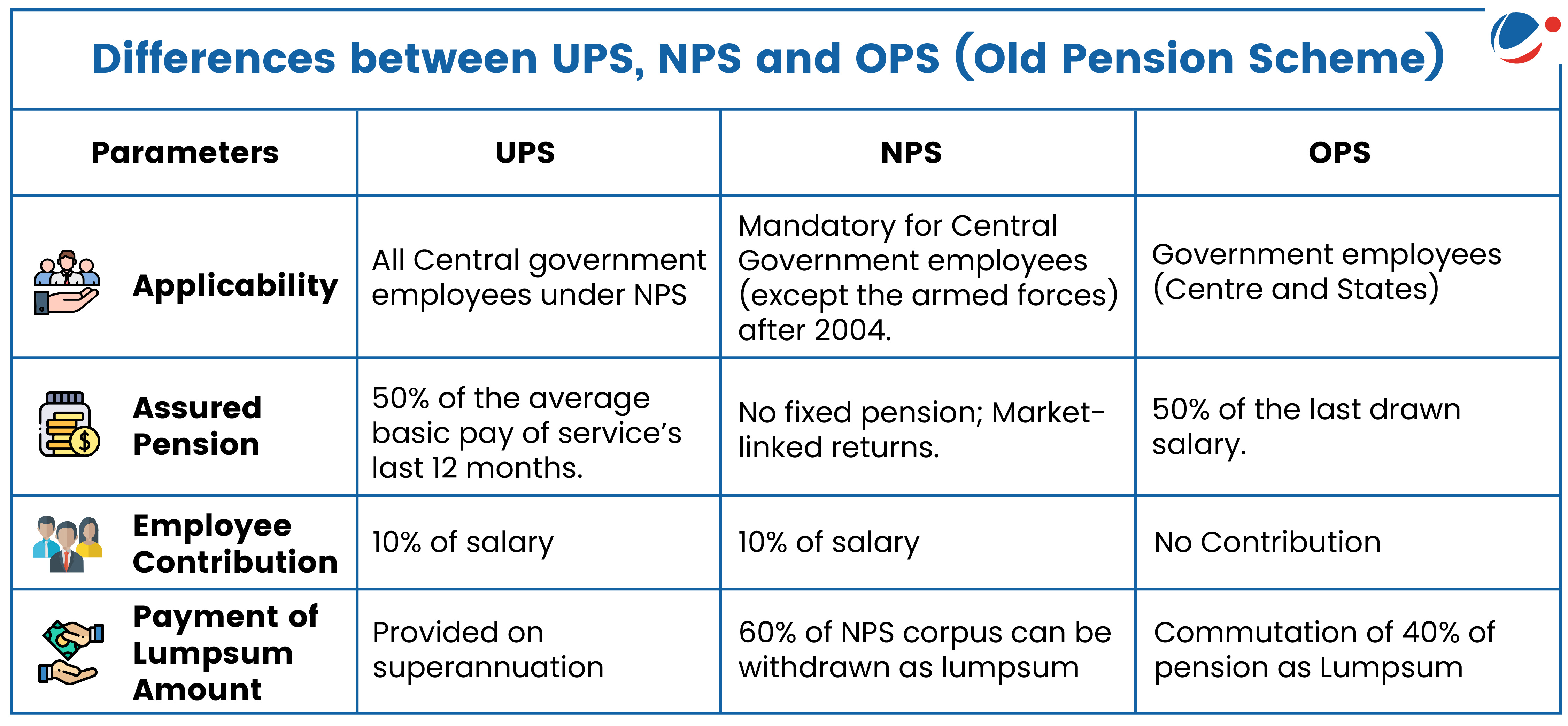

UPS shall be applicable to Central Government employees who are covered under the National Pension System (NPS) and who choose this option under NPS.

- It will be operational from April 1, 2025 and Pension Fund Regulatory and Development Authority (PFRDA) may issue regulations for its operationalization.

Salient features of UPS

- Assured pension: 50% of average basic pay drawn over last 12 months prior to superannuation for a minimum qualifying service of 25 years.

- Pension will be proportionate for lesser service period upto a minimum 10 years of service.

- Assured family pension: 60% of the employee's pension immediately before their demise.

- Assured minimum pension: ₹10,000/month on superannuation after minimum 10 years of service.

- Inflation indexation: Applicable to assured pension, family pension, and minimum pension.

- Dearness Relief based on All India Consumer Price Index for Industrial Workers (AICPI-IW) as in case of service employees.

- Lump sum payment at superannuation in addition to gratuity equivalent to 1/10th of monthly emoluments (pay + DA) for every completed six months of service.