Why in the News?

NITI Aayog CEO highlighted the need for India to get into global value chains (GVCs) to boost exports and secure supply chains.

What are Global Value Chains (GVCs)?

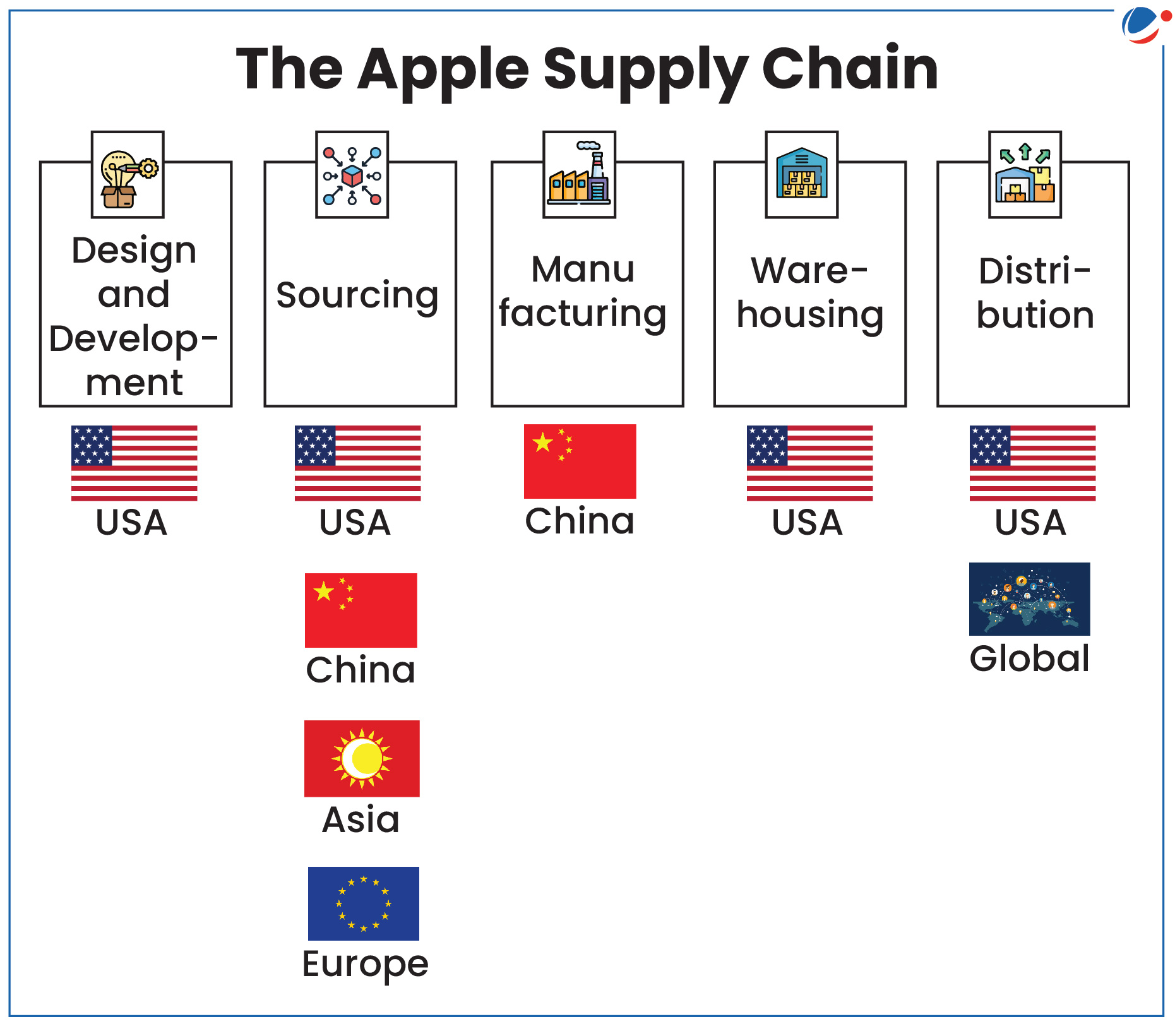

- It refers to a production sequence for a final consumer good, with each stage adding value (e.g., production, processing, marketing, transportation, distribution) and with at least two stages taking place in different countries.

- For example, a smartphone assembled in China might include graphic design elements from the United States, computer code from France, and silicone chips from Singapore.

- As per OECD, an estimated 70 % of trade occurs through GVC.

- Countries can participate in GVCs by engaging in either backward or forward linkages based on their economic specialisation.

- Backward linkages: when one country uses inputs from another country for domestic production.

- For example, India imports cotton fabric from Italy to make and export shirts.

- Forward linkages: when one country supplies inputs/intermediate goods that are used for production in another country.

- For Example, India supplies auto components to a German automaker for use in car production.

- Backward linkages: when one country uses inputs from another country for domestic production.

Importance of Global Value Chains (GVCs)

- Increase in Productivity: By accessing a variety of cheaper or higher quality imported inputs, increased knowledge sharing, leveraging economies of scale in firms and higher value added (most productive) tasks etc.

- Reduced Poverty: According to the World Bank, a 1% increase in GVC participation is estimated to boost per capita income levels by more than 1% (about twice as much as conventional trade).

- Employment Creation: GVCs can lead to the creation of more jobs when they catalyze structural transformation or generate new linkages in and around the chain.

- For example, In Bangladesh, the emergence of the GVC-oriented export apparel sector has significantly contributed to employment.

- Labour intensive and female-driven: In sectors most intensively traded in GVCs (such as apparel, footwear, and electronics) lower-skilled, young, female workers account for the largest share of employment.

- Greater scope for Specialisation: Due to the international fragmentation of production and unbundling of operations, countries no longer need to create complete products or value chains.

- Instead, they can create targeted industries for a particular stage of production along the value chain that suits their existing level of capability. E.g., Integration of Vietnam into global textile value chains.

India's participation in GVC

- Low Participation: India's GVC-related trade (as per cent of gross trade was at 40.3% in 2022) is significantly low, not only when compared to large economies like the United States, China, and Japan but also, smaller countries like South Korea and Malaysia.

- Although, the post-COVID-19 redistribution of supply chains has given an opportunity to India to increase its participation.

- Low export of Network products: such as electronics, computers, telecommunication equipment and vehicles for which GVCs are the dominant mode of production, account for only 10% of India's total merchandise exports.

- Key products driving India's GVC participation: include coal and petroleum, business services, chemicals, transport equipment etc.

- Predominance on forward linkages: India still depends heavily on exports of raw materials and intermediate products.

Reasons behind India's weak GVC integration

- Poor trade infrastructure: GVCs often require tight production schedules. For example, smartphones and laptops need rapid production to keep up with technology trends.

- The poor quality of road and rail infrastructure, subpotimal regional integration etc. adversely impact GVC integration.

- Uncertainty in trade and tariff policy: Average tariffs in India have jumped to 18.1 % (2022) from 13% (2014), which in turn has made India uncompetitive with respect to countries such as Vietnam, Thailand, Mexico etc.

- Suboptimal quality standards: For example, due to high export standards and strict delivery pressures, Indian garment firms find it easier to supply to the domestic market.

- Biased towards capital-Incentive Sector: Despite having comparative advantages in unskilled labour-intensive manufacturing activities, India's commodity composition of exports is biased towards capital- and skill-intensive products.

- Lack of information: Information regarding markets, partners, EXIM (Export-Import) rules, and even trade finance plays an important role for companies in creating partnerships.

- Domestic policy challenges: Complex tax policies and procedures, complex labour laws, and uncertainty in trade policy create obstacles in efforts to scale up production in India.

Measures Taken to Integrate India in GVC

|

Way forward

- Improving the Business Environment:

- Ensuring clarity on dispute settlement in the post-Bilateral Investment Treaty system.

- Promoting financial access by improving creditworthiness assessments (especially for SMEs).

- Ensuring early Implementation of New labour Codes.

- Facilitating Trade:

- Establishing stable tariff rules.

- Simplifying and streamlining border procedures.

- Establishing a National Trade Network (an online platform for all export-import compliance processes)

- Implementing the Indian National Strategy on Standardisation to increase firms' capacity to meet international standards.

- Stabilizing regulatory environment: Tax regulations and procedures must be uniformly implemented. Further, these should align with trade policies to assist firms in scaling up production.

- Target High-Value GVC Segments: Focus on high-value segments of GVCs, such as product conceptualization, design, prototype development, and after-sales services etc.

- Promote labour-intensive Sector: Domestic firms in the labour-intensive sector need to be incentivised to undertake activities which enable participation in GVCs.