Why in the news?

Recently, the National Highway Authority of India (NHAI) raised its highest-ever monetization value of Rs. 15,624.9 Crore through the Infrastructure Investment Trust (InvIT) mode.

About Asset Monetization (AM)

- Genesis: The idea of AM was first suggested by a committee led by economist Vijay Kelkar in 2012.

- AM was announced in the Union Budget 2021-22 through the National Monetisation Pipeline.

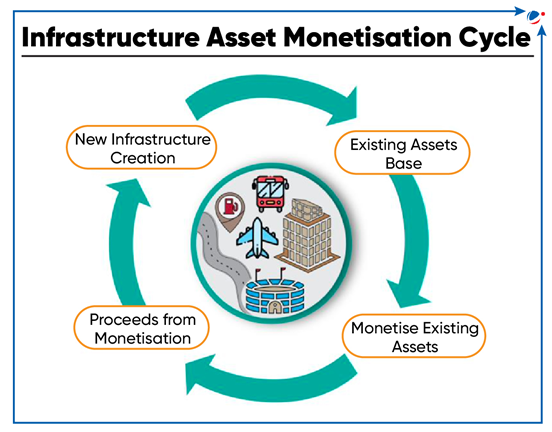

- Definition: AM is the process of creating new sources of revenue for the government and its entities by unlocking the economic value of unutilised or underutilised public assets.

- A public asset can be any property owned by a public body, roads, airports, pipelines, etc.

- Authority: An authorised Core Group of Secretaries on Asset Monetisation (CGAM) has been constituted under the chairmanship of the Cabinet Secretary to implement and monitor the project.

- Process of Asset Monetisation (AM)

- AM involves the license/lease of a government-owned asset to a private sector entity for a specific period.

- The transfer of rights in exchange for payments is governed by a concession agreement that facilitates balanced risk-sharing between the public authority and the private party.

Need for Asset Monetisation in India

- Fund the National Infrastructure Pipeline (NIP): NIP is aimed to provide world-class infrastructure to citizens and attract investments into this sector.

- NIP envisages an investment of 111 lakh crore over 2020 to 2025.

- Reduction of the fiscal strain: The capital invested by private parties during AM can reduce the fiscal burden on the public sector and free up resources for developing new infrastructure projects.

- Provision of finance to the State for the creation of new infrastructure: AM plays an important role in providing finance to the State for the creation of new infrastructure.

- Benefit from private sector efficiencies: AM will invite private sector efficiencies and transparency in the management of public assets.

- Facilitate economic development of the country: A robust AM plan could upgrade economic productivity, encourage demand, create jobs, boost growth prospects, and accelerate the country's economic development.

Initiatives taken for Asset Monetization

- National Monetisation Pipeline (NMP):

- Sectors: The government has identified 13 sectors to monetise its brownfield infrastructure assets.

- These top 5 sectors capture ~83% of the aggregate pipeline: Roads (27%), Railways (25%), Power (15%), Oil & Gas pipelines (8%), and Telecom (6%).

- Potential: Monetisation potential of Rs 6.0 lakh crores through core assets of the Central Government, over four years, from FY 2022 to FY 2025.

- Sectors: The government has identified 13 sectors to monetise its brownfield infrastructure assets.

- Various assets/ asset classes targeted for monetisation:

- Railways will monetise Dedicated Freight Corridor assets for operations and maintenance, after commissioning.

- Airports will be monetised for operations and management concession.

- National Land Monetization Corporation: It is a Special Purpose Vehicle (SPV) for undertaking surplus land monetization of Central Public Sector Enterprises (CPSEs) and other Government agencies.

- Asset Monetisation dashboard: For tracking progress and for providing visibility to investors.

Challenges faced in Asset Monetization

- Valuation Challenge: Accurately valuing public assets, especially brownfield projects, can be complex and may lead to disputes. E.g., According to CAG report, gross undervaluation of assets was observed in case of disinvestment in Metals and Minerals Trading Corporation of India.

- Implementational challenge: The ambitious target of monetizing assets within four years seems difficult given the experience in meeting the disinvestment targets.

- For instance, the Ministry of Railways and the Department of Telecom have been unable to monetise assets in comparison to the given targets.

- Transparency challenge: There is a larger question of where within the budget will such proceeds from monetisation be accounted for, and how these proceeds will be spent.

- Lack of a clear sector-specific roadmap for monetisation is also a major roadblock in the process.

- Other challenges: Limited interest and participation of bidders, technical competence of bidders to operate and develop assets, closing of transactions on time etc.

Way forward

- A clear roadmap: The monetisation of brown-field assets will need to address the conceptual and operational issues, besides a clear roadmap of implementation with scenario planning in place.

- Regulatory clarity: Clear policies with respect to legal disputes between concessioning authorities and concessionaires, could help the private sector to monetise their assets and invest in new projects.

- Capacity building support on asset monetisation processes: Providing training on asset valuation, revenue projections, and effectively utilizing expert support, etc.

- Structuring of the Assets: The market in India comprises myriad investors with varying risk appetites. Product packaging and structuring have to be customised for diverse investors.

- Supporting States: States have significant potential for asset monetisation but need to provide reassurance to investors about the risk characteristics of their assets.

- Support from the central government in this regard could be helpful.