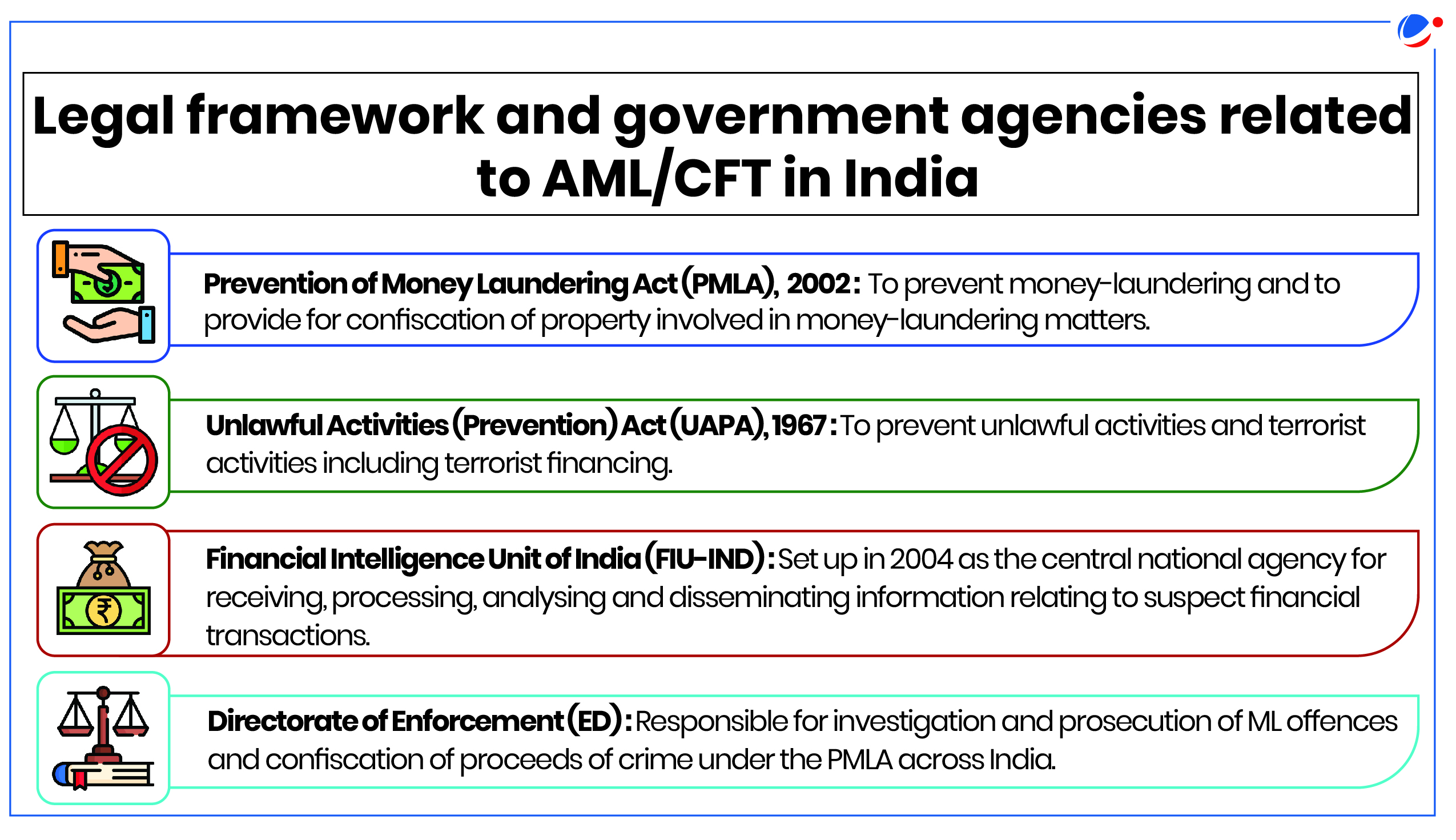

- Politically exposed persons (PEPs): Prevention of Money Laundering Act (PMLA), PML Rules, directions/guidelines issued by financial sector Regulators (RBI, SEBI, IRDAI and PFRDA) have no specific provisions dealing with domestic PEPs.

- PEP is an individual holding a prominent position (heads of States or Governments, senior politicians, senior government or judicial or military officers etc.) which may be vulnerable to misuse for laundering illicit funds or committing offences like corruption or bribery.

Policies implemented on identified risks in India

Risks identified | Measures taken |

Risks from cash-based economy | Financial inclusion programme - unique bio-metric identification number to each resident (Aadhar), access to zero-balance accounts at no charge (Jandhan). |

Non-visibility of business supply chains | Introduction of the Goods and Services Tax (GST) in 2017 requiring e-invoices and e-bills and a central data collecting agency allowing transparency of the supply chain. |

Risks from bank fraud | Access to Central Fraud Registry (CFR), a web based searchable database of frauds established in 2016. |

Corruption risks | Amendments of the Prevention of Corruption Act in 2018 clarifying liability of senior management in commercial organisations and enhancing punishments for accepting bribes. |

Risks from undisclosed foreign assets | Mutual Legal Assistance Treaty (MLAT) Portal, a digital case management system for formal international cooperation, launched in 2022. |

Misuse of legal persons | Task Force on Shell Companies set up in 2017 that compiled a database to identify shell companies found to be used in illegal activities, common directorships in shell companies. |

Risks from emerging technologies | Establishment by RBI of a FinTech Department in 2022 to foster innovative initiatives such as the Central Bank Digital Currency. |

Improving capacity of ML/TF agencies to reduce overall vulnerabilities | Development of Financial Intelligence Unit – India (FIU-IND) FINNET system in 2022 for collection, analytics, and dissemination of financial intelligence using sophisticated risk scoring based on multiple data sources. |

Way Forward (Key Recommendations of report)

- Risk analysis: Undertake more comprehensive financial network analysis especially on ML techniques associated with trafficking in human beings and migrant smuggling.

- Legal: Reduce the number of pending trials in ML cases – both for new trials and for the backlog, by making major changes to increase the capacity of the court system, and potentially the capacity of the ED.

- PEPs: Reporting entities should improve identification of domestic PEPs and take risk-based enhanced measures in relation to them.

- Supervision: DNFBPs should improve detection of suspicious transactions when suspicious activity is detected.

- Legal Persons and arrangements: Enhance monitoring of the Ministry of Corporate Affairs (MCA) registry to ensure the availability of adequate, accurate and up-to-date basic and Beneficial Ownership (BO) information on legal persons.

- Terror financing prevention: Improve framework for implementing Targeted Financial Sanctions (TFS) so that it is clear that all natural and legal persons are obliged to freeze funds and assets without delay.