Why in the news?

The enrolment of farmers under the PMFBY has crossed a record 40 million in 2023-24, an increase of 27% from the 31.5 million enrolled in FY23.

More on the news

- Claims: Around Rs. 500 paid as claims to farmers under PMFBY for every 100 rupees of premium paid (2016 - 2023).

- Claim recipients: Over 23.22 crore farmer applicants received claims under PMFBY in the past 8 Years of its implementation.

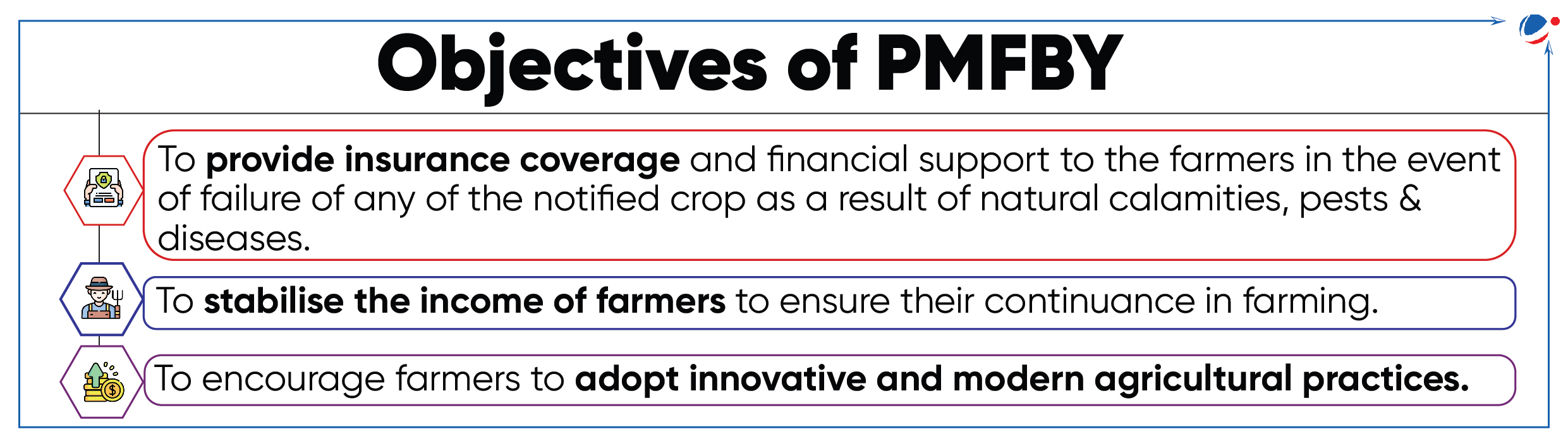

Salient features of PMFBY (launched in 2016)

- Purpose: Comprehensive crop insurance from pre-sowing to post-harvest period

- Type: Central Sector Scheme.

- Nature: Demand-driven scheme and is voluntary for the States as well as farmers

- Implementing Agency: Department of Agriculture, Cooperation & Farmers Welfare (DAC&FW), Ministry of Agriculture & Farmers Welfare (MoA&FW) and the concerned State.

- Coverage of Farmers: All farmers including sharecroppers and tenant farmers can avail it.

- However, in 2020, the scheme was made optional for all farmers including farmers who have taken agri-loans.

- Coverage of Crops: Food crops (Cereals, Millets and Pulses); Oilseeds; Annual Commercial / Annual Horticultural crops, etc.

- Premium to be paid: Premium is paid as % of the sum assured or Actuarial Premium Rate (APR), whichever is less. APR is the premium rate set by insurance companies.

- Premium by farmers:

- 2% for Kharif crops

- 1.5% for Rabi crops

- 5% for commercial horticulture crops

- Premium by farmers:

- Other notable features: Compulsory use of at least 0.5% of the gross premium collected by insurance companies for IEC activities; intensive use of technology; freedom to States to choose risk cover as per requirements, etc.

Key Initiatives under PMFBY

|

Challenges in FMBY

- Higher cost of premium subsidy: In several states, the claims have exceeded the gross premium and the states found that a substantial part of their agriculture budget was going to pay premium subsidies.

- Premium deducted from non-participating farmers: Lack of awareness among farmers about the procedure to opt out of the crop insurance scheme often leads to unintended deduction of premium amounts from their bank accounts.

- Crop yield estimation problem: Disputes on the quality of yield data have been a challenge in the effective implementation of the Scheme.

- Delays in settlement: The delayed release of premium subsidies by states, yield-related disputes between insurance companies and states, and non-receipt of farmers' account details contribute to delayed settlement.

- Defaulting Insurance Companies: Delays in taking action against defaulting insurance companies due to procedural complications.

- Difficulties to assess crop damage: By the insurance companies due to the localised nature of crop damage, possible negligence or even false claims by unscrupulous persons and the non-availability of data at the local level.

Way forward

- Ensure timely release of premium subsidy: To maintain strict financial discipline, subsidy payment should be streamlined through an escrow account jointly administered by the State government and the Centre.

- Also, all financial transactions (subsidy or claims) shall be routed through the National Crop Insurance Portal (NCIP).

- Presence of insurance companies in every tehsil of the district: It will be crucial for farmers in order to mitigate the problems faced in availing the scheme benefits.

- Penalties for companies: Effectively penalising defaulters in a time-bound manner.

- Adoption of smart sampling techniques: By all states using technological interventions such as satellite data or the use of drones.

- Corporate Social Responsibility (CSR): Insurance companies can plan to spend a share of their profits towards CSR in the districts from where profits are earned.