30 Years of the Marrakesh Agreement

World Trade Organization (WTO) is celebrating 30 years of the Marrakesh Agreement.

- Marrakesh Agreement was signed in Marrakesh, Morocco, by 123 countries in 1994 after the conclusion of the Uruguay Round.

- It led to the establishment of the WTO in 1995, replacing General Agreement on Tariffs and Trade (GATT) as an international organization.

About Marrakesh Agreement

- It serves as basic framework for trade relations among all WTO members.

- It expanded the scope beyond trade in goods to trade in services, intellectual property, and other topics.

- It established modern multilateral trading system, facilitating negotiations, dispute settlement, and economic cooperation among members.

- It created WTO’s governance, establishing the Ministerial Conference (highest decision making body), General Council, and specialized councils.

Achievements of WTO

- Lowering trade barriers: Since 1995, real volume of world trade has expanded by 2.7 times and average tariffs have almost halved, from 10.5% to 6.4%.

- Rise of Global Value Chains: Trade within these value chains today accounts for almost 70% of total merchandise trade.

- Growth in developing countries: Fastest poverty reduction since 1995 and increased purchasing power in all countries.

- International Trade Agreements and Rules: TRIPS Agreement, Nairobi Package, Trade Facilitation Agreement, Doha Development Agenda etc.

- Tags :

- World Trade Organization

- 30 years of Marrakesh Agreement

UNCTAD rebranded as UN Trade and Development

United Nations Conference on Trade and Development (UNCTAD) rebranded as UN Trade and Development.

- The rebranding marks the start of the 60th anniversary of the organization.

- This strategic move underscores the organization's commitment to increasing its global voice on the behalf of developing countries.

Key Achievements:

- Implementation of Financing for Development, as mandated by the global community in the Addis Ababa Agenda (2015), together with four other major institutional stakeholders.

- The institution includes the World Bank, the International Monetary Fund, the World Trade Organization, and the United Nations Development Programme.

- Assisted countries under the Debt Management and Financial Analysis System (DMFAS) Programme.

- Tags :

- UNCTAD

- Addis Ababa Agenda

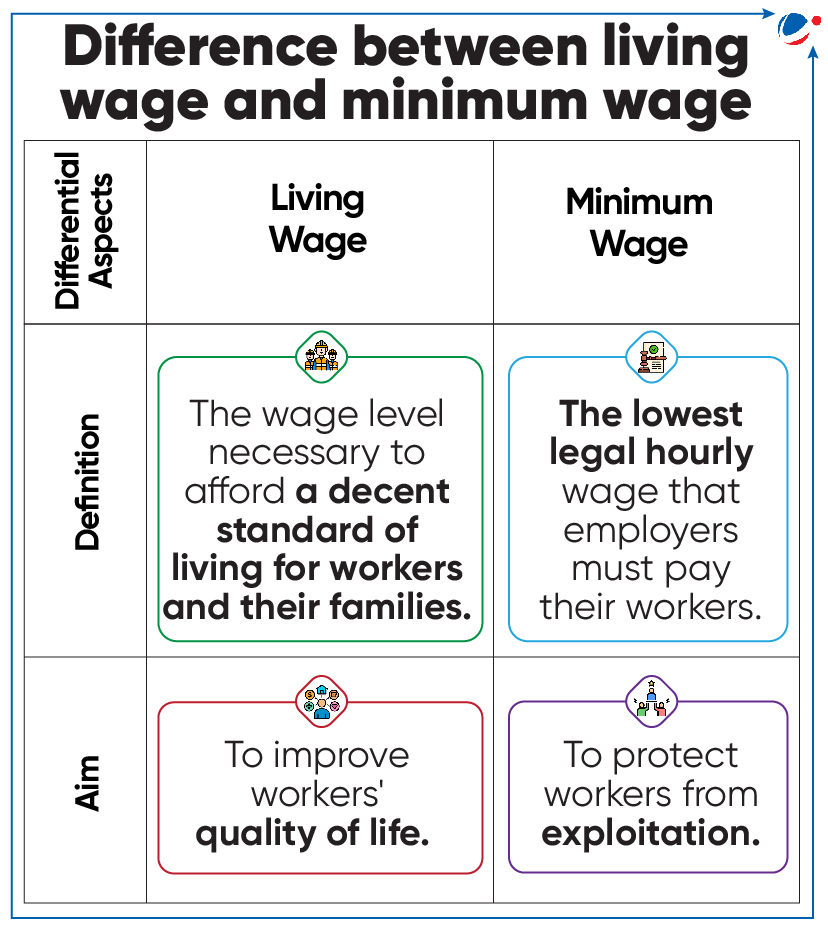

Living Wage and Minimum Wage

- The government sought technical assistance from ILO to create a framework for living wage

- Presently, India follows the minimum wage, which has remained stagnant since 2017.

- The Code on Wages passed (2019), proposed a universal wage floor which shall apply to all states once implemented.

- Issues with the present system

- The Minimum Wages Act, 1948 provides guidelines but does not specify the minimum wage.

- Fixing minimum wages in some jobs falls under both the Minimum Wages Act, 1948, and the Contract Labour (Regulation and Abolition) Act, 1970, leading to potential confusion.

- Wage payment discrepancies due to the lack of enforceability of the national wage floor across states.

- Gender disparity as scheduled employment with more women workers has lower minimum wages than those with more men.

- Advantages of Living Wage

- Accelerate Poverty alleviation efforts, aligning with Sustainable Development Goals (SDGs).

- Addresses wage insufficiency, especially considering inflation, and fosters a more equitable and sustainable economy.

- Challenges of Living Wage

- Implementing a national living wage framework across states due to the diversity of living costs in different regions of India.

- Financial strain especially for small businesses and MSMEs, due to increased labour costs.

- Tags :

- Living Wages

- Minimum wage

- LIVING WAGE AND MINIMUM WAGE

- Standard of living

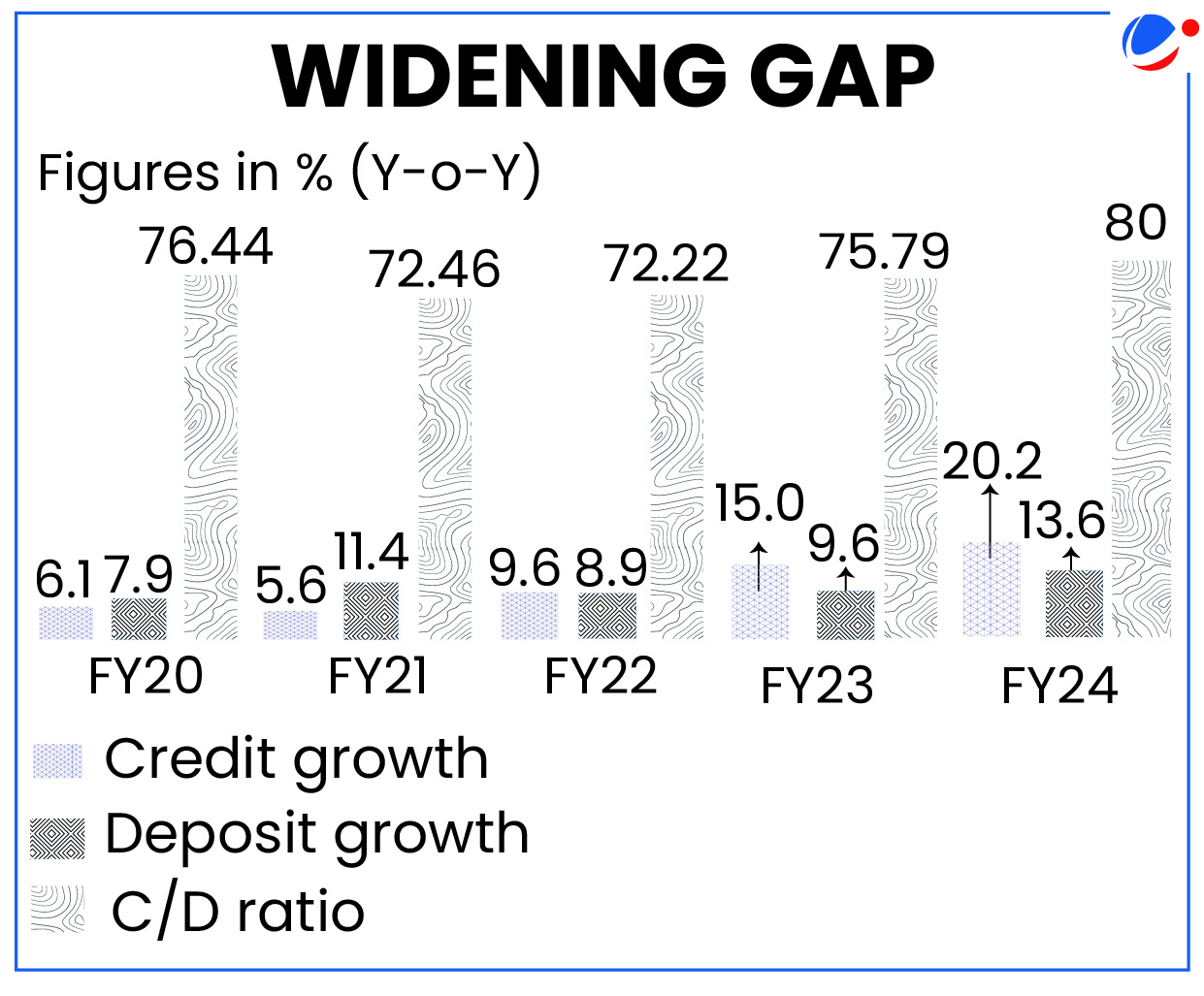

Credit Deposit Ratio (CDR)

- Indian banks are battling the worst deposit crunch in 20 years and at 80%, the credit-deposit ratio is at its highest since 2005.

- About CDR:

- It is the ratio of how much a bank lends out of the deposits it has mobilised.

- A higher CDR suggests that a significant portion of the bank's resources are allocated to loans.

- It could potentially stimulate economic growth but also implies higher risk.

- Regulators often monitor CDR to ensure banks maintain a prudent balance between lending and risk management.

- Tags :

- CDR

- CREDIT DEPOSIT RATIO

SEBI Complaint Redress System (SCORES 2.0)

- Securities and Exchange Board of India (SEBI) launched SCORES 2.0 version which strengthens investor complaint redress mechanism in securities market by making process more efficient.

- SCORES is an online system where investors in securities market can lodge their complaints through web URL and an App.

- Salient features of SCORES 2.0

- Reduced timelines for redressal of investor complaints across Securities Market i.e. 21 Calendar days from date of receipt of complaint.

- Introduction of auto-routing of complaints to concerned regulated entity to eliminate time lapses.

- Integration with KYC Registration Agency database for easy registration.

- Tags :

- SEBI

- SCORES 2.0

Cluster Development Programme (CDP) – SURAKSHA

- Several states are using SURAKSHA platform for disbursing subsidies to horticulture farmers under the CDP.

- CDP is a component of the central sector scheme of National Horticulture Board (NHB).

- About CDP-SURAKSHA

- SURAKSHA stands for ‘System for Unified Resource Allocation, Knowledge, and Secure Horticulture Assistance’.

- It allows an instant disbursal of subsidies to farmers in their bank account by utilising the e-RUPI voucher from the NPCI.

- Its key features are database integration with PM-KISAN, UIDAI validation, geotagging, geo-fencing etc.

- CDP-SURAKSHA allows access to farmers, vendors, Implementing Agencies, Cluster Development Agencies etc.

- Tags :

- Horticulture

- SURAKSHA platform

Expert Committee Report on Gift City

- Expert Committee on developing GIFT IFSC as ‘Global Finance and Accounting Hub’ submitted report to IFSCA.

- Committee was formed following a Ministry of Finance notification.

- The notification classified book-keeping, accounting, taxation, and financial crime compliance as ‘financial services’ under International Financial Services Centre (IFSC) Act, 2019.

- Gujarat International Finance Tech- City (GIFT City)-IFSC was established as Special Economic Zone (SEZ) in 2015, in Gujarat.

- An IFSC caters to customers outside the jurisdiction of the domestic economy. Such centres deal with flows of finance, financial products and services across borders.

- Opportunities for GIFT IFSC to become Global Finance and Accounting Hub

- Strong technology-driven outsourcing capabilities.

- Large talent pool of skilled manpower in the fields of accounting, etc.

- “Accounting and finance services” recognised as one of the 12 Champion sectors in services for exports.

- Recommendations

- Proposes a new regulation, providing for comprehensive and inclusive definition for Bookkeeping, Accounting, Taxation, and Financial Crime Compliance Services.

- Only firms that are registered as a company or a Limited liability partnership should be allowed to offer these services.

- Long-term strategies for education and skill acquisition through developing specialized degree or diploma programs, etc.

- Proposes a new regulation, providing for comprehensive and inclusive definition for Bookkeeping, Accounting, Taxation, and Financial Crime Compliance Services.

IFSC Authority

- IFSC Authority is a statutory body established under IFSC Act,2019.

- A unified regulator for development and regulation of financial products, financial services and financial institutions in IFSCs in India.

- Tags :

- GIFT CITY

- IFSCs

- Global Finance and Accounting Hub

Payment Aggregator (PA)

- PayU has received an in-principle approval from the Reserve Bank of India (RBI) to operate as a PA.

- About PAs

- It is a financial technology company that simplifies the process of accepting electronic payments for businesses. E.g., GooglePay, PhonePe, Cashfree etc.

- It acts as an intermediary between the business and the financial institutions.

- It is incorporated as a company under the Companies Act, 1956 / 2013.

- Non-bank PAs require authorisation from RBI under the Payment and Settlement Systems Act, 2007.

- Tags :

- FinTech

- PAYMENT AGGREGATOR

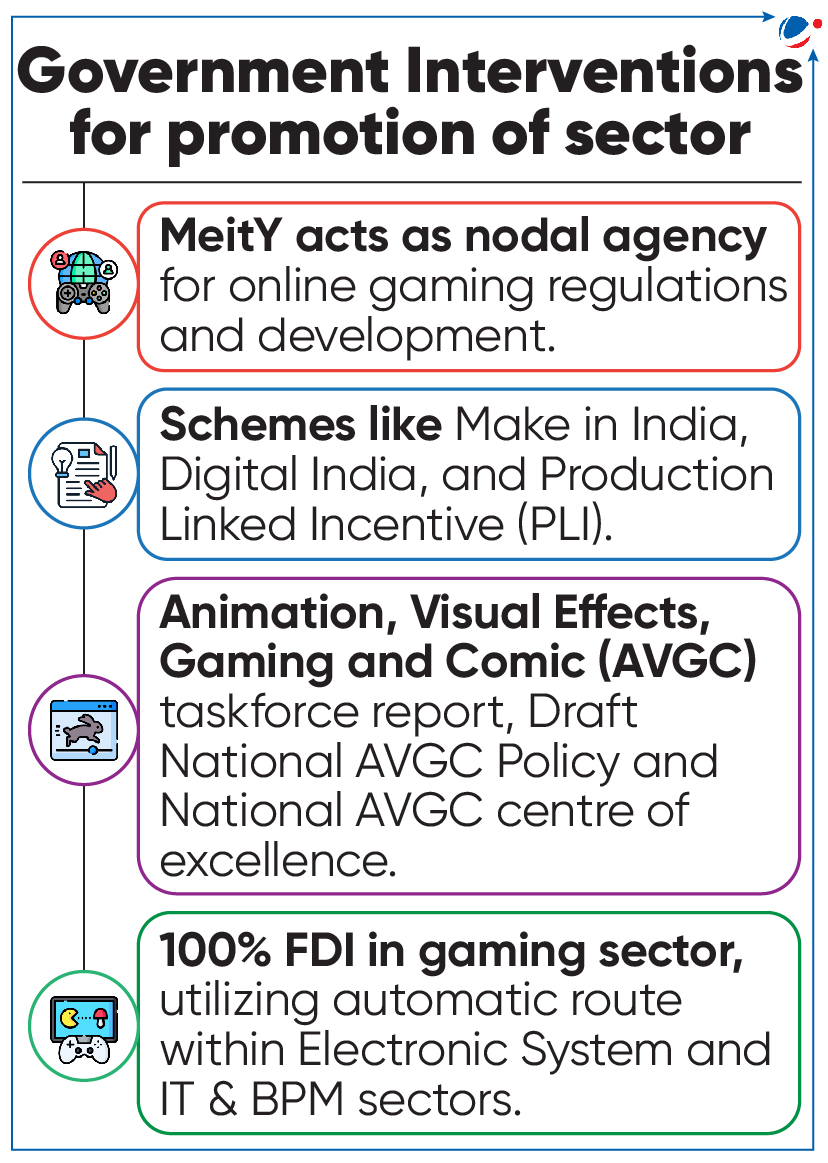

India Gaming Report 2024 Released

- Interactive Entertainment and Innovation Council (IEIC) and WinZO released India Gaming Report 2024 .

- Key findings:

- With 568 million users, India is officially the largest gaming market and accounts for every one in five online gamers globally.

- Indian gaming market is expected to reach $6 Billion by 2028.

- Number of Indian gaming companies surged from 25 in 2015 to over 1400 in 2023.

- Factors responsible for boost in gaming industry:

- Rise of affordable high-speed internet ($0.17/GB) and increase in smartphone penetration (820 million users).

- Burgeoning share of young population (~600 million) and rising disposable income.

- Supply side factors include global investments in game development, rewarding gaming career, vernacular language content and gamification of Indian culture etc.

- Gaming’s contribution to society: Reduction in social isolation, community building, especially for women gamers, and its role in enhancing research, education and skilling.

- It also improves penetration of emerging technologies like Virtual Reality, Artificial Intelligence among others.

- Challenges to gaming sector:

- Sustainability issues from 'internet pollution' (3.7% of Greenhouse Gas emissions).

- Financial literacy gaps, regulatory complexities, and data security challenges.

- Gaming can have a detrimental impact on physical and mental health in certain cases. E.g., issues like ‘Blue Whale Challenge’.

- Recommendations:

- Utilise green innovations and virtual environments for sustainable gaming.

- Establish a global gaming cluster with policy support, supporting startups and talent development.

- Prioritise R&D for online safety and digital literacy.

- Tags :

- Online Gaming

- INDIA GAMING REPORT

- Gaming sector