Why in the News?

Starting January 1, 2025, Switzerland has suspended the Most-Favoured-Nation (MFN) clause in the Double Taxation Avoidance Agreement (DTAA) with India.

India-Switzerland DTAA MFN Issue

|

About Double Taxation Avoidance Agreement (DTAA)

- About DTAA: A treaty between two or more countries which ensures taxpayers (individuals or businesses) are not taxed on the same income.

- India has signed DTAAs with over 90 countries, including major economies like the USA, UK, UAE, Singapore, and Mauritius.

- How DTAA Works? Residence Country vs. Source Country

- Residence Country: This is the country where the taxpayer lives or is based (home country).

- Source Country: This is the country where the income is earned (foreign country).

- The DTAA ensures that the same income is not taxed twice—once in the source country (where it is earned) and again in the residence country (where the taxpayer lives).

MFN Clause in Double Taxation Avoidance Agreement (DTAA)

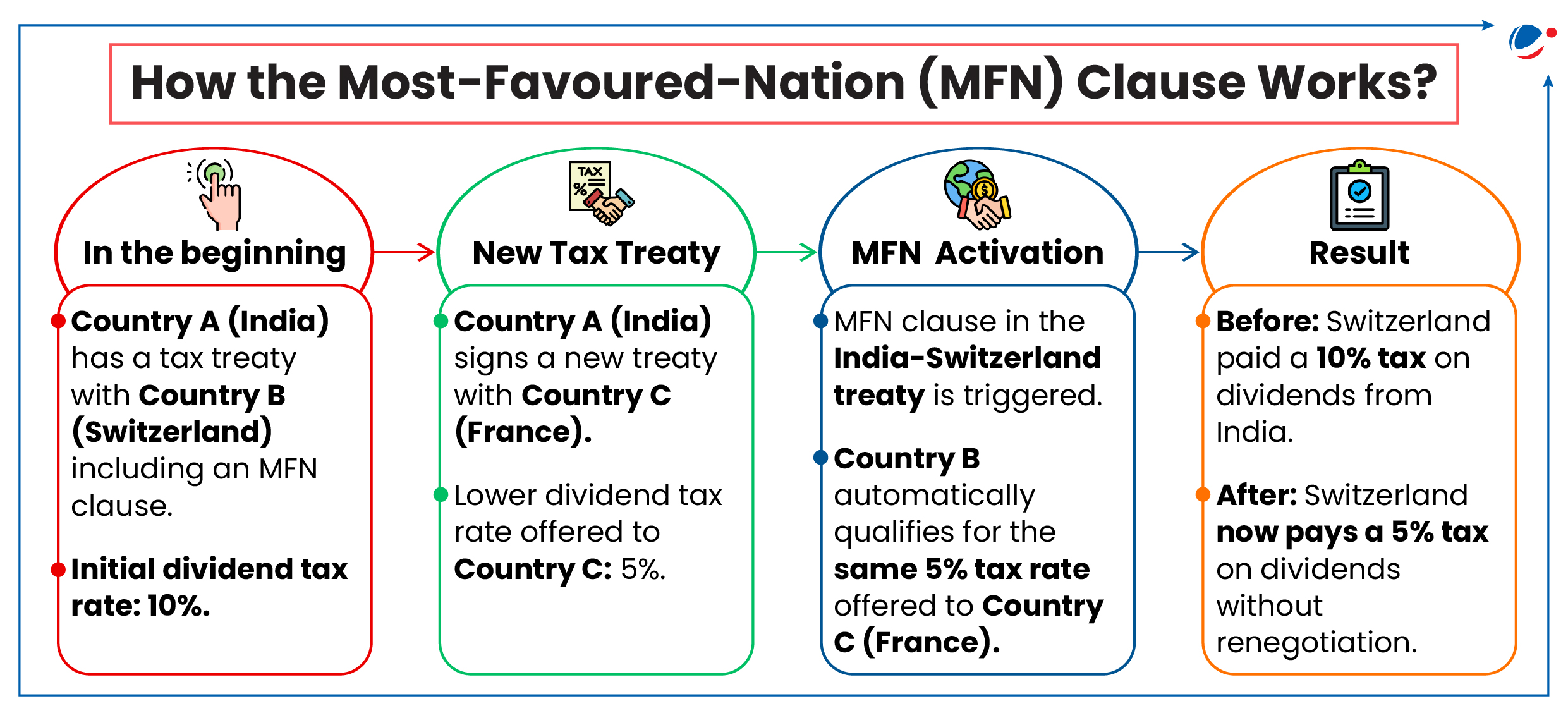

- Definition: The MFN clause within DTAA is a provision in tax treaties that ensures a country grants the same or better tax benefits to the other country as it provides to any of its other "most favored" treaty partners.

- If India offers a better tax rate on dividends or other income to a third country (say France), Switzerland can also claim the same favorable rate for its taxpayers.

- MFN Principle is also found within WTO Framework.

- The DTAA MFN clause ensures equal tax benefits between treaty partners, while the WTO MFN principle mandates equal trade treatment by extending any trade advantage granted to one WTO member to all others.

- WTO's MFN Principle: It is codified in Article I of the General Agreement on Tariffs and Trade (GATT), Article 2 of the General Agreement on Trade in Services (GATS), and Article 4 of the Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPS).

Significance of DTAA in Global Tax Governance

- Legal Certainty: DTAAs offer taxpayers clear guidelines on their tax duties, providing a sense of legal certainty and aiding in financial and business planning.

- DTAA provides Mutual Agreement Procedures (MAP), e.g., resolving transfer pricing disputes between India and Japan.

- Prevention of Fiscal Evasion: These agreements help in curbing tax evasion by setting forth definitive tax compliance measures for cross-border income.

- Certain DTAAs includes anti-abuse clauses, e.g., India-Mauritius DTAA revised to prevent treaty shopping and round-tripping of funds.

- Tax Savings: By leveraging the DTAA, individuals and businesses can take advantage of the lower tax rates between the two countries, leading to tax savings.

- Tax Refund Opportunities: Companies operating internationally can receive tax refunds through DTAA when their home country offers reimbursement for taxes paid abroad, helping reduce the burden of double taxation.

- Reduced TDS Rates: The agreement also reduces TDS (Tax Deducted at Source) rates on dividends received in India. This can lead to significant savings, especially for those with substantial dividend income.

Challenges in DTAA Architecture

- Treaty Shopping and Abuse: Companies exploit DTAAs to reduce taxes by routing investments through countries with favorable treaties, even without substantial business operations.

- Example: Mauritius was historically used by foreign investors to route funds into India to claim capital gains tax exemptions under the India-Mauritius DTAA.

- Interpretation and Implementation Issues: Differences in interpreting DTAA provisions between countries lead to disputes and double taxation.

- Lack of Harmonization with Domestic Laws: DTAAs often conflict with domestic tax laws, creating confusion and compliance challenges.

- Example: The recent 2023 Nestle issue between India-Switzerland.

- Inadequate Dispute Resolution Mechanisms: Delays and inefficiencies in resolving disputes under the Mutual Agreement Procedure (MAP) create uncertainty for taxpayers.

- MAP is an alternative available to taxpayers for resolving disputes giving rise to double taxation whether juridical or economic in nature.

Conclusion

Switzerland's suspension of the MFN clause in the India-Switzerland DTAA reflects evolving global tax norms, emphasizing the need for clear treaty interpretations, compliance with domestic laws, and alignment with international tax standards.

India-Switzerland Relations: An Overview |

|