Remarks were made on a bail application where SC noted the absence of a clear regime on regulating virtual currency.

About Cryptocurrency and Hawala

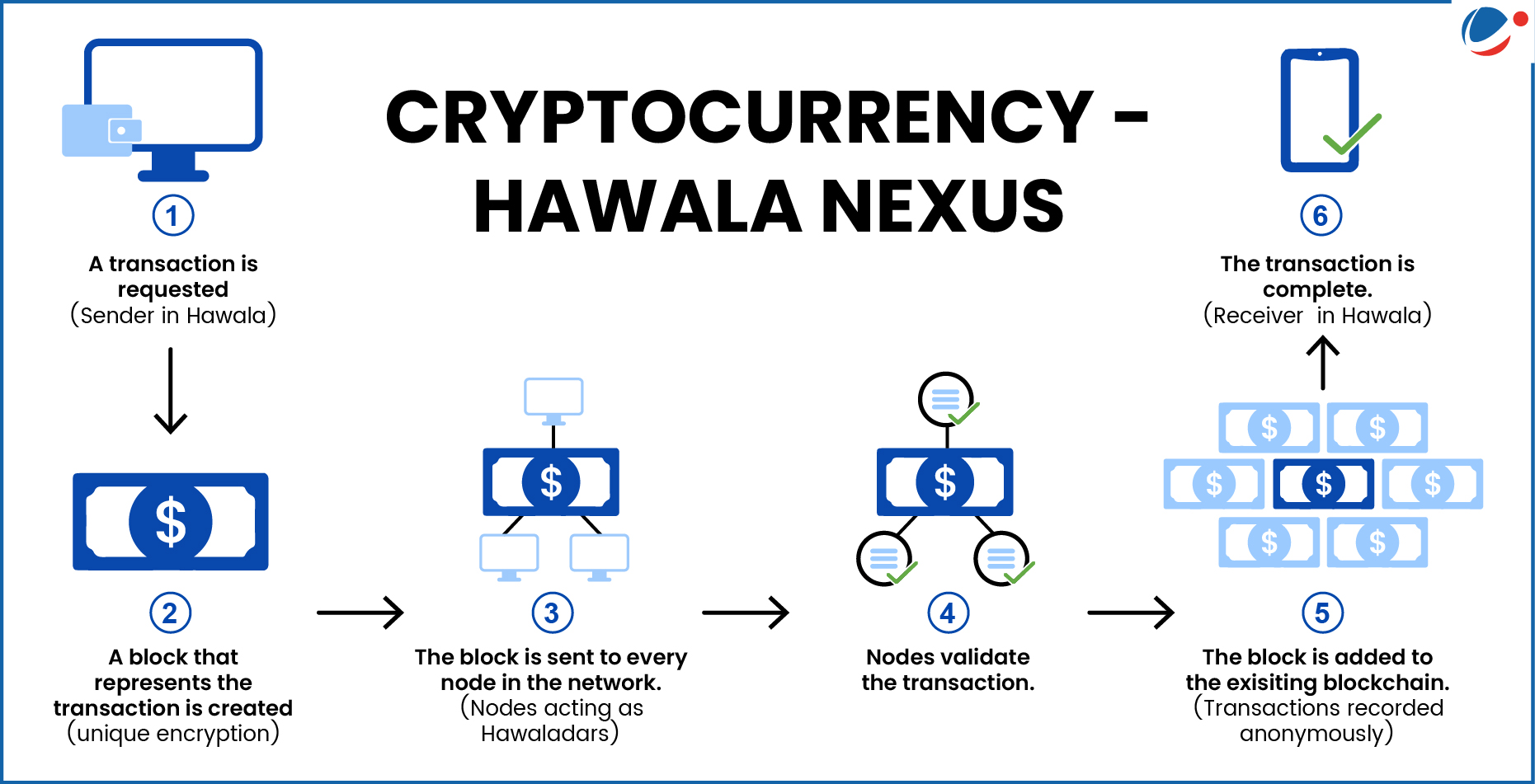

- Cryptocurrency: Form of digital currency (based on the blockchain technology) that utilizes a unique software code. E.g., Bitcoin, Ethereum, etc.

- Blockchain is an open-source database (public ledger) distributed across a decentralized computer network/internet that forms a permanent record of transactions between parties.

- Key Features: Non fiat (functions independently of government/Central Bank); No intrinsic Value, etc.

- Hawala: Informal channel for transferring funds from one location to another through service providers (hawaladars) regardless of the transaction nature.

- Key Features: Based on trust between parties, it does not involve cash movements as hawaladars settle debts among themselves.

- Nexus between Hawala and Cryptocurrency: In Blockchain, nodes can be seen as hawaladar that maintain the network through mutual trust/consensus.

Reasons for Rising Nexus between them

- Outside the Traditional Banking System: Both are unregulated and unreported transaction vulnerable for illicit activities.

- Cheaper: Both are not subjected to prohibitive commissions and currency exchange fees.

- Lack of Transparency: In Cryptocurrencies, transactions are recorded in public ledger anonymously, while in hawala it is done in cash without any paper trail.

- Unique passcodes/Encryption key: While Cryptocurrency uses an encryption key, hawaladars use the passcodes shared between them.