Why in the News?

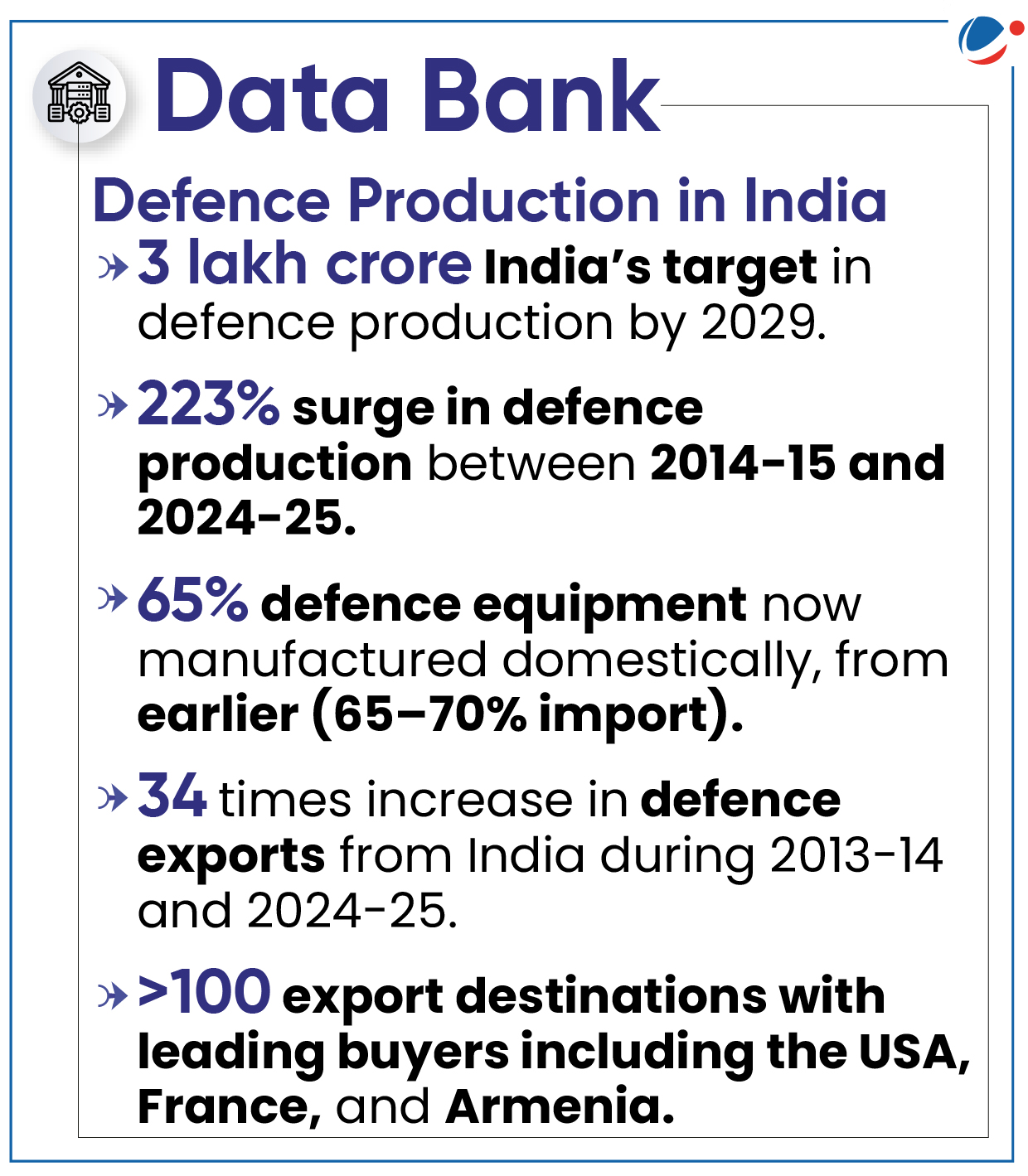

According to the data from the Department of Defence Production, the private sector share in defence production hits record of 23% in FY 2024-25, marking third consecutive year of increasing private sector involvement.

Reasons behind increased share of Private sector in Defence Production

- Institutional reforms

- Creation of Chief of Defence Staff (CDS) and Department of Military Affairs to enhance synergy within the armed forces and promote the use of indigenous equipment by the Services.

- Policy and Regulatory Reforms

- Defence Acquisition Procedure (DAP-2020): Prioritizes domestic procurement, opening larger contracts to private players and strengthening indigenous manufacturing.

- Liberalized Foreign Direct Investment (FDI) Policy: Since 2020, up to 74% FDI allowed under Automatic Route (and up to 100% through the Government Route), enabling global defence majors to transfer technology to Indian firms (e.g., Tata-Airbus partnership for C-295 aircraft).

- Positive Indigenization Lists (PILs): Imports of over 5,500 items are restricted, mandating domestic sourcing and creating assured demand for private industry.

- Make in India Initiative: This flagship campaign promotes indigenous manufacturing and encourages private companies to invest in defence production, boosting private sector involvement. E.g., SRIJAN Portal.

- Industrial Infrastructure and Budget Support

- Defence Industrial Corridors: Dedicated manufacturing hubs established in Uttar Pradesh and Tamil Nadu with incentives, infrastructure, and investment-friendly policies attracting private sector investments.

- Budgetary Prioritization: For FY2025-26, the Ministry of Defence has earmarked 75% of its modernization budget (₹1.11 lakh crore) specifically for procurement from Indian firms.

- Innovation and Ease of Doing Business

- Innovation Ecosystem (iDEX & ADITI): Startups and MSMEs receive grants and contracts to develop cutting-edge technologies such as artificial intelligence, drones, and quantum systems, fostering advanced indigenous innovation.

- Ease of Doing Business Measures: Processes simplified by extending license validity, de-licensing many defence items, and implementing digital export approval systems, reducing entry barriers for private companies.

Challenges in India's Defence Production

- Production lag: Industry is way off the target set by the government for exports. E.g., HAL losing the Malaysian LCA contract and Garden Reach Shipbuilders losing a tender in the Philippines.

- Industrial and manufacturing: Heavy reliance on imports for raw materials, high-tech components, and electronic systems, limited production capacity and demand affecting scalability, etc.

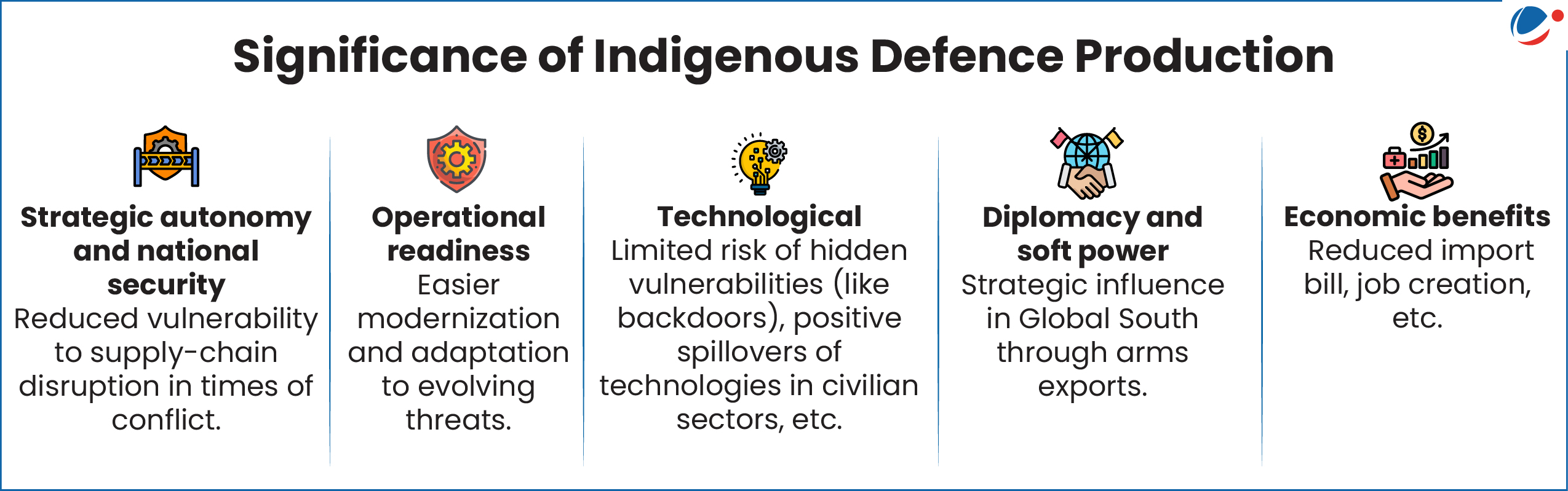

- Dependence on imports: Continued reliance on imported armaments, components, and machine parts exposes India to supply chain disruptions (e.g., S-400 delays due to the Russia-Ukraine conflict).

- Technological: Foreign Original Equipment Manufacturers (OEMs) are protective of intellectual property and provide limited technology transfer, hindering local innovation and advanced manufacturing capabilities.

- Limited technological depth in emerging defence technologies including AI, hypersonics, cyber warfare, and stealth tech, etc.

- Funding Gaps: Defence budget still remains below the 3% benchmark, with over half spent on personnel costs, leaving limited funds for modernization and R&D.

- Dependence on foreign technology: Even with "Make in India," India remains dependent on global partners like the US and France for cutting-edge technologies.

Way Forward

- Enhance and Prioritize Indigenous R&D: Significantly increase investment in defence R&D to at least 2% of GDP, matching global standards.

- Shift to Absorption of Technology (AoT): Promote joint ventures with foreign OEMs that include technology sharing, co-development, and co-manufacturing.

- Focus on Skill Development and Human Resources: Develop specialized defence education, vocational training, and technical skill programs aligned with industry and R&D needs.

- Boost Export Competitiveness: Encourage DPSUs and private companies to jointly bid in foreign contracts for stronger competitiveness.

- Foster Innovation: Provide sustained handholding, funding, and capacity-building support to smaller enterprises to integrate them into defence supply chains.

- Vijayaraghavan Committee: Empower a PMO-led Defence Technology Council to oversee defence technology decision, Refocus DRDO primarily on research and development, Increase private sector and academia participation in defence R&D.

Conclusion

The coming decade offers an opportunity to position India not just as a manufacturer, but as an innovator shaping the future of warfare technologies, from AI-driven systems to space and cyber defence. By leveraging its demographic dividend, deepening international collaborations on equitable terms, and cultivating a vibrant ecosystem of startups and MSMEs, India can redefine its role in the global defence value chain.