Why in the News?

Recently, the 4th International Conference on Financing for Development (FFD4) adopted the final outcome document Compromiso de Sevilla, also known as Seville Commitment, to address the SDG financing gap in developing countries.

More on News

- The Sevilla Commitment is adopted by consensus, lays out a path to close the $4 trillion annual SDG financing gap in developing countries.

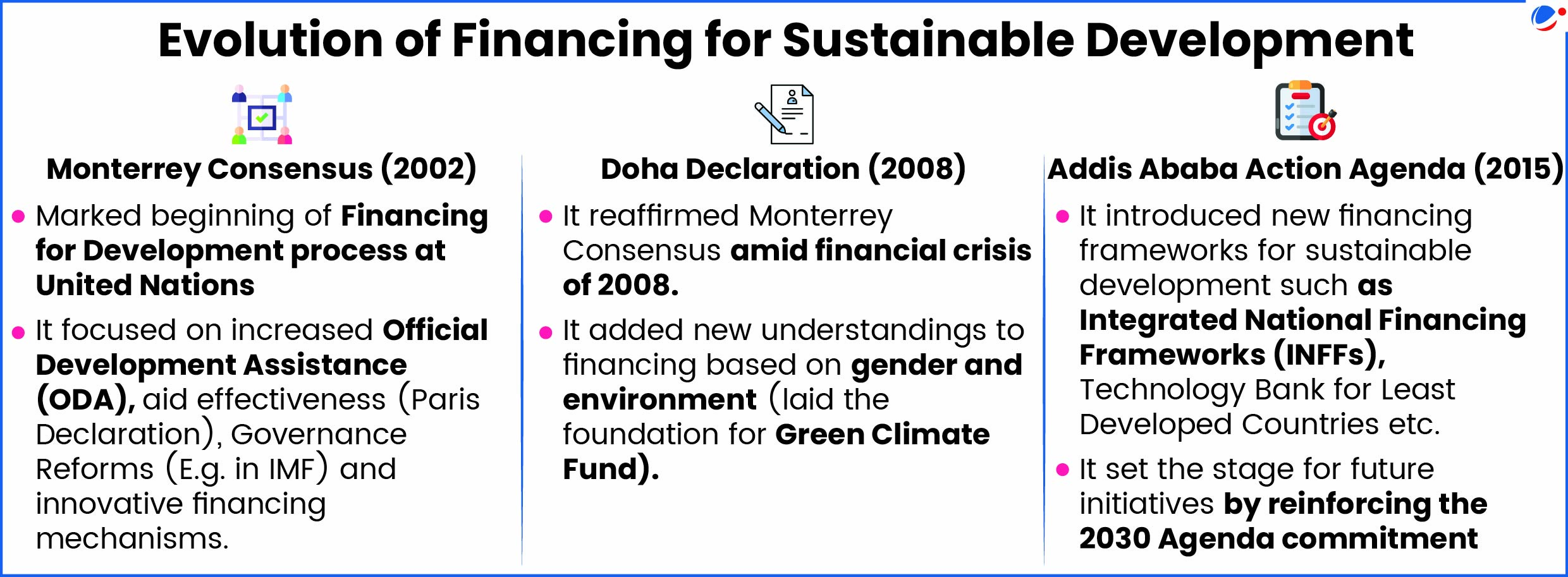

- It is built upon the earlier frameworks (Infographic)

- The United States decided to exit the process entirely.

- The Indian Finance Minister also proposed a Seven-point strategy to boost private investment for sustainable development.

- It includes strengthening multilateral banks, improving credit rating methods, and developing domestic financial markets, Unlocking capital at the Grassroots Level, scaling blending financing, etc.

Requirement for Financing for Sustainable Development'

- SDG Financing Gap: The Gap between SDG aspirations and financing has continued to widen. E.g.It has reached 4 trillion US dollars annually (UN estimates).

- Investment in Climate Finance: E.g. In case of enhanced nationally determined contributions scenario, energy-related investment is expected to grow by 40% between 2022 and 2030 (OECD,2025)

- Wealth Inequality: E.g. Wealthiest 1% own more wealth than 95% of the total global population combined. (Oxfam 2024)

- Tax Disparity: E.g. Wealth of richest 1% has surged $33.9 trillion since 2015 enough to end annual poverty 22 times yet billionaires only pay around 0.3% in real taxes. (Oxfam,2025)

- Debt Trap: Over 40 per cent of people living in extreme poverty live in countries with severe debt challenges. {Financing for Sustainable Development Report (FSDR) 2023}.

Impediments to Financing for Sustainable Development

- Shrinking Fiscal Space: E.g. 46 developing countries (3.4 billion people) spend more on interest payments than on either health or education. (UNCTAD)

- Unequal Special Drawing Rights (SDR) Allocation: E.g. of total SDR allocations, developed countries receive 66%, Africa receives only 5.2% while the least developed countries receive just 2.5%. (FSDR Report,2023).

- The SDR is an international reserve asset created by the International Monetary Fund. It is not a currency, but its value is based on a basket of five currencies.

- Geo-economic Fragmentation: Geo-economic fragmentation is replacing globalisation worldwide.

E.g. >24000 new restrictions were imposed on trade and investment between 2020 to 2024 (Economic Survey 2024-25)

- Illicit financial flows: It reduce the availability of resources for financing the SDGs and recovery from global shocks such as COVID-19, undermining domestic resource mobilisation.

- Gender Gap: E.g. Women represent <40% of employment in manufacturing. Moreover, they are overrepresented in sectors with lower profit margins, low technology intensity and low wages.

Steps Taken

The Sevilla Commitment focuses on three key areas i.e. Catalysing investment for sustainable development, addressing the debt crisis, and reforming the international financial architecture. New financing mechanisms were announced under the Seville Commitment: -

- To address debt challenge

- Debt-for-Development Swap Programme: It is a deal between a government and its lenders to cancel or reduce debt in exchange for the government agreeing to spend money on a development goal.

- E.g., Italy will convert 230 million Euros of debt obligations of African countries into investments in development projects

- Debt "Pause Clause" Alliance: Aims to include "pause clauses" in lending to suspend debt service payments during crises.

- Debt Swaps for Development Hub (led by Spain and the World Bank): To enhance collaboration to scale up debt swaps and lower debt service burdens.

- Sevilla Forum on Debt: To help countries learn from one another and coordinate their approaches in debt management and restructuring, with a UN entity serving as its secretariat, with support from Spain.

- To catalyse investment with development impact

- Scaling Blended Finance: E.g. Blended finance platform, SCALED has been launched to scale up blended financing to create scalable blended finance instruments.

- Blended finance is a financing method that strategically combines public, philanthropic, and private capital to fund sustainable development initiatives.

- An Effective Taxation of High-Net-Worth Individuals initiative (led by Brazil and Spain): To ensure high-net-worth individuals pay their fair share.

- Coalition for Global Solidarity Levies (led by France, Kenya and Barbados): Aims to tax premium-class flying and private jets to raise funds for climate action and sustainable development.

- To support architecture reform at the national and global levels

- Enhancing Local Currency Lending: E.g. FX EDGE Toolbox (Inter-American Development Bank) and Delta Liquidity Platform (European Bank for Reconstruction and Development) for local currency lending.

- A coalition led by the UK and the Bridgetown Initiative: To scale-up pre-arranged financing from 2% to 20% of total disaster financing by 2035.

Conclusion

Creating the right environment for private investment, strengthening public development banks, and reforming the multilateral system are essential to align finance with the SDGs. Key reforms include fiscal incentives, long-term funding, and updates to WTO rules and investment treaties to reflect current global needs.