It is a half-yearly publication, with contributions from all financial sector regulators.

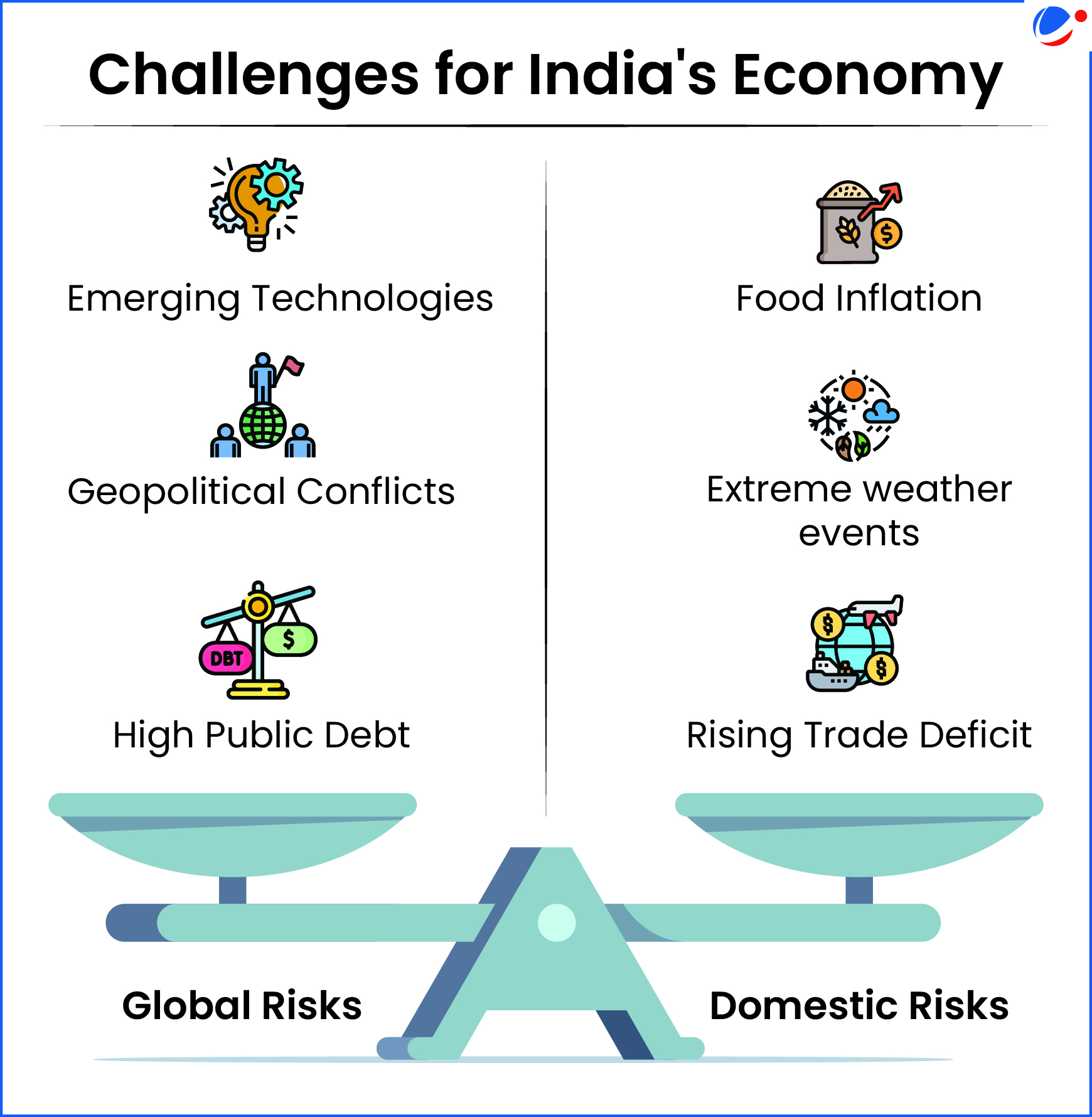

- It presents the collective assessment of the Financial Stability and Development Council subcommittee on current and emerging risks to the stability of the Indian financial system.

Key Highlights:

- Resilient Indian Economy: Gross domestic product (GDP) is projected to grow at 6.6 % in 2024-25, aided by a revival in rural consumption, Government spending, & services exports.

- Government Finance: Central government's debt-to-GDP ratio is expected to decrease from its pandemic peak of 62.7% (2020-21) to 56.8% by 2024-25.

- States' outstanding liabilities are projected to decline from 31% to 28.8% during same period.

- Stable Financial System: The soundness of scheduled commercial banks (SCBs) has been bolstered by strong profitability, declining non-performing assets & adequate capital and liquidity buffers.

About FSDC

|