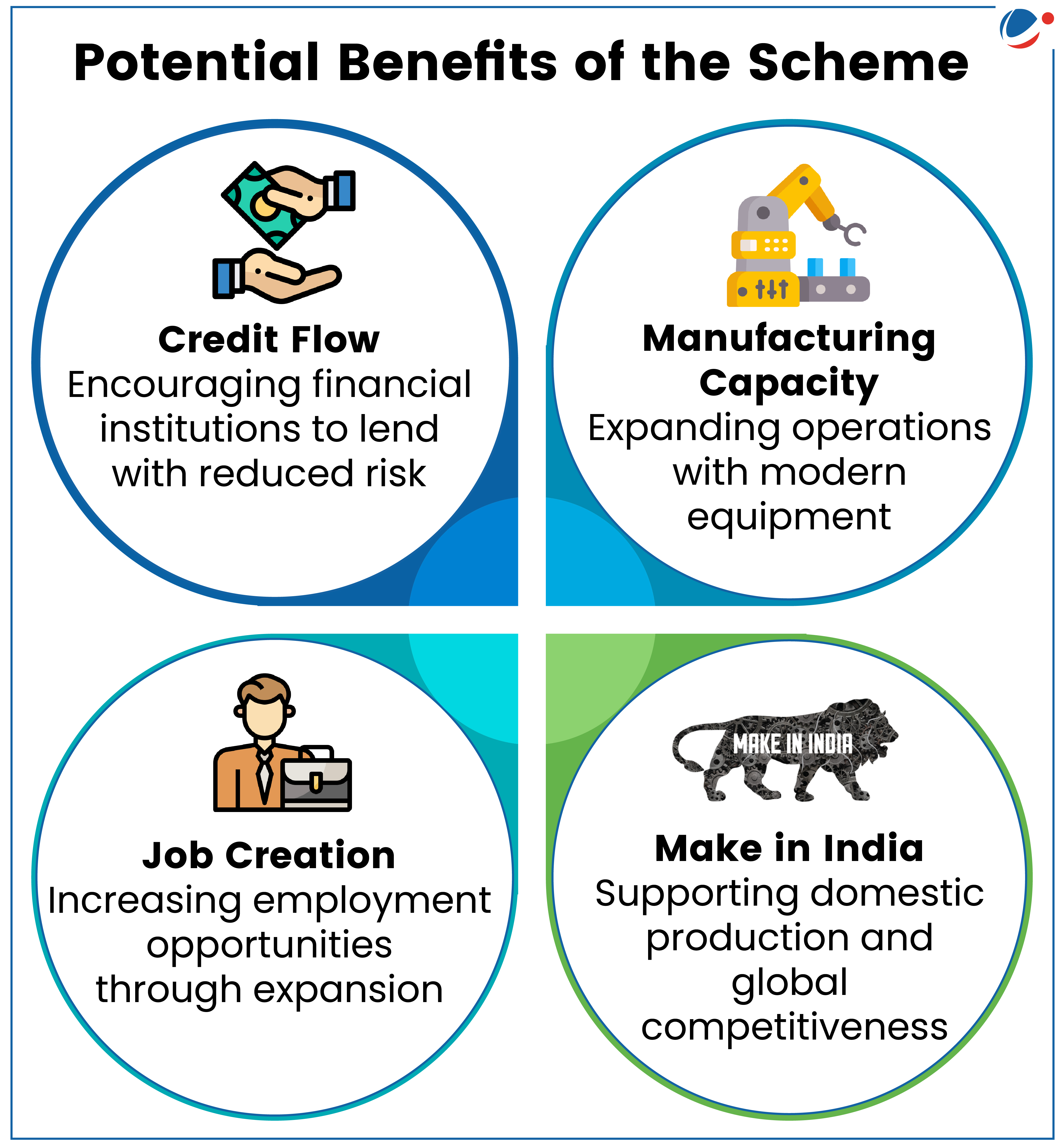

Government of India has recently approved introduction of Mutual Credit Guarantee Scheme for MSMEs (MCGS-MSME) for providing 60% guarantee coverage by National Credit Guarantee Trustee Company Limited (NCGTC) to Member Lending Institutions.

- MLIs are Financial Institutions such as Commercial Banks, NBFCs registered with NCGTC under the Scheme.

Salient Features of MCGS-MSME

- Eligible Borrowers: MSMEs with a valid Udyam Registration Number.

- Loan Coverage: Up to ₹100 crore per MSME for purchasing Plant and Machinery/ Equipment.

- Project Cost can exceed ₹100 crore, but at least 75% of the cost must be for machinery/equipment.

- Repayment Terms:

- Loans up to ₹50 crore: Repayment period of up to 8 years (including 2 years moratorium on principal).

- Loans above ₹50 crore: Longer repayment and moratorium can be considered.

- Scheme Duration: 4 years from the issue of operational guidelines or until a cumulative guarantee of ₹7 lakh crore is issued.

Other Steps taken to ease access to Credit for MSMEs

- Credit Guarantee Fund Trust for Micro and Small Enterprises to provide collateral-free loans to MSEs.

- Raising and Accelerating MSME Performance (RAMP) Program: ₹6,000 crore investment over 5 years for MSME growth.

- Priority Sector Lending (PSL) norms: All bank loans to MSMEs conforming to the conditions prescribed therein qualify for classification under priority sector lending.