Why in the News?

As per the new amendments proposed in Finance Act 2016, Equalization levy or digital tax on online advertisements will not apply on or after April 1, 2025.

Equalization Levy

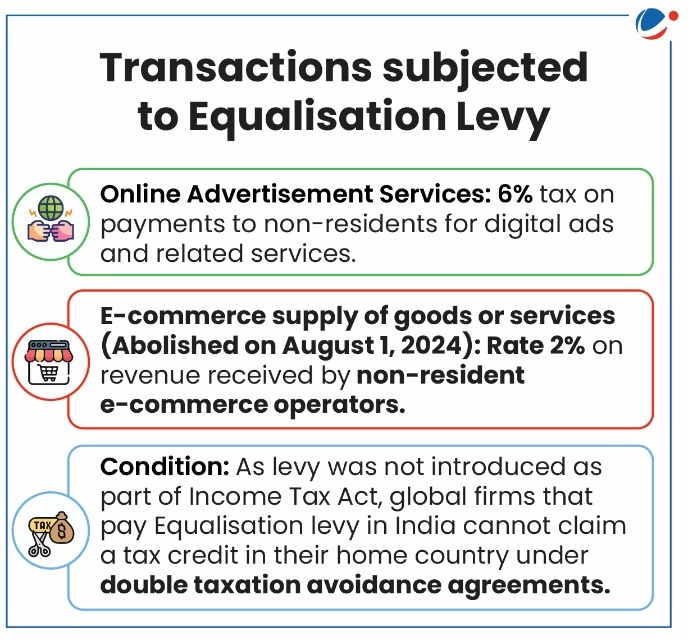

- It is a direct tax introduced by Finance Act, 2016, taxing digital transactions i.e. income accruing to foreign e-commerce companies from India.

- This covers income from advertising also which is aimed at taxing business to business transactions.

- Finance Act 2020 has extended scope of this levy to e-commerce supply and services.

Reasons for its Imposition

- Fair Competition: It aimed to level the playing field for domestic and international companies.

- Bridging Tax Gaps: Prevents companies from avoiding taxation due to a lack of physical presence in India.

- Taxing Foreign Digital Companies: Ensures that foreign e-commerce giants contribute to India's tax system.

- Revenue Collection Opportunity: Recognizes the boom in digital transactions, further accelerated by COVID-19.

Associated Concerns

- Trade friction with the US: Foreign trade barrier report mentions Equalization levy as barrier to overseas trade.

- Risk of Retaliatory Tariffs: Other nations may impose countermeasures, affecting Indian companies operating overseas.

- Double Taxation & Compliance Burden: Foreign companies may face dual taxation, increasing their costs.