Parliamentary Committee on Public Accounts sought comprehensive review of GST Framework.

Key Issues Highlighting the Need for Review of GST Framework

- Issues of MSMEs: Struggle with compliance due to complexity of Inverted Duty Structure and administrative burden.

- Issues of Exporters: Face delays in input tax credit (ITC) refunds, causing cash flow issues and reducing global competitiveness.

- Issues of steel rolling mills: Pay dual taxes as scrap dealers evade GST (thus, hindering ITC claims by mills); some businesses relocate to states with GST relaxations.

- Tax evasion by Online Gaming Sector: Despite recent amendments to the GST law targeting this sector, tax evasion persists due to varied business models.

- From October 1, 2023, online gaming is taxed at 28% GST.

- Suppliers of online money gaming must register under the Simplified Registration Scheme of the IGST Act.

- The Directorate General of GST Intelligence (DGGI) can direct intermediaries to block unregistered offshore gaming platforms violating the IGST Act.

Way ahead

- Simplified GST compliance framework specifically designed for MSMEs,

- Dedicated fast-track refund processing system for exporters, ensuring that ITC claims related to exports,

- A detailed independent study to understand the revenue streaming models adopted by various gaming platforms and accordingly develop a comprehensive guidelines specifically tailored to the online gaming sector.

10th report on ‘Demands for Grants (2025-26)’ of Ministry of Corporate Affairs (MCA) highlights various issues and gives recommendations thereof for making Corporate Social Responsibility (CSR), Insolvency and Bankruptcy Code (IBC) & Environmental, Social and Governance (ESG) Regulations effective:

Areas | Issues | Recommendations |

Corporate Social Responsibility (CSR) |

|

|

Insolvency and Bankruptcy Code (IBC) |

|

|

Environmental, Social and Governance (ESG) Regulations |

|

|

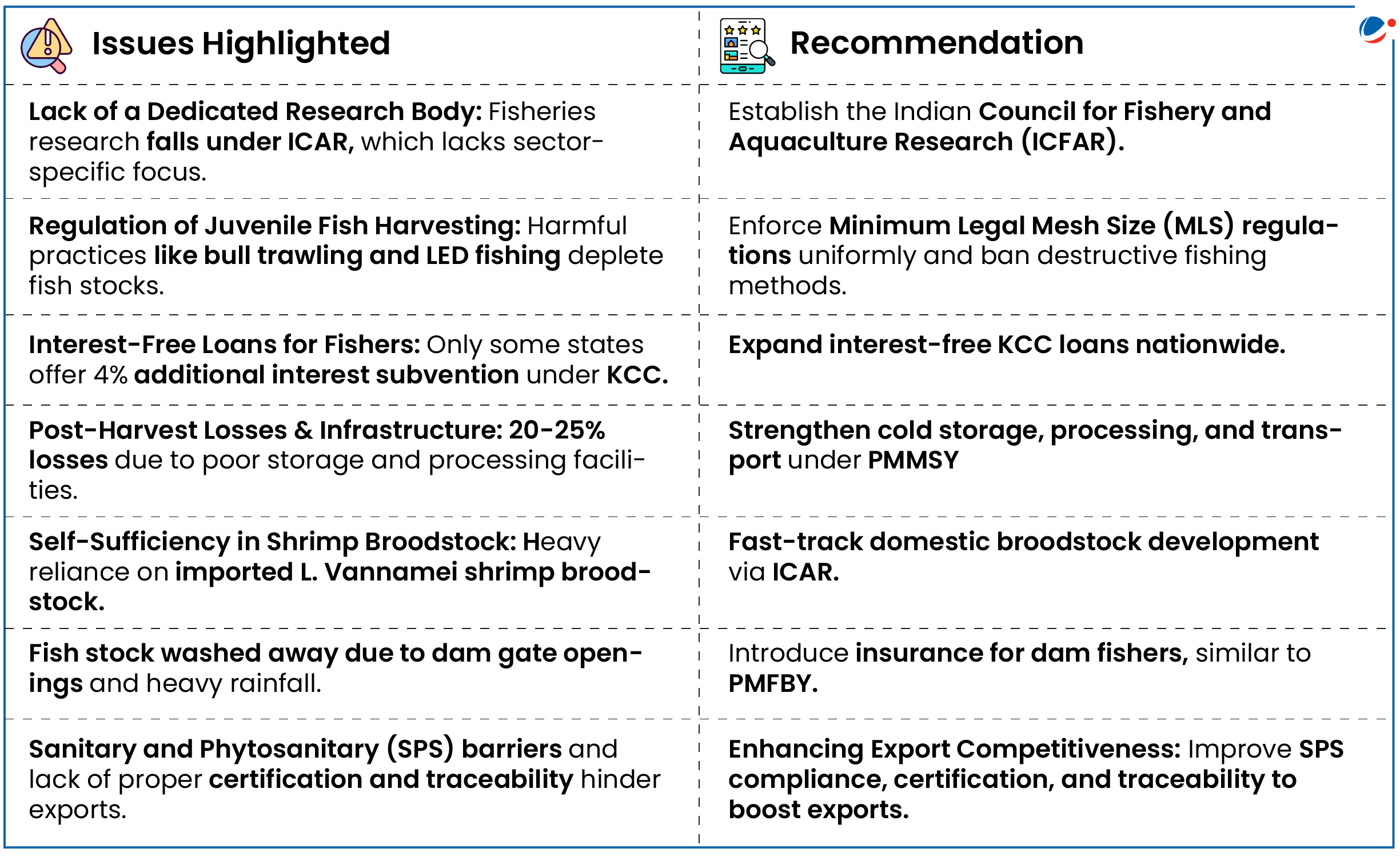

The report evaluates the government's response to recommendations aimed at improving the fisheries sector, enhancing employment opportunities, and increasing revenue generation.

- India is 3rd largest fish-producing country, accounting for approximately 8% of global fish production.

- Over the years, the sector’s contribution to agricultural GVA has risen from around 4% to over 6.72%.

Key Highlights

Recently, Union Government has notified a scheme for Cooperative Sugar Mills under modified Ethanol Interest Subvention Scheme.

About Scheme for Cooperative Sugar Mills

- Ministry: Ministry of Consumer Affairs, Department of Food & Public Distribution

- Aim: Conversion of existing sugarcane-based feedstock ethanol plants into multi-feedstock based plants to use grains like Maize and Damaged Food Grains (DFG).

- Under modified Ethanol Interest Subvention Scheme, Government is providing Interest subvention @ 6% per annum or 50% of rate of interest charged by banks/financial institutions, whichever is lower.

Article Sources

1 sourceIndia’s tobacco exports have doubled over the last 4 years.

Tobacco

- India’s Status: Second largest producer (after China) as well as second largest exporter (after Brazil).

- Major Producing States: Gujarat (45% of total cultivated area, 30% production), Andhra Pradesh, Karnataka, UP and Bihar.

- Favourable Conditions:

- Temperature: Between 20° to 27°C is required.

- Rainfall: When grown as a rainfed crop then requires at least about 500 mm of well-distributed rainfall during the crop growing season. (Usually not grown in the area if rainfall exceeds 1200 mm).

- Soil: sandy or sandy loam soil. Cigarette-tobacco growing areas of Andhra Pradesh are an exception in that the crop is grown on heavy black soil.

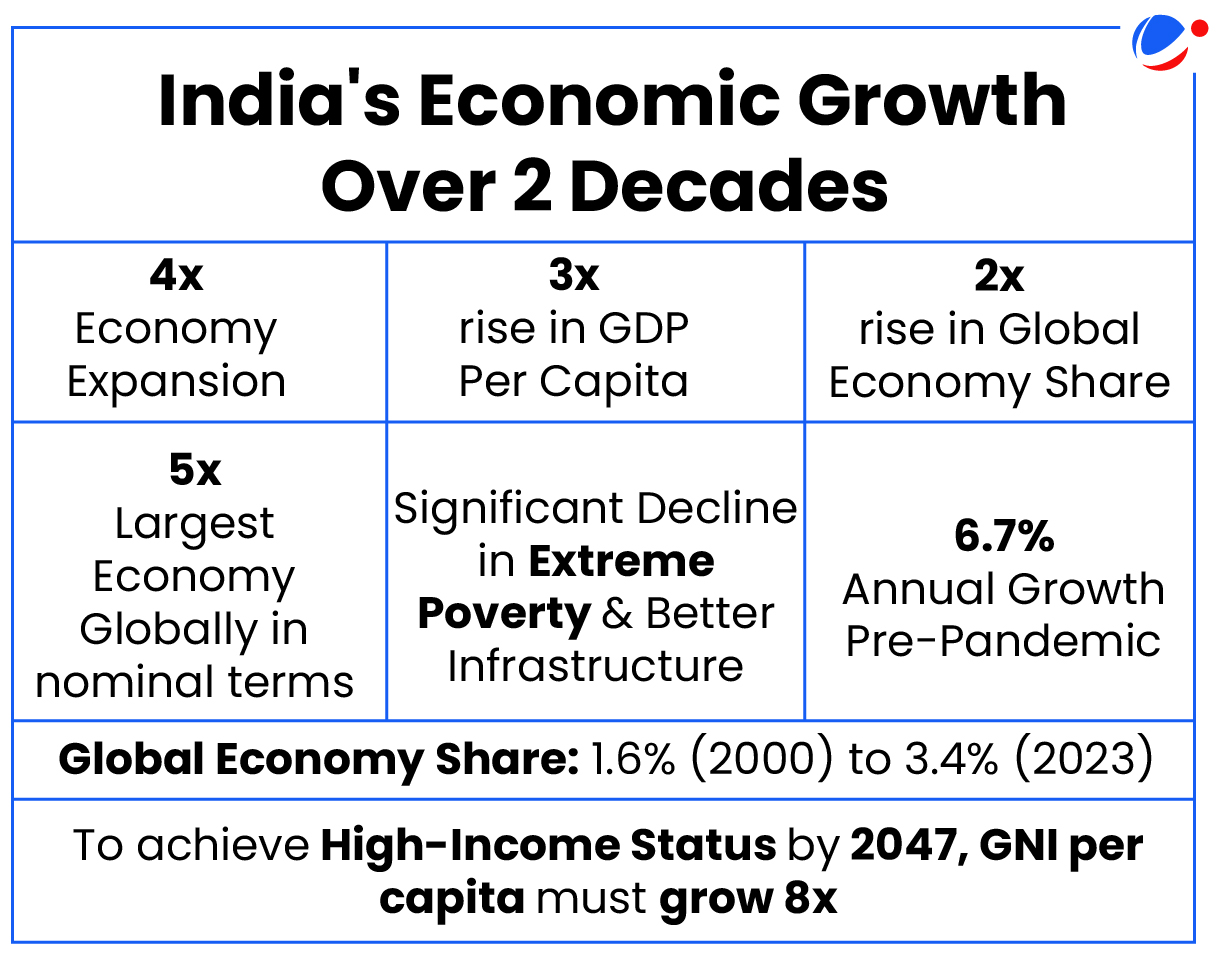

The report recognizes that India needs to grow by 7.8% on average over the next 22 years to become High-Income Country (HIC) by 2047.

- India became a Low Middle-Income Country (LMIC) in 2007-08 and is currently on track to become an Upper Middle-Income Country (UMIC) by 2032.

Key Challenges In Becoming HIC By 2047

- Slow Structural Transformation: Agriculture still employs 45% of the workforce (2023-24) while traditional market services and construction (low productivity) together constitute nearly 30%.

- In contrast, the share of manufacturing in total employment was around 11% and modern market services accounted for only 7%.

- Declining Private Investment: Private investment surged post-1990s reforms but it has fallen as a share of GDP, particularly since the global financial crisis in 2008.

- Underutilisation of Demographic Dividend: Over 2000-19, the working-age population increased by 37.4%, but employment increased by only 15.7%.

- During this period, the labor force participation rate fell from 58% to 49% remaining low by middle-income countries standards.

Key Strategies for Growth

- Boost Investment: Increase investment from 33.5% to 40% of GDP by 2035 through better financial regulations, easier MSME credit, and simplified FDI policies.

- Create Jobs: Encourage private investment in job-rich sectors like agro-processing, manufacturing, transport, and care economy.

- Balanced Regional Growth: Less developed states focus on basics (health, education, infrastructure), while developed states advance next-gen reforms.

Public debt can drive development by funding critical expenditures, but excessive debt growth poses challenges, especially for developing nations.

- United Nations Conference on Trade and Development (UNCTAD) ’s 2024 report warns of rising debt risks, urging immediate global action to ensure stability.

Key Findings of the Report

- Global Debt Surge: Public debt reached $97 trillion in 2023, with developing countries' debt rising twiceas fast as developed nations.

- India's public debt was recorded at 2.9 trillion US dollars.

- Debt Servicing Strains: 54 developing nations spend more on interest payments than on social sector.

- Unequal Financial System: Developing nations pay 2 to 12 times more in interest than developed countries.

Challenges Posed by the Rising Global Public Debt

- Debt Overhang: High debt levels can stifle economic growth by discouraging investment and consumption.

- Liquidity Challenge: The withdrawal of nearly $50 billion by private creditors from developing countries has worsened liquidity constraints.

- The creditor base with West-dominated institutions (private, multilateral, and bilateral creditors) makes debt restructuring expensive.

Recommendations

- Debt restructuring mechanisms to address coordination challenges.

- Expand contingency financing to prevent debt crises.

- Enhance participation of developing countries in global financial governance.

Article Sources

1 sourceIndia and Japan have renewed the $75 billion bilateral currencies swap agreement.

About BSA:

- It is an agreement between two central banks to exchange a cash flow in one currency against a cash flow in another currency according to predetermined terms and conditions.

- Purpose of India - Japan BSA: It is a two-way currency swap mechanism, allowing both countries to exchange local currencies for US dollars when needed.

- Significance: Help manage exchange rate volatility and provide liquidity during financial crises

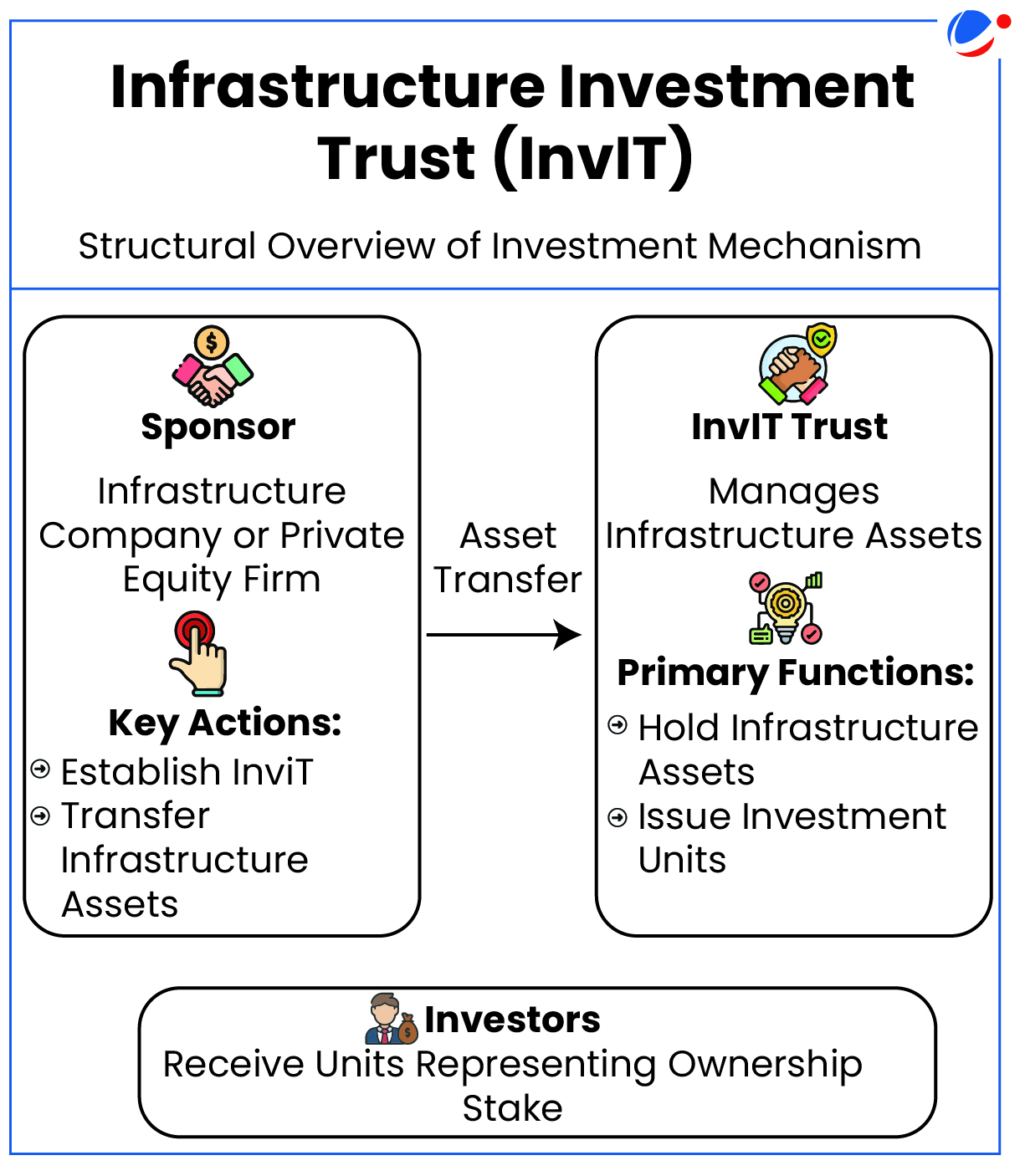

National Highways Infra Trust (NHIT) completed largest INVIT monetization in roads sector.

- NHIT is the Infrastructure Investment Trust (InvIT) set up by National Highways Authority of India (NHAI) in 2020 to support India's Monetization programme.

Infrastructure Investment Trust (InvIT)

- Definition: It is an investment vehicle, like a mutual fund or Real Estate Investment Trusts (REITs).

- InvITs enable direct investment of money from individual and institutional investors in infrastructure projects.

- Investments can be made directly or through SPV (Special Purpose Vehicle)/Holding Company by the InvIT.

- InvITs earn income through tolls, rents, interest or dividends from their investments.

- The interest, dividend, and rental income are taxable in the hand of the unitholder.

- Regulation: InvIT are regulated by the SEBI (Infrastructure Investment Trusts) Regulations, 2014.

- SEBI requires InvITs to distribute at least 90% of their income to investors.

- InvITs are recognized as borrowers under the ‘Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002’.

- Types of InvITs: Public InvITs, Private listed InvITs and Private unlisted InvITs.

- Advantages of InvITs: Access to retail investors to invest in large infrastructure projects, low ticket size, liquidity (as units are listed on stock exchanges), etc.

- AM is the process of creating new sources of revenue for the government and its entities by unlocking the economic value of unutilised or underutilised public assets.

Asset Monetization (AM)

|

Article Sources

1 sourceMinistry of Finance launched a new credit assessment model using MSMEs' digital footprints to streamline credit appraisal and disbursement.

About New Credit Assessment Model

- It will leverage the digitally fetched and verifiable data available in the ecosystem and devise automated journeys for MSME loan appraisal.

- It aims to improve financial inclusion, reduce reliance on traditional credit scores, and support MSMEs with easier access to formal credit.

- It was announced in Union Budget 2024-25 that public sector banks (PSBs) will build their in-house capability to assess MSMEs for credit, instead of relying on external assessment.

Article Sources

1 sourceIndia’s Venture Capital (VC) funding surges 43% to $13.7 billion in 2024.

About VC

- It is a form of private equity and a type of financing for startup companies and small businesses with long-term growth potential.

- Venture capital usually takes the form of equity shares or a future claim on equity, such as convertible debt, which in return allows the venture capital firm to receive a share of ownership in the business.

- Venture capitalists provide backing through financing, technological expertise, or managerial experience

Valueattics Re has become the first private firm to receive IRDAI’s nod to commence reinsurance business in India.

- Currently, public sector General Insurance Corporation (GIC Re) is the only reinsurance company operating in India.

About Reinsurance

- Reinsurance is a risk management practice where insurance companies transfer a portion of their risk to another insurance company (reinsurer) to protect themselves from large financial losses.

- Regulator: Insurance Regulatory and Development Authority of India (IRDAI).

- Laws: Governed under the Insurance Act, 1938 and IRDAI (Re-Insurance) Regulations, 2018.

Article Sources

1 sourceCentre for Development of Telematics launches ‘Samarth’ a cutting edge Incubation Program for telecommunications and IT sectors.

About Samarth

- Aim: Encourage the development of sustainable and scalable business models, offer access to cutting-edge resources, and help Startups Bridge the gap from ideation to commercialization.

- Implementation Partner: Software Technology Parks of India (STPI), premier S&T organization under Ministry of Electronics and Information Technology (MeitY).

UpLink initiative under World Economic Forum’s (WEF) cut carbon emissions by 142,400 tonnes in 2023-2024.

About UpLink Initiative

- It is an initiative focused on impactful early-stage innovation.

- It was founded in 2020 by WEF in collaboration with Deloitte and Salesforce.

- It builds ecosystems that enable purpose-driven, early-stage entrepreneurs to scale their businesses for the markets that are essential to a net-zero, nature-positive and equitable future.

- Objectives: Accelerate impact of early-stage innovators, Enable Innovation Ecosystems and Influence perception.