The Forward-Looking Survey on Private Sector Capex Investment Intentions (Capex Survey), the first of its kind by the National Statistics Office (NSO) (under MOSPI), was conducted under the Collection of Statistics Act, 2008.

Key Findings

- Private sector CAPEX grew 66% from FY22 to FY25, reaching ~Rs 6.5 lakh crore.

- Manufacturing enterprises accounted for 48% of total private sector CAPEX in FY24-25.

- In 2024-25, most enterprises focused CAPEX on core assets, with others investing in value addition, opportunistic assets, and diverse strategies.

Significance of Capital Expenditure (CAPEX)

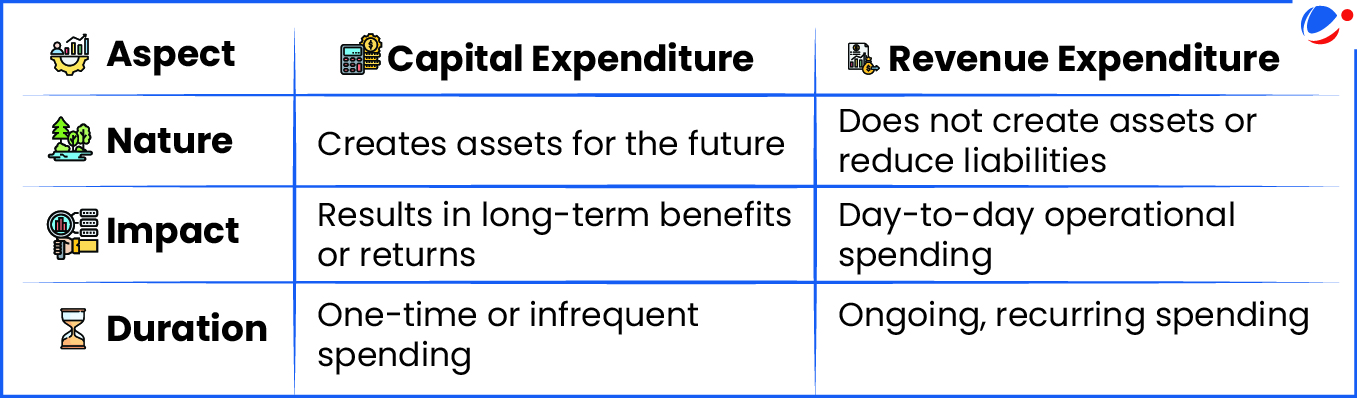

- Capex involves spending on assets: That have long-term benefits for the business. E.g., Property, equipment, acquiring new technology.

- Strategic Decision-Making: Capex decisions reflect strategic priorities, indicating where resources are allocated to drive future growth.

- Competitive Advantage: By investing in Capex, companies can enhance their operational efficiency, innovate products or services, and stay ahead of competitors.

- Asset Maintenance and Upgrades: Capex is needed to maintain existing assets, upgrade technology, or expand production capacity.

- Investor Confidence: Capex signals to investors that the company is committed to its long-term growth and value creation.

Challenges hindering private sector Capital Expenditure

- Difficulty in mobilizing large equity and affordable debt.

- Project structuring issues related to risk estimation and mitigation.

- Delays in clearances and land acquisition.

About Capital Expenditure

- Definition: Capital expenditure is the money spent by the government on the development of machinery, building, health facilities, education, etc.

- Capital expenditure includes money spent on the following: Acquiring fixed and intangible assets; Upgrading an existing asset; Repairing an existing asset & Repayment of loan