Why in the News?

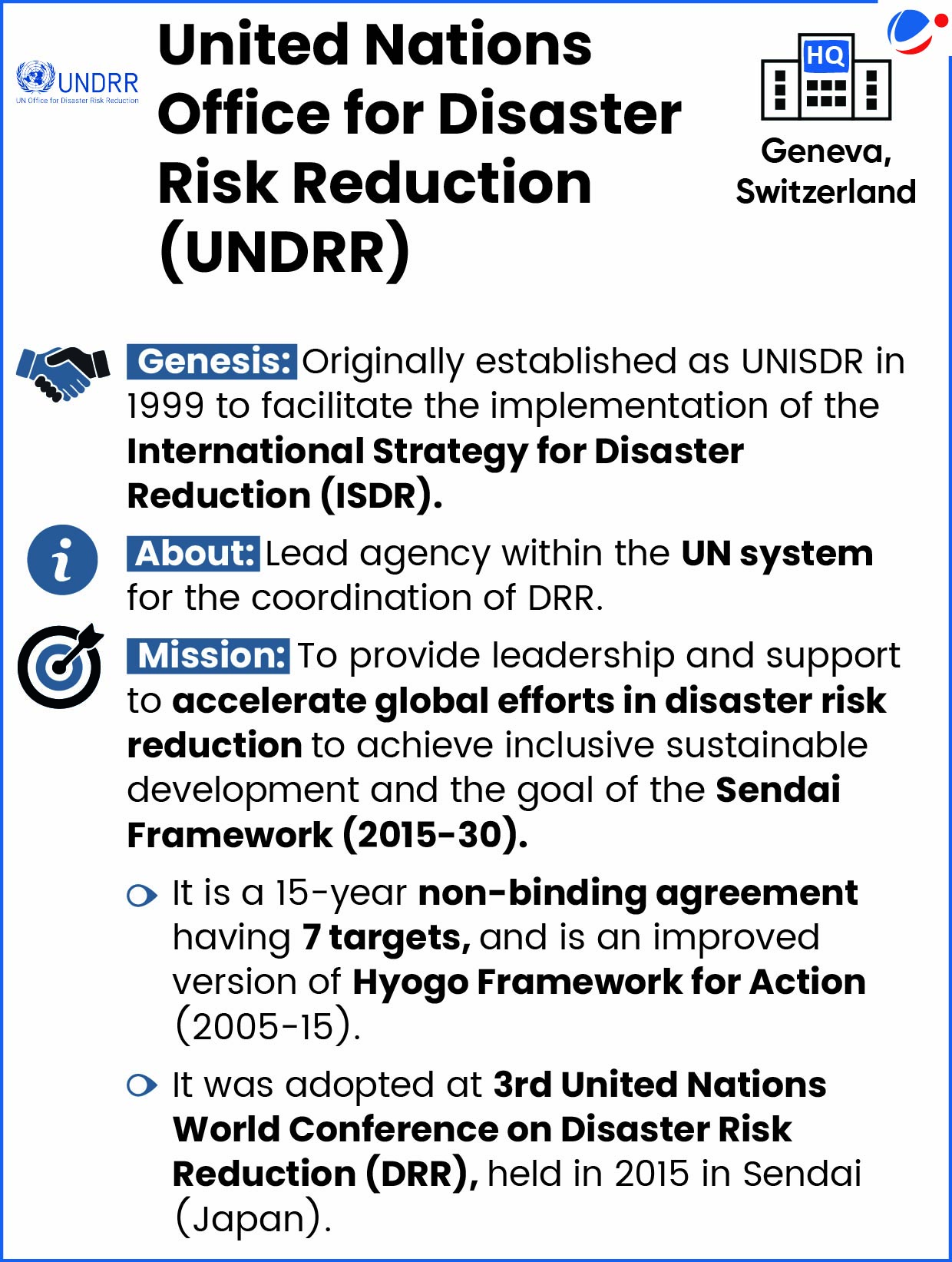

United Nations Office for Disaster Risk Reduction (UNDRR) released the Global Assessment Report (GAR) on titled "Resilience Pays: Financing and Investing for our Future".

More on the News

- Also, recently India showcased the World's Largest Disaster Risk Reduction Financing System at the 8th session of the Global Platform for Disaster Risk Reduction (GP2025).

- GPDRR was established in 2006 to assess and discuss progress on the implementation of the Sendai Framework for DRR.

What is Disaster Risk Reduction (DRR)?

- It refers to the steps taken to prevent new and reduce existing disaster risk and manage risk retention (aka residual risk), thereby strengthening resilience and sustainable development.

- E.g., New hazard-resilient infrastructure.

Why there is a need for financing Disaster Risk Reduction? (GAR 2025)

- Limited aid: Just 2% of development aid goes to DRR.

- Mounting Economic Burden of Disasters: Financial losses from disasters have doubled in the past two decades.

- Higher Vulnerability of Developing Countries: As of 2023, only 49% of Least developed Countries (LDCs) had multi-hazard early warning systems.

- Breaking 3 negative spirals of unsustainable disaster risk management:

- Decreasing income, increasing debt spiral: By 2050, global incomes could decline by 19% due to climate-related hazards, with lower income countries suffering disproportionately

- Unsustainable risk transfer spiral: E.g., India continues to have very low insurance penetration, with coverage below 1%, limiting the ability to share disaster risk.

- Respond-repeat spiral: Every $1 invested in DRR saves $15 in averted future disaster recovery costs.

What are the key Challenges in mobilizing adequate DRR Financing?

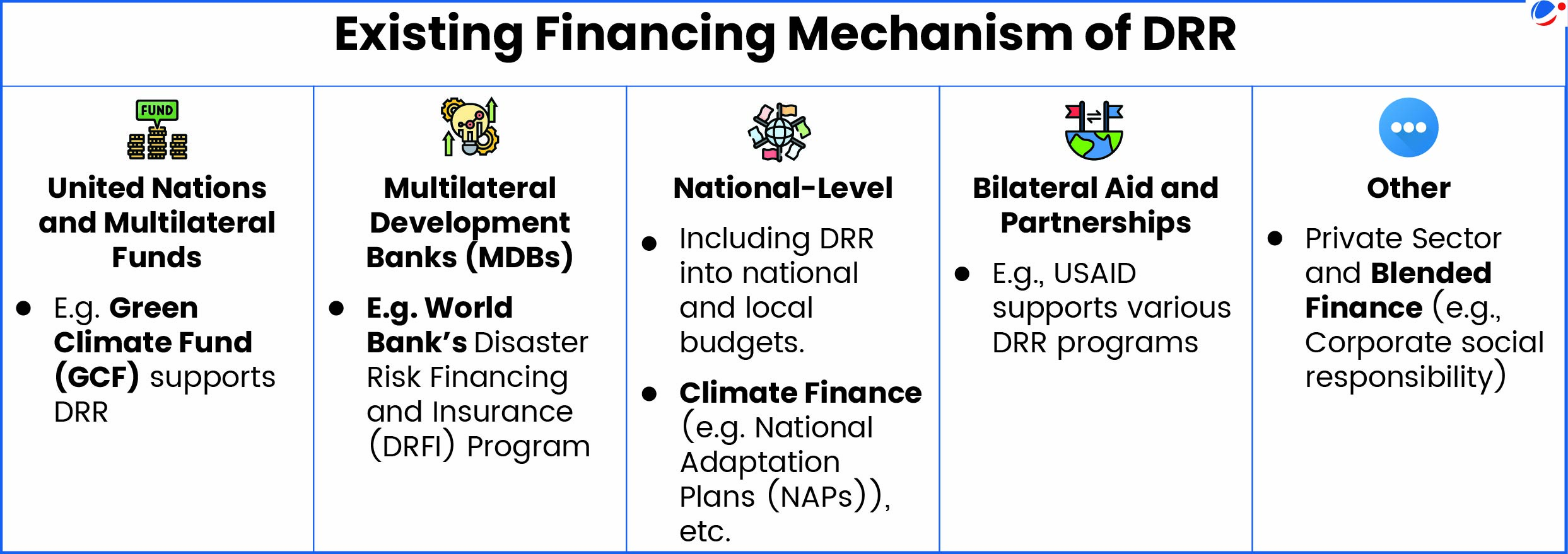

- Absence of dedicated international financial mechanism: To support the establishment of DRR financing systems.

- Low integration with financial decision-making: Governments, businesses, financial institutions don't incorporate hazard considerations in financial decisions.

- Data and evidence to incorporate relevant hazard risk analysis into financial decisions may be limited in certain geographies and for certain hazards.

- Considered as politically risky: Financing DRR seen as spending on uncertain events with non-immediate benefits.

- Other: Weak Institutional Capacity in Developing Countries, Lack of national DRR strategies etc.

India's Disaster Risk Reduction (DRR) Financing System

|

Way Forward

- Overhaul regulatory environment: E.g. National governments and regulators need to create Standards and taxonomies (e.g., define sustainable, disaster resilient investments, etc.).

- Tracking Finances: E.g. Tracking financing flows in risk prevention and fiscal data to identify the volume of investment utilized out of budgeted allocation.

- Adopting Innovative Financial Approaches: E.g., Blended finance, Debt-for-resilience swaps, Integrating disaster risks into credit ratings, Green bonds, Catastrophe bonds (transfer risk to global investors and provide additional financial protection beyond traditional insurance), etc.

- Promoting layered financing: For example, low-cost, high frequency events might be covered through national reserves or contingent credit lines, while rarer, more severe disasters require insurance or other risk-transfer solutions.

Conclusion

DRR financing is not just a development necessity but a strategic investment for sustainable futures. To break the cycle of disaster and recovery, the global community must shift from reactive spending to proactive risk management, ensuring resilience is at the heart of financial and policy decisions.