Why in the News?

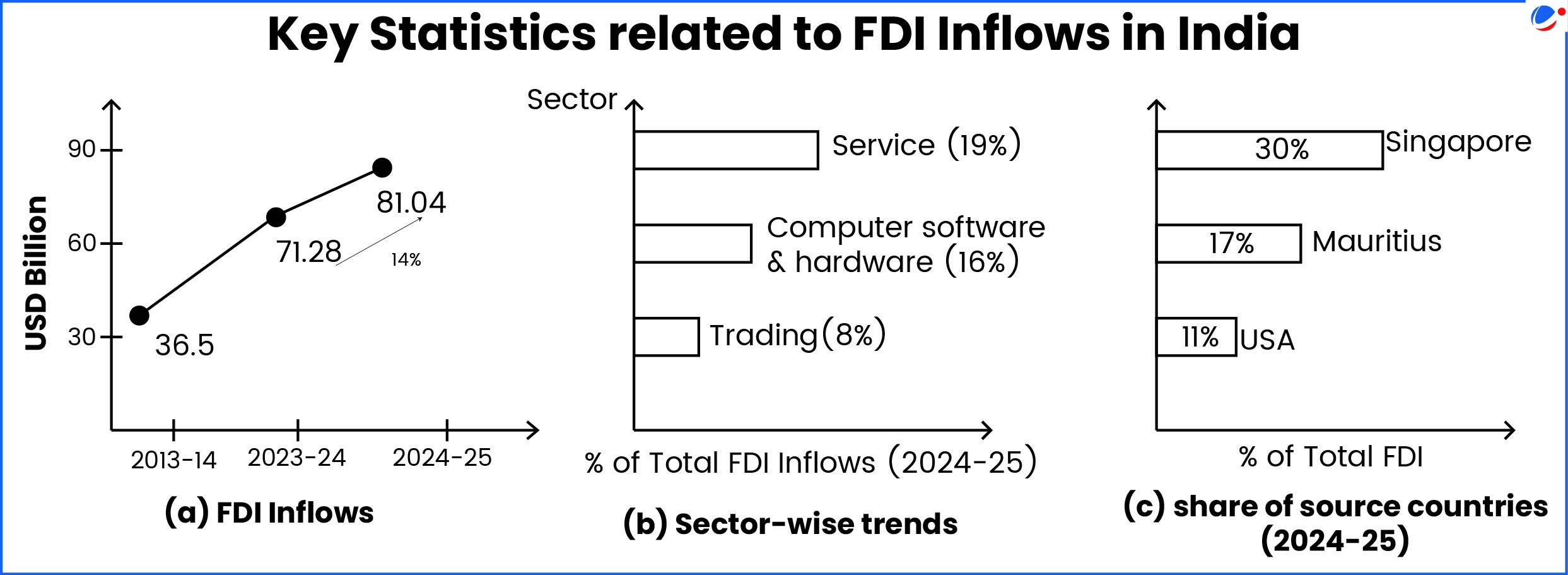

As per RBI Bulletin (June 2025), India's net FDI inflows fell by 96% in FY25 in comparison to FY24 despite rise in its gross FDI inflows.

About Foreign Direct Investment (FDI)

- It refers to the investment through equity instruments by a person resident outside India in an unlisted Indian company; or in 10% or more of the post issue paid-up equity capital on a fully diluted basis of a listed Indian company.

- Governance and Regulation: Consolidated Foreign Direct Investment Policy (2020); Foreign Exchange Management (Non-Debt Instruments) Rules, 2019.

- Gross and Net FDI:

- Gross FDI: Total investment made by foreign entities directly into the productive assets of India.

- Net FDI: Difference between inward FDI flows and outward FDI flows (Repatriation by foreign firms + Outward FDI by Indian firms).

- Entry Routes:

- Automatic Route: Prior approval of the RBI or the Central Government is not required.

- Example of sectors with 100% FDI Through automatic route: Agriculture & Animal Husbandry; Coal and Lignite; Exploration of Oil and Natural Gas; Airports (Greenfield and Existing); Industrial Parks; Telecom Services; Trading etc.

- Government Route: Prior Government approval required, and foreign investment shall conform to the conditions stipulated by the Government in its approval.

- Automatic Route: Prior approval of the RBI or the Central Government is not required.

- Examples of FDI Prohibited Sectors in India: Lottery Business including Government/private lottery, online lotteries; Gambling and Betting including casinos etc.; Chit funds; Nidhi company; Activities/sectors do not open to private sector e.g. Atomic Energy, Railway Operations etc.

Significance of growing FDI inflows

- Capital Investment: It is a major non-debt financial resource infusing long term sustainable capital contributing to technology transfer, strategic sector development, etc.

- E.g., India attracted significant greenfield investments, with projected capital expenditure rising ~25% to USD 110 billion in 2024. (UNCTAD's World Investment Report (WIR), 2025)

- Exchange Rate Stability: As on May 2025, India's forex reserves can cover 11+ months of imports and 96% of external debt. (RBI Bulletin June 2025)

- Sustainable Finance: E.g., India is by far the largest carbon credit issuer in the Verra Registry (UNCTAD's WIR, 2025)

- Supports Competition and Innovation: Brings in new market entrants, best practices, managerial and technological know-how, and generates employment.

Reasons for Fall in Net FDI in India

- Rising Outward Indian investment: Ministry of Finance's Monthly Economic Review (April 2025) noted that Indian direct overseas investment rose to 12.5 billion in FY25.

- Liberalised policy: E.g., liberalised Overseas Direct Investment (ODI) guidelines, 2022 allows Indian entities and individuals to invest in foreign entities with greater ease and fewer restrictions.

- Increase in Repatriations: RBI held that it is indicative of maturing market where foreign investors can enter and exit smoothly.

- Other risks to FDI:

- Global Economic Uncertainty: Rising trade tensions particularly tariff hikes by the USA.

- Global FDI declined by 11% (YoY) in 2024 (UNCTAD's WIR 2025).

- Maturing investment cycle: Several older FDI inflows are entering the harvest phase, with foreign companies withdrawing parts of their investments after realising growth and profitability targets.

- Weak Global Demand impacting export: According to S&P Global Manufacturing Purchasing Managers Index, April 2025 marked the steepest export decline since 2012.

- Global Economic Uncertainty: Rising trade tensions particularly tariff hikes by the USA.

Initiatives taken to boost FDI in India

|

Way Forward

- Undertaking Policy Reforms: Stable policies in taxations along with regulatory and judicial reforms would improve the ease of doing business resulting in higher FDI.

- E.g., Vietnam implements 10-year economic plans to specifically offer guidelines for investment and market liberalisation process.

- Strengthening Digital Economy: Advancing Multilateral Dialogues to shape coherent and development-oriented rules on investment in the digital economy.

- Digital economy was a key driver of global FDI, with investments rising by 14% in 2024 (UNCTAD's WIT 2025).

- Investment Incentives: They can be used to attract and steer capital through fiscal incentives like tax breaks, grants and subsidies.

- International Cooperation: Reforming International Financial System (lending through hybrid capital, etc.), multilateral cooperation to manage global risks, promoting fair investment, etc.

Conclusion

The recent decline in net FDI is seen as a temporary result of shifting investments, not a sign of long-term problems in the economy. To retain its position as the largest FDI recipient in South Asia, India must focus on smarter capital which is long-term, inclusive and aligned with sustainable development.