Why in the News?

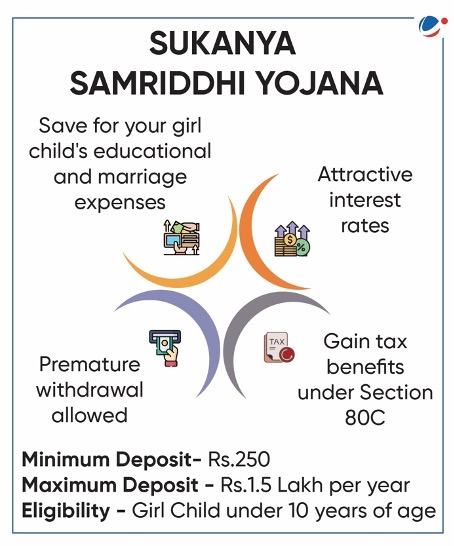

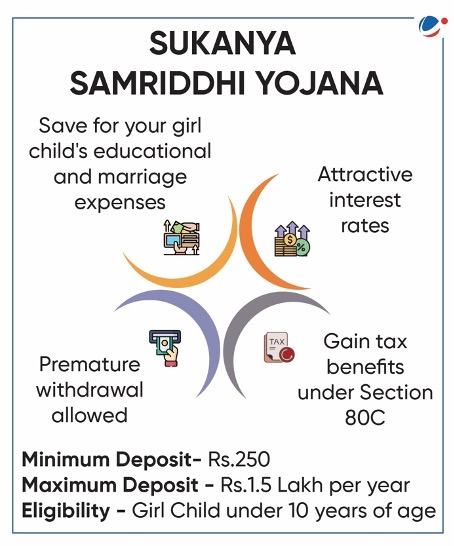

Finance Ministry recently increased the interest rate for the Sukanya Samriddhi Account Scheme from 8% to 8.2% for January-March (2024) quarter.

Objectives | Salient features |

|

|

Periodically curated articles and updates on national and international developments relevant for UPSC Civil Services Examination.

High-quality MCQs and Mains Answer Writing to sharpen skills and reinforce learning every day.

Watch explainer and thematic concept-building videos under initiatives like Deep Dive, Master Classes, etc., on important UPSC topics.

A searchable repository of past resources — News Today, Monthly Magazine, PT 365, Mains 365, etc. — for easy revision.

A comprehensive overview of all our flagship, foundation, and advanced courses for UPSC preparation.

A short, intensive, and exam-focused programme, insights from the Economic Survey, Union Budget, and UPSC current affairs.

Need help? 8468022022

Finance Ministry recently increased the interest rate for the Sukanya Samriddhi Account Scheme from 8% to 8.2% for January-March (2024) quarter.

Objectives | Salient features |

|

|

Discover more articles, videos, and terms related to this topic

Loading video...

Please select a subject.

linked

No references added yet

Please login to continue using this feature.

Login to your account for a personalized experience.