Why in the News?

In the context of robust growth seen in the rural consumer market, the Union Minister for Finance urged the FinTech companies to widen their perspective towards rural India from a social responsibility to an opportunity to "create new markets".

Rural India: The new engine of India's consumer market

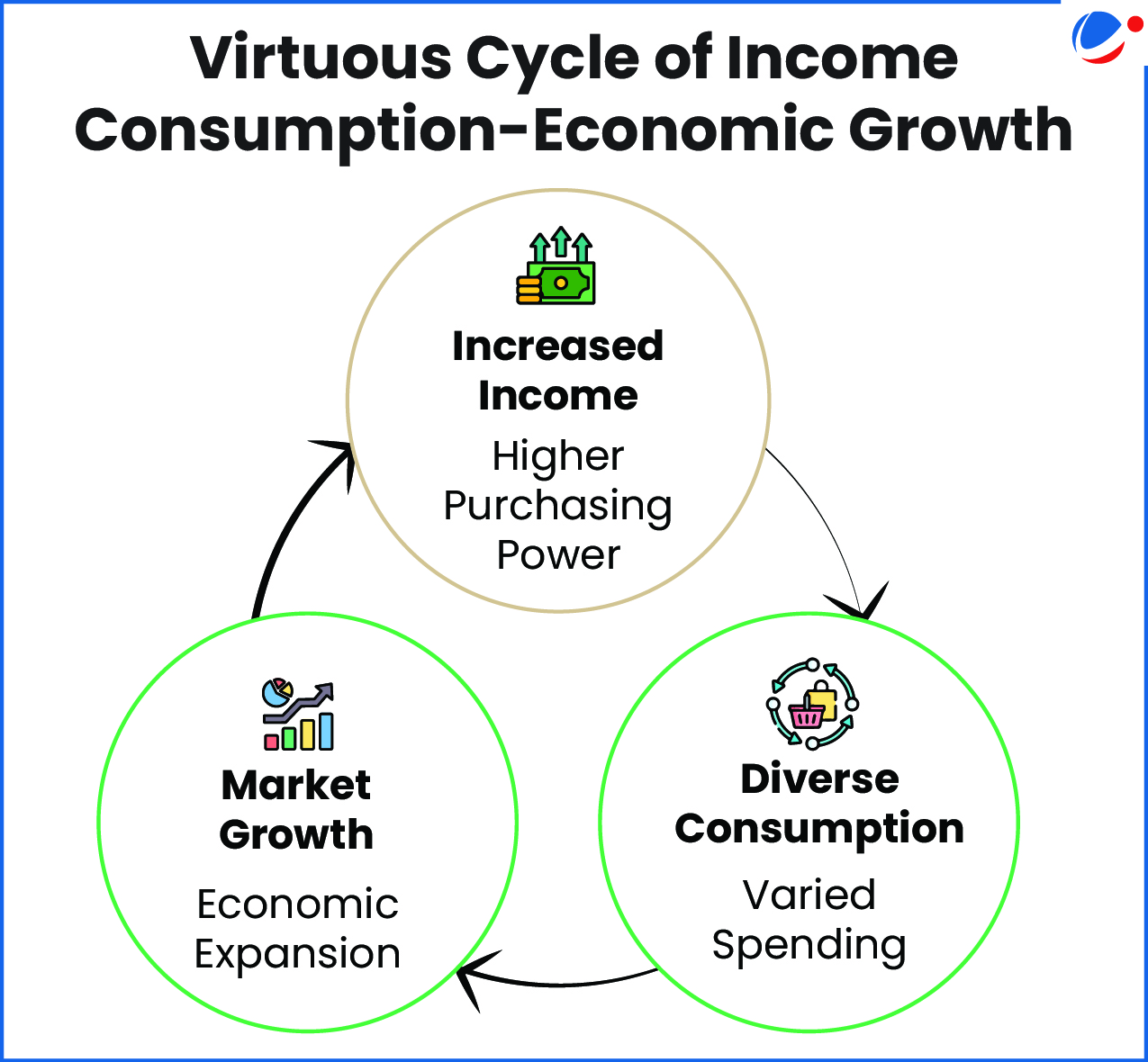

- Growing Rural markets: Rural consumer demand is outpacing urban demand. E.g., Growth of Fast-Moving Consumer Goods (FMCG) sector (Dabur etc.) in rural India is faster than cities.

- The average estimated Monthly Per Capita Consumption Expenditure (MPCE) in rural India rose 9.2% in 2023-24 from the previous year, higher than urban areas, with 8.3% rise. (Household Consumption Expenditure Survey (HCES) 2023-24)

- It is significant because India is a predominantly domestic consumption-driven economy with about 2/3rd of India's GDP coming from household and government consumption.

- Declining Rural-Urban consumption inequality: The urban-rural gap in MPCE declined to 69.7% in 2023-24 from 71.2% in 2022-23.

- Urbanization of consumption patterns: Rural and semi-urban markets are tending towards mimicking urban consumption patterns.

- E.g., Non-food items dominating average monthly expenses across the country with increase in expenditure on communication, education, and medical services.

Reasons for growth of rural consumer market

- Rising Disposable Incomes: Non-farm diversification (e.g., MGNREGA, rural entrepreneurship, remittances) is making rural incomes more resilient and discretionary.

- Reduced Rural Poverty: Rural poverty fell to less than 5% for the first time in 2023-24 from 25.7% in 2011-12. (SBI Report)

- Role of Government Initiatives: Targeted government initiatives like Direct Benefit Transfers (DBT) and PM-KISAN have injected liquidity and fostered financial stability for rural population, leading to increased consumption expenditure.

- Infrastructure Development: Development of physical and digital connectivity infrastructure leads to better market access, facilitating digital payments, e-commerce, and access to online services.

- Physical connectivity: Helps in strengthening supply chains and movement of people and goods. E.g., Pradhan Mantri Gram Sadak Yojana, etc.

- Digital Connectivity: It reduces information asymmetry. Rural internet subscriptions have seen a remarkable 200% increase between 2015 and 2021, outpacing urban growth (158%). E.g., BharatNet initiative.

- Financial inclusion: The expansion of financial services in rural India has been a cornerstone of its consumer market growth, empowering households with greater economic agency.

- E.g., UPI, PM-Jan Dhan Yojana (67% of bank accounts opened in rural or semi-urban areas and 55% by women.)

What are the concerns with the current rise in rural consumption?

- Intra-rural inequality: Shows rural income growth is not uniformly distributed, prevalence of socio-economic disparities and rise of a rural affluent class driving discretionary spending.

- E.g., Top 5% of rural consumers reportedly spending more than six times what the poorest consume on average.

- Infrastructure gaps: Inadequate last-mile connectivity and logistics bottlenecks, fragmented supply chains, limited and skewed internet penetration, etc.

- Inadequate Cold chains & storage: For perishable goods and pharmaceuticals, rural supply chains often lack the infrastructure for safe delivery.

- Digital Divide: Low rural digital literacy, language barriers, prevailing lack of trust and cybersecurity concerns form barrier to the widespread adoption of e-commerce and digital payments in rural areas.

- Climate vulnerabilities: Climate events can cause income shocks, derailing consumption. E.g., erratic monsoons impacting farm and allied incomes.

What needs to be done?

- By Government:

- Reduce intra-rural inequality through targeted investments in aspirational districts.

- Convergence of schemes for rural skilling (such as PM Kaushal Vikas Yojana) and entrepreneurship (such as Deen Dayal Antyodaya Yojana – National Rural Livelihood Mission), especially among women and youth.

- Ensure multi-modal rural infrastructure (roads, internet, warehousing).

- By Private Sector:

- Localize marketing and products—adapt to cultural and language diversity.

- Promote rural micro-entrepreneurship (e.g., HUL's Project Shakti: 1.6 lakh women entrepreneurs).

- Use low-cost tech like IVR, vernacular AI chatbots, or WhatsApp commerce to connect.

Conclusion

Rural India can no more be seen from a myopic lens of social responsibility. It is set to be the engine for growth in the consumer-led growth trajectory of India. Continued investment in robust infrastructure, alongside targeted programs to enhance digital and financial literacy, build trust in digital platforms, and foster inclusive income growth, will be paramount for sustaining the growth of the rural consumer market.