It has been done under the Ethanol Blended Petrol (EBP) Programme for the Ethanol Supply Year (ESY) 2024-25 (November, 2024- October, 2025)

- As per the revision, the administered ex-mill price of ethanol derived from C Heavy Molasses (CHM) is fixed at Rs.57.97 per litre from Rs.56.58.

Significance of the Price Revision

- Offer price stability and remunerative prices for ethanol suppliers and sugarcane farmers.

- Environmental benefits and assures sufficient ethanol availability for meeting blending target.

Ethanol Blended Programme (EBP)

- About: Requires OMCs to sell petrol blended with ethanol up to 20%.

- Ministry: Ministry of Petroleum and Natural Gas.

- Objective: Promote the use of alternative and environment friendly fuels and reduce import dependence, boost agriculture sector, etc.

- Revised Target: Target of 20% ethanol blending in petrol was revised to 2025-26 from previous 2030.

Key Achievements of EBP

- Saving Foreign Exchange: Approximately, 1.13 lakh crore saved during the last decade (as on 31.12.2024).

- Increased Blending by OMCs: From 38 crore litre in ESY, 2013-14 to 707crore litre with an average blending of 14.60%in ESY 2023-24.

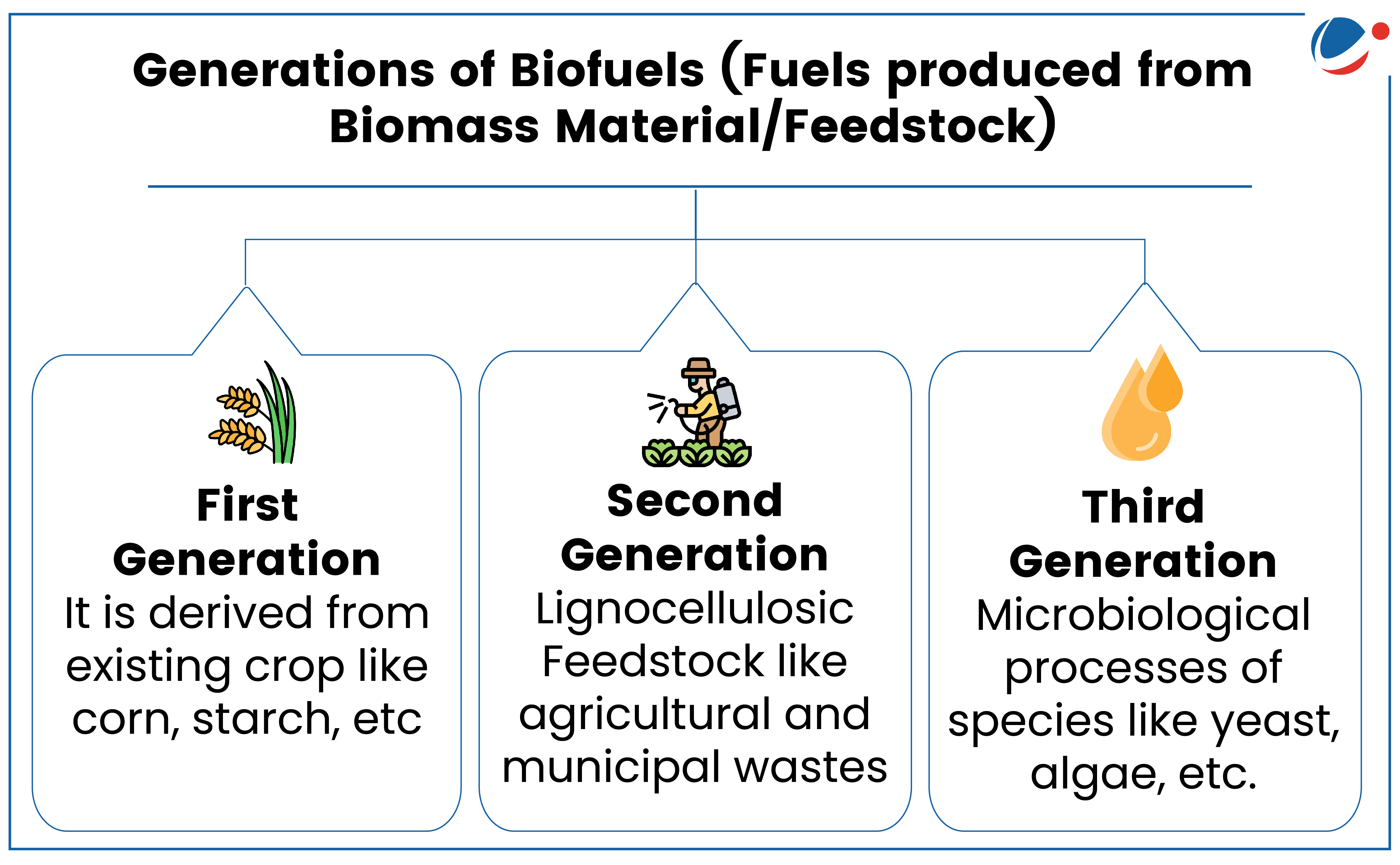

Other Initiatives taken for Promotion of Biofuels

|