FSR (biannual report) is based on assessment of Sub-Committee of Financial Stability and Development Council.

- It highlights that Scheduled commercial banks Gross NPAs (GNPAs) and Net NPA ratios fell to multi-year lows of 2.8% and 0.6% respectively at March-end 2024.

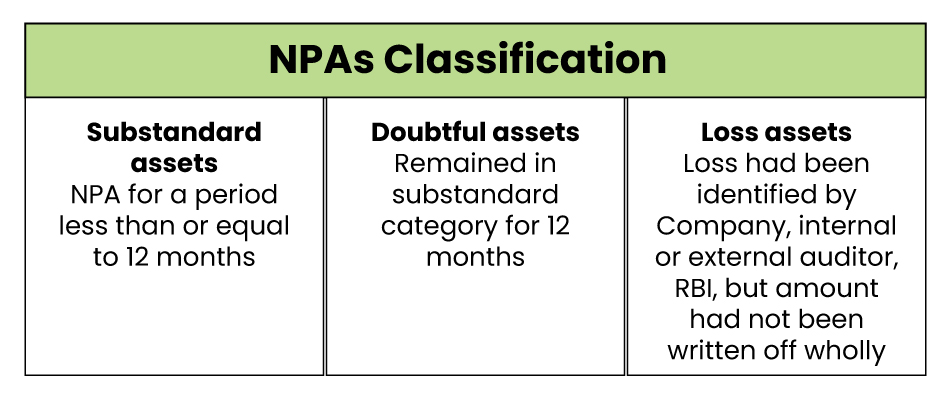

About NPA

- Refers to classification for loans or advances of a bank that are in default or arrears.

- Loan is in arrears when principal or interest payments are late or missed and become an NPA when interest/ instalment of principal remain overdue for more than 90 days.

- GNPAs are sum of all loan assets that are classified as NPAs.

Reasons for NPAs

- Surge in wilful defaults (Rs 353,874 crore as of March 2023).

- Rise in Bank frauds (14,483 cases between April- Sept 2023 from 5,396 in same period 2022).

- Non-compliance with regulatory directions regarding banking operations by Public Sector Banks.

Steps taken to reduce NPA

- SARFAESI Act, 2002: Allows secured creditors to take possession of collateral upon a default in repayment.

- Insolvency and Bankruptcy Code (IBC), 2016: For reorganisation and insolvency resolution of corporate, partnership firms and individuals within 180 days (extended period of 90 days).

- National Asset Reconstruction Company Limited to resolve stressed assets above Rs. 500 crore.