Why in the news?

Recently, Prime Minister asked the Reserve Bank of India (RBI) to prepare a 10-year strategy to make the Indian rupee a globally accessible and acceptable currency, enabling its internationalization.

About Internationalization of currency

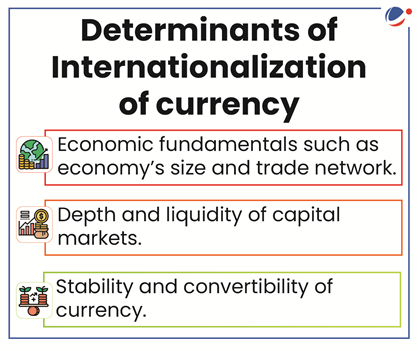

- An international currency is one that is used and held beyond the borders of the issuing country, not merely for transactions with that country's residents, but also, for transactions between non-residents.

- Currency internationalization has thus been described as the international extension of a national currency's three basic functions of serving as a unit of account, medium of exchange and store of value.

- Currently, the US dollar, the Euro, the Japanese yen and the pound sterling are the leading reserve currencies in the world.

- India moved toward partial convertibility in the late 1990s and made subsequent progress with multiple reforms.

- India has enabled capital-account transactions, such as permitting corporate entities to raise resources through external commercial borrowings and Masala bonds (rupee-denominated bonds issued by Indian entities outside India).

Benefits of Internationalization of Currency

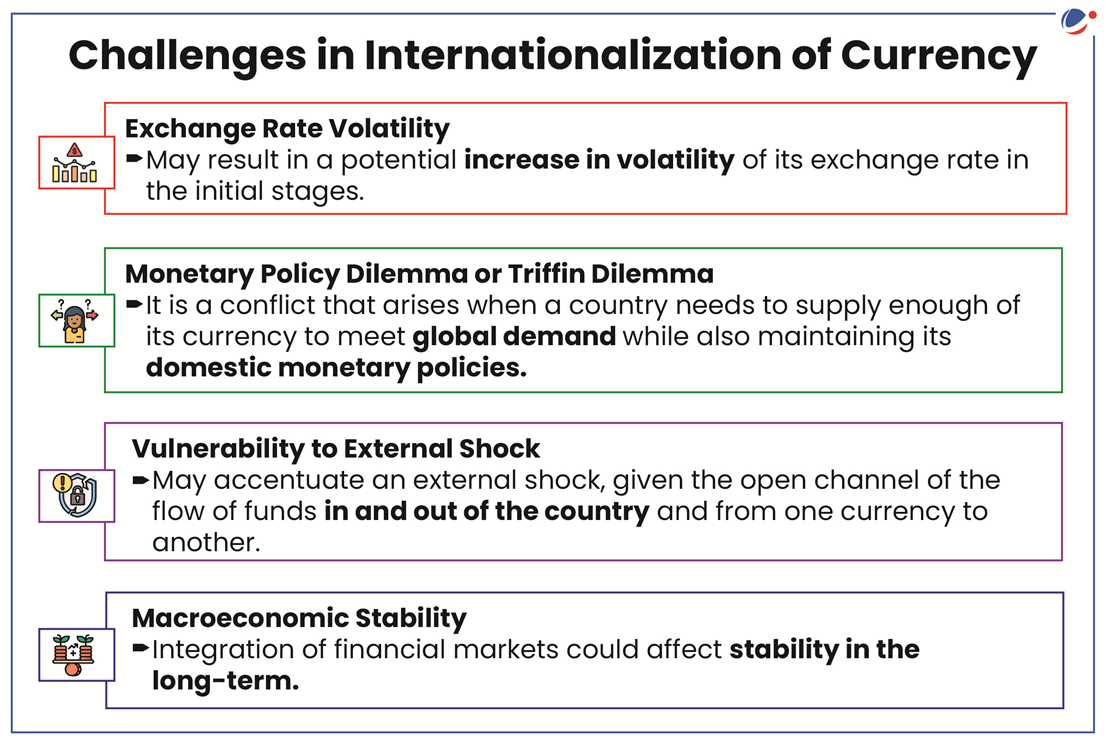

- Limit exchange rate risk: It allows the country's exporters and importers to limit exchange rate risk as domestic firms can settle their exports/imports in their currency.

- Access to international financial markets: It permits domestic firms and financial institutions to access international financial markets without assuming exchange rate risk.

- Boost capital formation: A larger, efficient financial sector reduces capital cost and widens set of financial institutions.

- Financing budget deficit: It may allow a country's government to finance part of its budget deficit (or current account deficit) by issuing domestic currency debt in international markets rather than issuing foreign currency instruments.

- Regulating Capital Flows: It results in lowering the impact of sudden stops and reversals of capital flows and enhances the ability to repay external sovereign debt.

- Reducing requirement of forex reserves: It reduces the requirement to maintain and depend on large foreign exchange reserves in convertible currencies to manage external vulnerabilities.

- Presently, India's foreign exchange reserves are at a record high of $642.63 billion as of March 2022.

Approach for Internationalization of Rupee

- Capital Account Convertibility: INR (Indian National Rupee) is fully convertible in the current account but partially in the capital account.

- There is need to review extant Foreign Exchange Management Act (FEMA) provisions and extending incentives for international trade settlements in INR.

- Banking Services (loans, guarantees, credit lines, etc.) in INR through offshore branches of Indian banks.

- Promoting international use of INR: To facilitate international financial transactions in INR, an efficient settlement mechanism, availability of liquidity and development of robust cross-border payments system would be required.

- Currency Swaps and Local Currency Settlement (LCS): These provide currency diversification that stabilises the local currency, protect businesses against currency risk exposure and reduces transaction costs.

- Internalisation of Indian Payment Systems: Extension of global reach of India's payment systems including Real Time Gross Settlement (RTGS), National Electronic Funds Transfer (NEFT) and Unified Payments Interface (UPI).

- Inclusion of INR in Continuous Linked Settlement (CLS): CLS is a global system for the settlement of foreign currency transactions on a Payment vs Payment (PvP) basis.

- CLS system currently settles trades in 18 currencies. However, INR is not among those currencies.

- Creation of an Indian Clearing System: Clearing system would provide its member banks with a market to purchase currencies against their domestic currency.

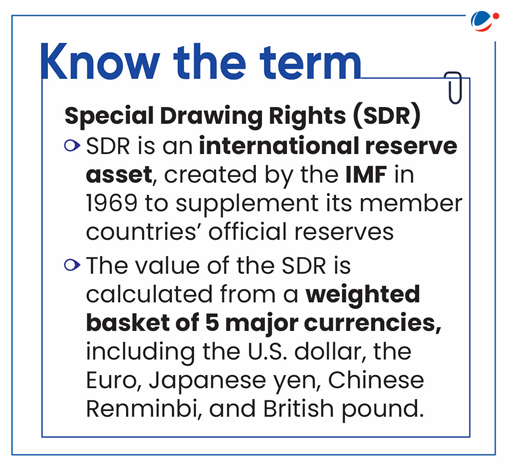

- INR as a vehicle currency/contender to Special Drawing Rights (SDR) basket: It can be taken forward by encouraging trade invoicing in INR by expanding trade relations with other economies.

- Strengthening Financial Markets:

- Harmonisation of KYC (Know Your Customer) norms of RBI and SEBI to ease access of foreign investors to INR assets.

- Global 24x5 INR market: While customer transactions are facilitated round-the-clock in the offshore market, the inter- bank market operates only for a limited set of hours onshore.

- Inclusion of Indian Government Bonds in Global Bond Indices: It will enable widening of investor base, stable passive flows, appreciation of INR, and reduction of overall borrowing costs.

Steps taken towards Internationalization of Rupee

|