Why in the News?

According to data from the Department for Promotion of Industry and Internal Trade (DPIIT), the cumulative amount of FDI inflows into India has crossed the $1 trillion milestone ($1,033.40 billion) in the April 2000-September 2024 period.

More on the News

- The decade 2014-24 saw an increase of 119% in FDI inflows over the preceding decade (2004-14). (Union Ministry of Commerce and Industry)

- India's FDI inflows have increased ~20 times from 2000-01 to 2023-24.

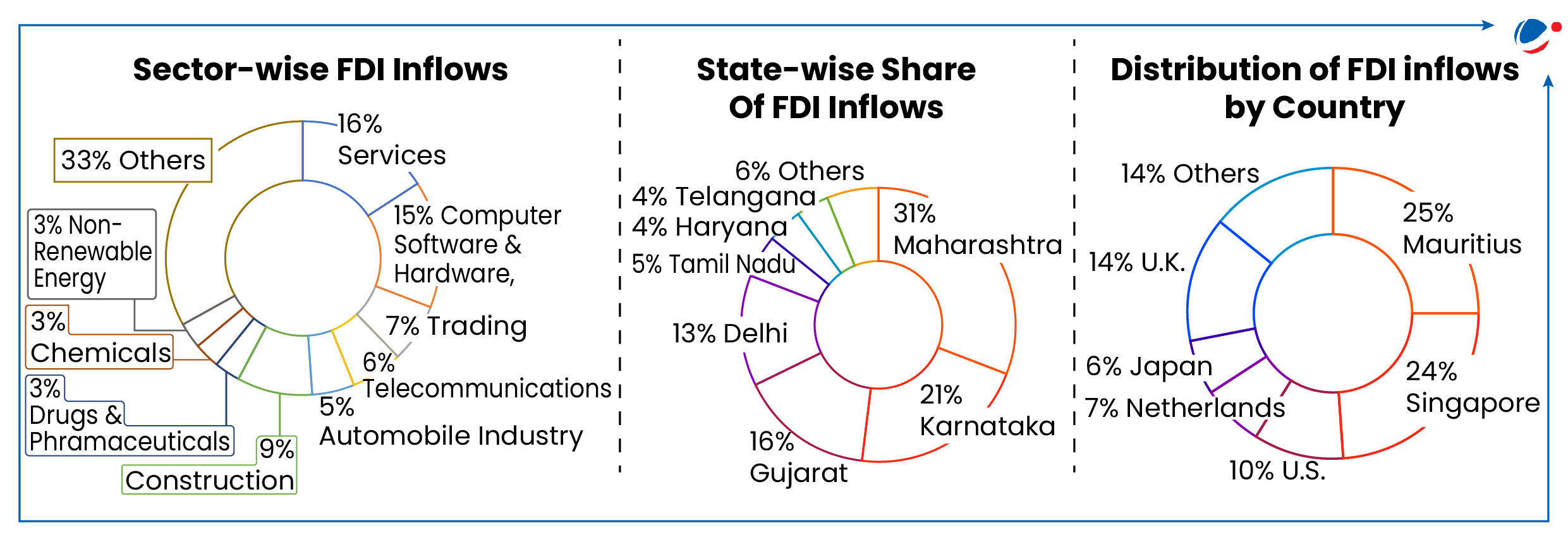

- During 2000-2024, India's service sector attracted the highest FDI equity inflow (US$ 115.18 billion).

What is Foreign Direct Investment (FDI)?

- FDI means investment through capital instruments by a person resident outside India in an unlisted Indian company; or in 10% or more of the post issue paid-up equity capital on a fully diluted basis of a listed Indian company.

- It is usually a long-term investment and is largely a non-debt creating capital flow.

- Routes of FDI

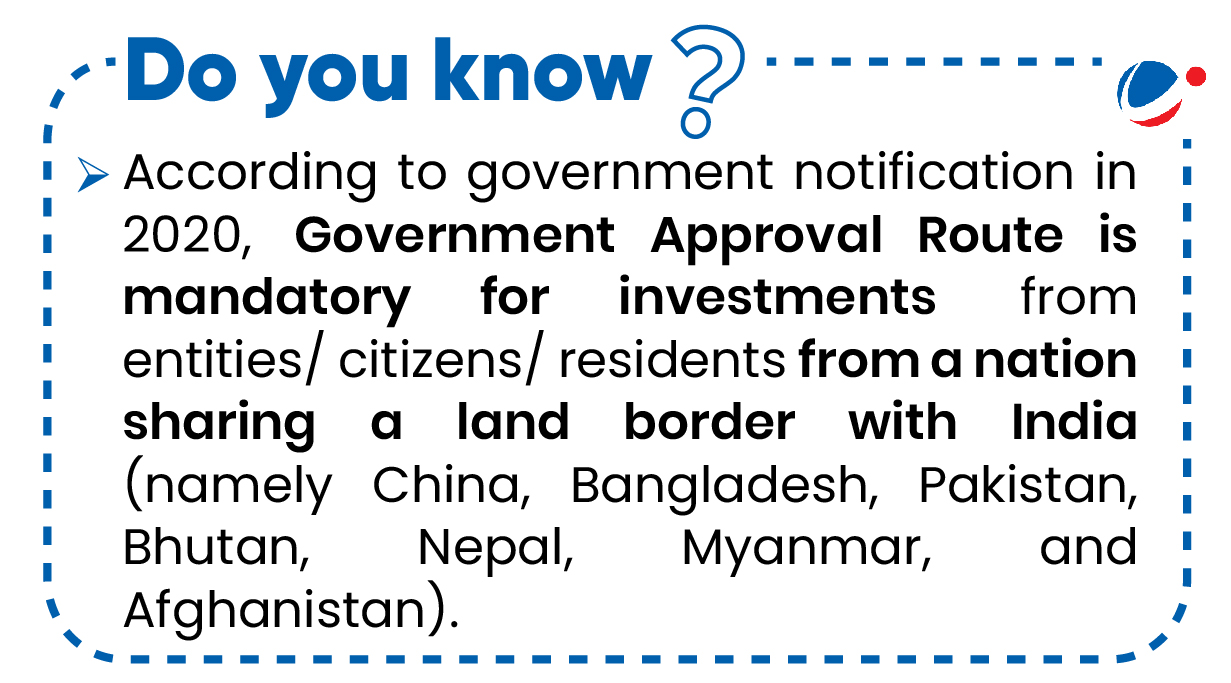

- Automatic Route: Under the automatic route, an overseas investor is only required to inform the Reserve Bank of India (RBI) after the investment is made.

- Government Approval Route: Under the government approval route, a foreign investor has to get a prior nod from the Ministry or department concerned.

- Regulation

- Currently, FDI in India is governed by FDI Policy 2020 and FEMA (Non-debt Instrument) Rules, 2019.

- DPIIT is the primary regulator of FDI in India.

- The RBI, which has the authority to implement the FDI Rules, is the other major regulator.

FDI vs. Foreign Portfolio Investment (FPI)

Parameters | Foreign Direct Investment (FDI) | Foreign Portfolio Investment (FPI) |

Form of investment | An investment made by a foreign entity in a business enterprise intended for long-term operations. | Investment in financial assets (e.g., stocks, bonds) of a foreign country intended at short-term gains. |

Type of investment | Involves investments in financial and non-financial assets, including resources, technology, and securities. | Focuses on financial assets such as stock, bonds, etc. |

Volatility | Low volatility due to stability of extended investment periods. | More volatile and subject to quick changes in investor sentiment. |

Investor Control | Higher as they can influence company decisions | Limited control and are considered passive investors. |

Liquidity | Low liquidity as long-term investment with assets not easily liquidated. | Highly liquid, investors can buy or sell assets with ease. |

Challenges for FDI in India

- Complex Regulation and policy uncertainty: The complexity of regulations such as tax laws, transfer pricing etc., impact foreign investors due to difficulties in compliance. This leads to legal disputes, potential financial losses and opportunities for companies to exploit loopholes.

- E.g., Retrospective taxation on Vodafone leading to legal disputes.

- Institutional deficiencies: The Competition Commission of India (CCI) has not been entirely effective in halting anti-competitive actions and preventing the misuse of dominant positions, impacting India's economic development.

- E.g., Flipkart controversy resulted in India losing out from preferential treatment under the US Generalised System of Preferences (GSP).

- Concentration of FDI: FDI inflows have been disproportionately concentrated in few sectors like services as well as regions (urban areas of states like Maharashtra, Karnataka etc.), creating inequalities in development prospects.

- Lack of adequate infrastructure facilities especially in rural areas acts as a deterrent in attracting FDI.

- Impact on local businesses: Foreign company's extensive operations and purchasing power threaten the local businesses who find it hard to compete with these companies.

- E.g., Opposition towards Walmart's arrival into India.

- Impact on Labour market: FDI and foreign companies may raise questions about the nature of work, job security, and possible displacement of local people.

- E.g., Amazon and Uber are facing legal action and criticism in India due to subpar working conditions.

Challenges faced by Indian Economy due to FDI

|

Steps taken to promote FDI inflows

- Schemes: Make in India, Start-up India, PM Gati Shakti, National Industrial Corridor Programme, Production Linked Incentive (PLI) Scheme etc. have promoted FDI inflows into India in line with Atmanirbhar India.

- Promoting Ease of Doing Business (EoDB): Reducing compliance burden, India Industrial Land Bank, Project Monitoring Group (PMG), liberalization of FDI policy are initiatives that simplify, rationalize, digitize and decriminalize Government to Business (G2B) and Citizen Interface.

- E.g., Jan Vishwas (Amendment of Provisions) Act, 2023; more than 42,000 compliances have been reduced and more than 3,800 provisions have been decriminalized.

- Project Development Cells (PDCs): An institutional mechanism in all concerned Ministries/ Departments to fast-track investments.

- Technological interventions: National Single Window System (NSWS) for simplified FDI approvals and Foreign Investment Facilitation Portal (FIFP) as an online single point interface to facilitate FDI.

- State Investment Summits: States like Gujarat, Uttar Pradesh etc. have organized Global Investment Summits, showcased economic potential and attracted FDI.

- E.g., Vibrant Gujarat Global Summit has helped attract FDI worth USD 55 billion (2002-22).

Way Forward

- Infrastructure and Skill Enhancement: Strengthen competitiveness through multimodal connectivity, robust infrastructure (e.g., high-speed rail, expressways), and workforce upskilling in sunrise sectors like renewable energy, semiconductors, and EVs to attract FDIs.

- Policy reforms for balanced inflow FDIs: Formulation of separate rules and procedures for manufacturing and service Special Economic Zones (SEZs) to lay adequate emphasis on attracting FDI in manufacturing as well. (Baba Kalyani Committee)

- Dispute resolution and contract enforcement: Streamlining dispute resolution by setting up adequate number of arbitration and commercial courts.

- Strengthened contract enforcement can also promote legal certainty for foreign investors.

- Promote Tier-II and Tier-III cities: Incentivize FDI in smaller cities and adopt cluster-based development (Bulk Drug Parks, Mega Food Parks, etc.) to attract sector-specific investments.

- Bilateral Investment Treaties (BITs): Strengthening and updating BITs can establish the terms and conditions for foreign investments and enhance investor confidence.