Internationalisation of Rupee

The RBI has unveiled new measures to promote wider international use of the Indian Rupee (INR), expanding both trade and investment avenues.

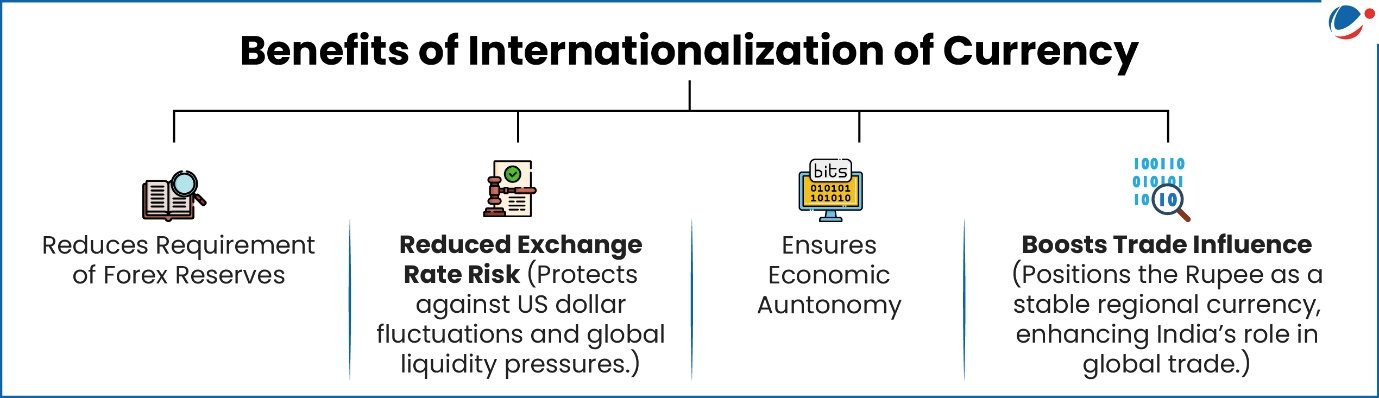

- Internationalisation of the Rupee means allowing the Indian Rupee to be used for global trade and financial transactions.

Key Measures Announced

- Loans in Indian Rupees to Non-Residents: Authorised dealer banks in India and their overseas branches will be permitted to lend in INR to persons resident in Bhutan, Nepal, and Sri Lanka, including a bank.

- Establishing Transparent Reference Rates: Financial Benchmarks India Limited (FBIL) will develop transparent reference rates for the rupee against major global currencies.

- Currently, the RBI publishes reference rates for the U.S. dollar, euro, Japanese yen, and sterling.

- Widening Use of Special Rupee Vostro Accounts (SRVAs): SRVA balances can now be used to invest in corporate bonds and commercial papers.

- Previously, surplus vostro balances were allowed to be invested in central government securities.

Special Rupee Vostro Account

|

- Tags :

- Internationalisation of Rupee

SWAMIH Fund

RBI has exempted SWAMIH (Special Window for Affordable and Mid-Income Housing) Fund, a government-backed fund from its tightened rules of Alternate investment fund (AIF).

- The RBI prescribes the regulatory guidelines in respect of investment by the regulated.

- entities in AIF.

About SWAMIH, 2019

- It is a Category II AIF.

- AIF means any fund established or incorporated in India which is a privately pooled investment vehicle which collects funds from sophisticated investors, whether Indian or foreign, for investments.

- SEBI regulates AIF. E.g., Venture capital funds (Including Angel Funds)

- Objective: Provide priority debt financing for completion of stalled housing projects.

- Fund Manager: SBI Ventures Limited.

- Tags :

- SWAMIH Fund

Engels’ Pause

Geoffrey Hinton who was awarded the 2024 Nobel Prize, warned that AI could trigger a modern Engels’ pause.

About Engels’ Pause

- It is a term coined by Oxford economist Robert Allen, based on Friedrich Engels’ observations of 19th-century Britain.

- It refers to the paradox during early Industrial Revolution in Britain (c. 1780–1840) when industrial output rose sharply but real wages of workers remained stagnant.

- There are concerns that AI driven Economy could replicate Engels’ pause, where economic growth exists but the gains are unequally distributed, leaving many behind.

Aspect | Historical (Industrial Revolution) | Modern (AI-driven Economy) |

Driver of Change | Mechanization and steam power | Artificial Intelligence, automation, machine learning |

Timeframe | 1780–1840 | 2020s–2030s (projected) |

Productivity Trend | Sharp industrial growth | Rising output through AI automation |

Wage Response | Real wages stagnant | Wages of low/mid-skill workers stagnate or decline |

Distribution of Gains | Capital and inventors enriched | Tech firms, investors, and high-skilled AI workers benefit |

Social Outcome | Urban inequality, worker unrest | Skill polarization, job displacement, inequality across sectors and countries |

- Tags :

- Engels’ Pause

weighted average call rate (WACR)

RBI would continue to use the overnight weighted average call rate (WACR) as the operating target for monetary policy.

About WACR

- It is the average interest rate at which banks lend and borrow money from each other overnight, just for one day.

- Significance:

- It reflects the short-term cost of money in the banking system.

- It helps the RBI monitor how easy or difficult it is for banks to get funds.

- If WACR goes up, it means money is becoming costlier; if it goes down, it means money is easier to get.

- Tags :

- WACR

- weighted average call rate

World Economic Outlook

IMF projected India’s GDP growth rate for 2025-26 to 6.6% (6.4% earlier) and 6.2% for 2026-27 in its WEO.

- Global growth is projected to slow from 3.3% in 2024 to 3.2% in 2025 and 3.1% in 2026.

About World Economic Outlook

- Published by: International Monetary Fund (IMF)

- Purpose: It presents analyses and projections of the world economy in the near and medium term.

- It is usually published twice a year with updates in between.

- Tags :

- World Economic Outlook

Global Finance Stability Report (GFSR)

International Monetary Fund (IMF) recently released the Global Finance Stability Report (GFSR), April 2025.

About GFSR

- Purpose: Provide a regular assessment of global financial markets and identify potential systemic weaknesses before they lead to crises.

- Key Findings

- Tightened Global Financial Conditions: Have caused significant increase in the Global financial stability risks.

- Role of Major geopolitical risk events: Especially military conflicts, can lead to substantial decline in stock prices and increases in sovereign risk premiums.

- Other Key Reports by IMF: World Economic Outlook, Fiscal Monitor.

- Tags :

- Global Finance Stability Report (GFSR)