Why in the News?

China's Ministry of Commerce imposed export restrictions on seven rare earth elements (REEs) and magnets used in the defence, energy, and automotive sectors in response to U.S. tariff increases.

More on the News

- The new restrictions apply to 7 of 17 REEs: It requires companies to secure special export licenses to export these minerals and magnets.

- The new restrictions are not a ban: They require firms to apply for a license to export rare earths.

What are Rare Earth Elements (REE)?

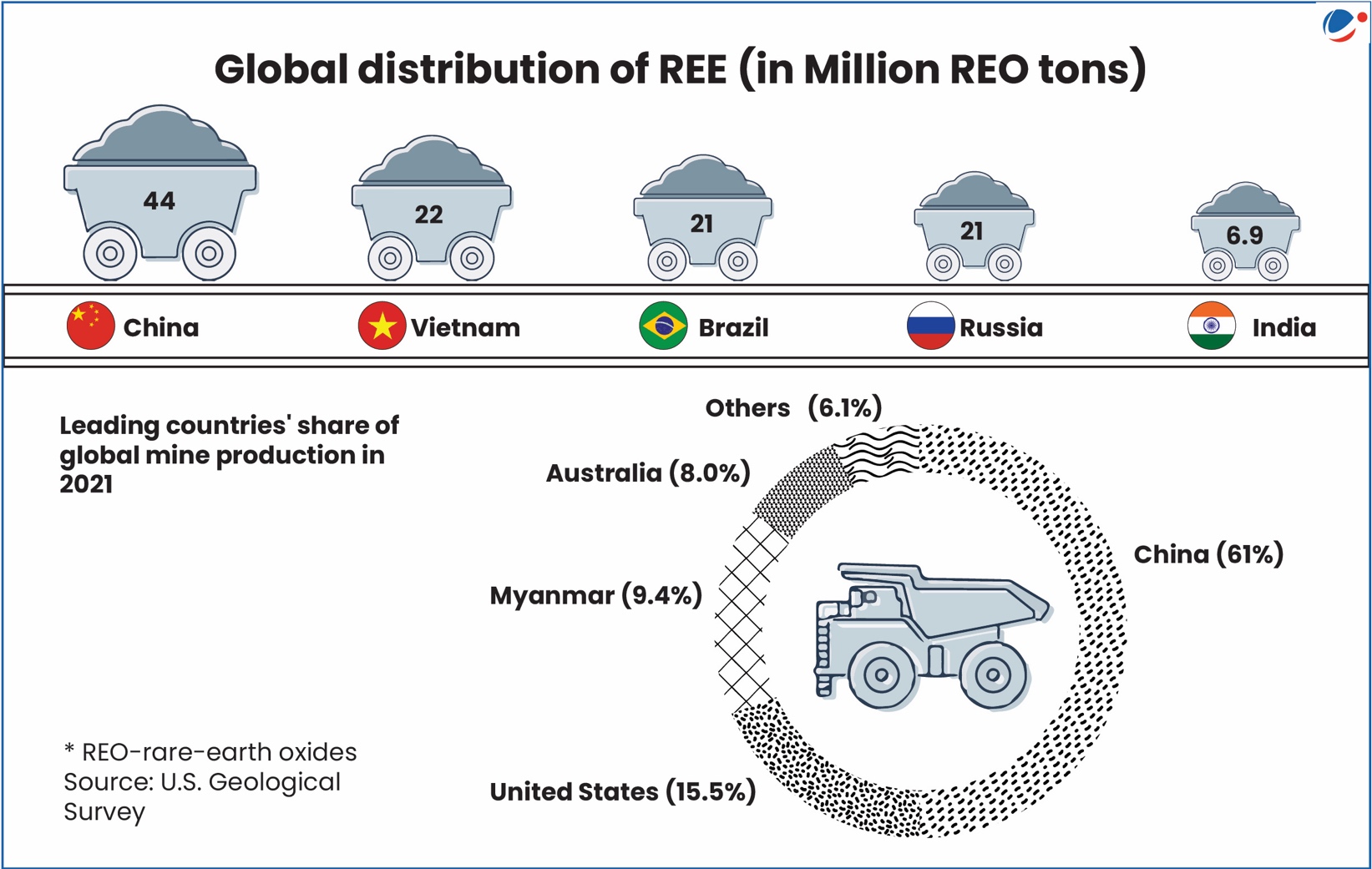

- Misnomer: According to the United States Geological Survey (USGS), most REEs are not as rare as their name suggests and are found in abundance in the Earth's crust.

- However, they're rarely found in concentrations that are economically viable for mining.

- They were named "rare-earth elements" because most were identified during the 18th and 19th centuries as "earths Elements" and, in comparison to other "earths Elements," such as lime or magnesia, they were relatively rare.

- Earth's Elements are defined as materials that cannot be changed further by heat.

- Rare Earth Elements (RREs): As per the International Union of Pure and Applied Chemistry (IUPAC) in 2005, are a group of 17 elements.

- These elements share similar properties such as high density and high conductivity.

- cerium (Ce), dysprosium (Dy), erbium (Er), europium (Eu), gadolinium (Gd), holmium (Ho), lanthanum (La), lutetium (Lu), neodymium (Nd), praseodymium (Pr), promethium (Pm), samarium (Sm), scandium (Sc), terbium (Tb), thulium I, ytterbium (Yb), and yttrium (Y).

- Source: Main sources of REEs are minerals such as bastnasite, loparite and monazite.

Geostrategic significance of recent export control of REE

- To gain upper hand in the tariff war: Retaliation against the USA's reciprocal tariffs, which may hurt the Chinese industry due to a fall in exports.

- Implications on Critical technologies: Yttrium and Dysprosium, which are widely used in the manufacturing of jet engine components, defence equipment, and advanced electronics.

- For importing nations, supply disruptions can cripple industries, inflate costs, and delay technological advancements.

- Global supply Chain disruption: Due to crunch in supply may affect major REE-consuming countries like the US, Japan, Vietnam, and Germany.

- Weaponisation of REE: China first weaponized rare earths in 2010 when it banned exports to Japan over a fishing trawler dispute.

- Between 2023 and 2025, China began imposing export restrictions of strategic materials including gallium, germanium etc.

- Geostrategic alternatives: Longer-term consequences include diversification of supply, reshoring and friend-shoring of manufacturing, and acceleration of recycling.

- Reshoring means bringing back the production to the home country, and Friend shoring is where businesses source or produce goods in countries with shared values.

- Countries are seeking alternatives in Africa (notably the Democratic Republic of Congo and Malawi), South America, and Australia.

Global efforts to reduce dependence on China for REE

- Critical Minerals Mapping Initiative (CMMI) in 2019: Formed by the US, Australia and Canada to conduct research on critical mineral resources, including REEs.

- The UN Secretary-General's Panel on Critical Energy Transition Minerals: To discuss proper management and a roadmap for Critical energy transition minerals such as rare earth elements.

- Mineral Security Partnership (MSP): Partnerships between countries, including India to focuses on the supply chain of minerals and metals that are most relevant for advanced technologies, defence, energy, and industrial processes

Indian Initiatives for REE production

|

Conclusion

To reduce dependence on China for rare earth elements (REEs), countries may build strategic inventories, boost domestic production, and invest in advanced refining technologies. Deep-sea exploration and recovery from secondary sources offer additional supply avenues. Streamlined regulations and private sector incentives are essential to accelerate self-reliance in the REE value chain.