It is a bi-annual report which analyses the trends in payment transactions carried out using different payment systems in the last 5 calendar years (CY) up to CY-2024.

Key findings

- Digital payment transactions: In 2013 there were 222 crore digital transactions valued at Rs 772 lakh crore, it has increased 94 times in volume and more than 3.5 times in value in CY-2024.

- Unified Payment Interface (UPI): Volume of UPI transactions reflects a CAGR of 74.03 %, value of the transactions represented a CAGR of 68.14% in last 5 years.

- Credit cards & Debit cards: Number of credit cards has more than doubled in five years whereas debit cards have remained relatively stable in last 5 years. .

- Global trends: India joined Project Nexus, facilitating multilateral linkage of fast payment systems (FPS) of four ASEAN Nations (Malaysia, Philippines, Singapore and Thailand) and India.

- Project Nexus, conceptualized by Bank for International Settlements (BIS), enables instant cross-border retail payments by interlinking domestic FPSs.

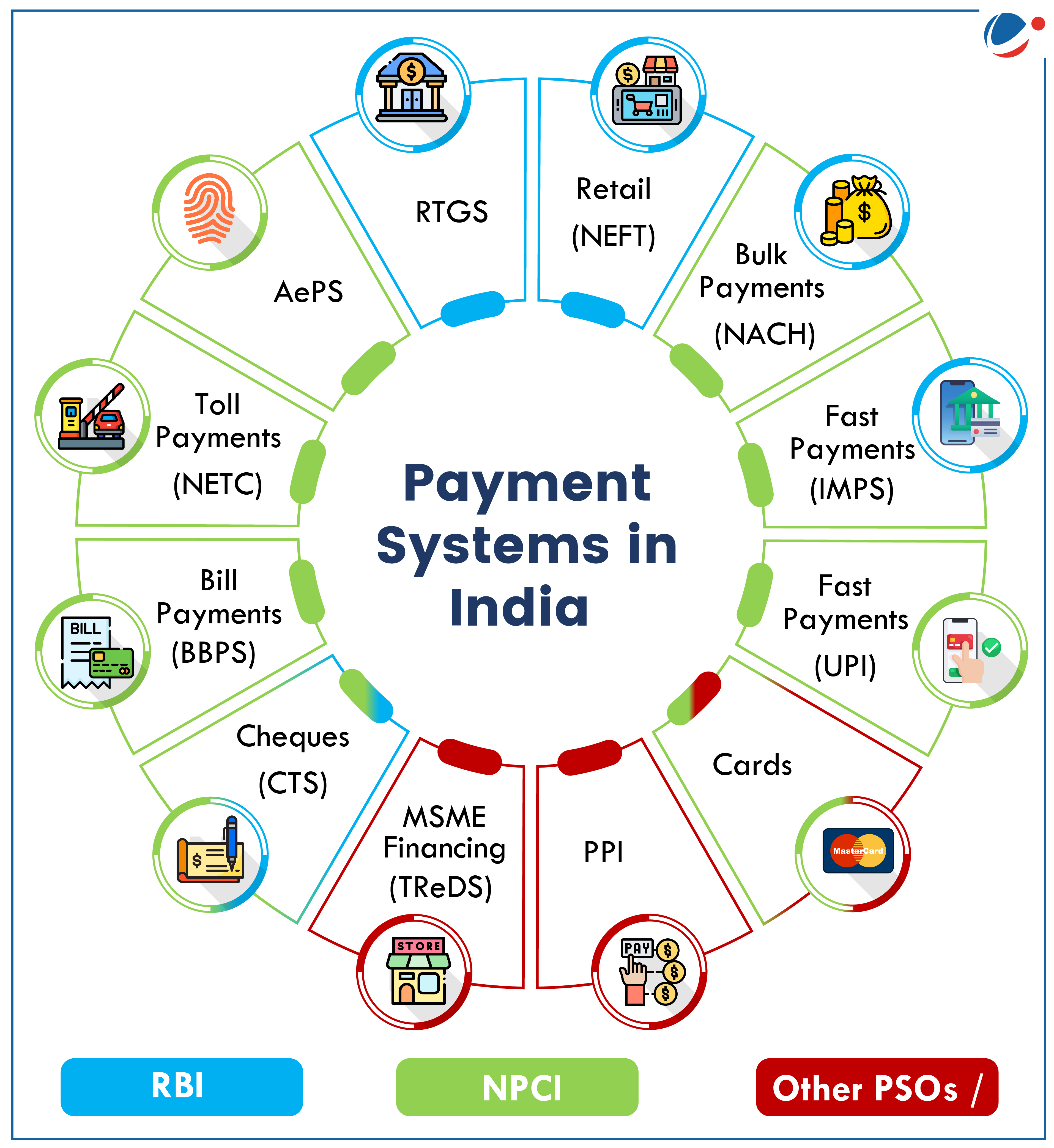

Payment Systems in India

- Payment systems are mechanisms established to facilitate the clearing and settlement of monetary and other financial transactions.

Regulation of Payment Systems in India

- Payments and Settlement Systems Act, 2007 (PSS Act)

- It authorizes RBI to regulate & supervise payment systems in India.

- Empowers RBI to issue licenses / authorizations to payment system operators such as Clearing Corporation of India Ltd, NPCI, card payment networks, ATM networks etc.

- Board for Regulation and Supervision of Payment and Settlement Systems (BPSS)

- Highest policy making body on payment systems established by RBI under PSS Act.

- Its chairman is RBI Governor, while Deputy Governor in charge of the DPSS is Vice-Chairperson.