The New Rule were issued by the Reserve Bank of India (RBI) under Section 22(1) of the Banking Regulation Act, 1949.

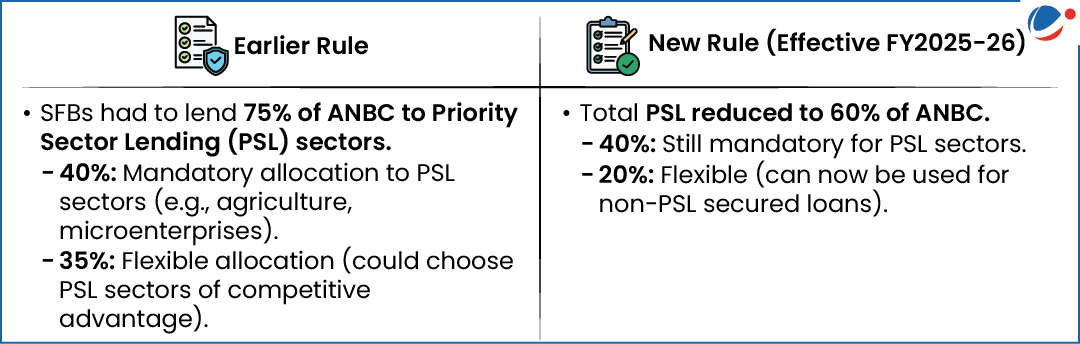

Key Change in PSL Requirements for SFBs

- Impact on SFBs:

- Frees up ~₹40,000 crore for lending to lower-risk secured segments, such as: Loans Against Property (LAP), Personal Loans, etc.

- Helps SFBs diversify loan portfolios beyond microfinance (reduces risk).

About Priority Sector Lending (PSL)

- Established: In the 1970s.

- Concept: PSL framework, initiated by RBI, mandates banks to allocate a specific percentage of their Adjusted Net Bank Credit (“ANBC”) to priority sectors.

- ANBC Comprises: Net Bank Credit (NBC), Bank's investments in non-statutory liquidity ratio (non-SLR) bonds, etc.

- Categories under Priority Sector: Agriculture; Micro, Small and Medium Enterprises; Export Credit; Education; Housing; Social Infrastructure; Renewable Energy; Others.

- Applicability: Commercial Bank [including Regional Rural Bank (RRB), Small Finance Bank (SFB), Local Area Bank (LAB)] and Primary (Urban) Co-operative Bank (UCB) other than Salary Earners’ Bank.