The report calls for an integrated financial system and suggests broad principles to policymakers for promoting integration.

What is Fragmentation of Global Financial Systems (GFS)?

- Meaning: It can be understood as the degree of differences that exists across jurisdictions in the prices of economically identical (or similar) assets, or in the free movement of capital across borders, etc.

- It causes increased tariffs, economic sanctions and export controls hampering cross- border investments.

Recent trends on Fragmentation of GFS

- Economic Statecraft: Use of economic tools and policies by a state to achieve its foreign-policy and domestic objectives. Example, Use of Sanctions, quotas, etc.

- Rising Multipolarity: Marked by declining dollar’s share in global reserves from 71% (1999)to 58% (2024).

- Geopolitical Events: COVID-19 shock and subsequent supply-chain disruptions, industrial policies to increase the resilience of domestic economies, E.g., Made in China, 2025, etc.

- Weakening global governance: Since 2019, the WTO Appellate Body has been unable to issue decisions, accelerating the formation of regional trading blocs.

Issues with Fragmented GFS

- Macroeconomic: It can negatively impact global output losing about 5% of global gross domestic product (GDP) in the short term.

- Impact on Emerging Markets and Developing Economies: Without access to capital and investment, they may seek financial support outside the international rules-based system.

- Impact on Financial Institutions: Reduces their ability to facilitate financial intermediation along with subjecting them to credit, currency and insolvency risks, etc.

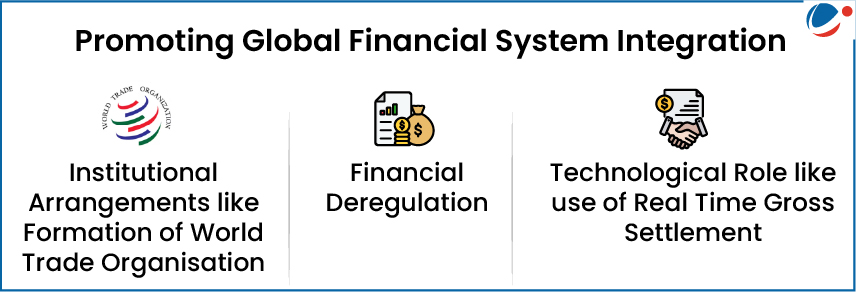

Key recommendations on Promoting GFS Integration

|