सुखस्य मूलं धर्मः । धर्मस्य मूलं अर्थः । अर्थस्य मूलं राज्यः ॥ The foundation of well-being is dharma. The foundation of dharma is economic strength. And the foundation of economic strength is the state. -Chanakya Sutras |

Introduction

- The chapter argues that while India enters the late 2020s with resilient growth and strong macroeconomic fundamentals, the nature of its development challenge is shifting.

- In a geoeconomic landscape defined by fragmentation and technological disruption, India must transition from strategic resilience to strategic indispensability, where it becomes a source of reliability and value for the world.

- This transition relies heavily on the depth and quality of state capacity.

Chapter Precap

Global Context

| The Swadeshi Framework

|

Competitiveness & Economy

| State Capacity

|

We have done well

Economic Survey 2025-26 assess India's economic performance and resilience following the COVID-19 as exceptional. It outlines how India has retained strong macroeconomic fundamentals and policy autonomy despite global shocks.

Category | Key Achievements & Developments |

Macroeconomic Fundamentals |

|

Sectoral Trends |

|

Structural Reforms (2025) |

|

Fiscal & Tax Relief |

|

Trade & External Strategy |

|

Not so sure about the world

While India's internal fundamentals are strong, the global environment has become deeply structural in its uncertainty, presenting significant risks to emerging economies.

- The Unravelling of the Post-Cold War Order

- The TMT (Telecommunication, Media and Technology) bubble burst in the early 2000s.

- China's entry into the WTO (2001), disrupting industries and investment patterns in both developed and developing nations.

- The Global Financial Crisis (2008), which significantly damaged global confidence in the American model of post-industrial financialisation-led growth.

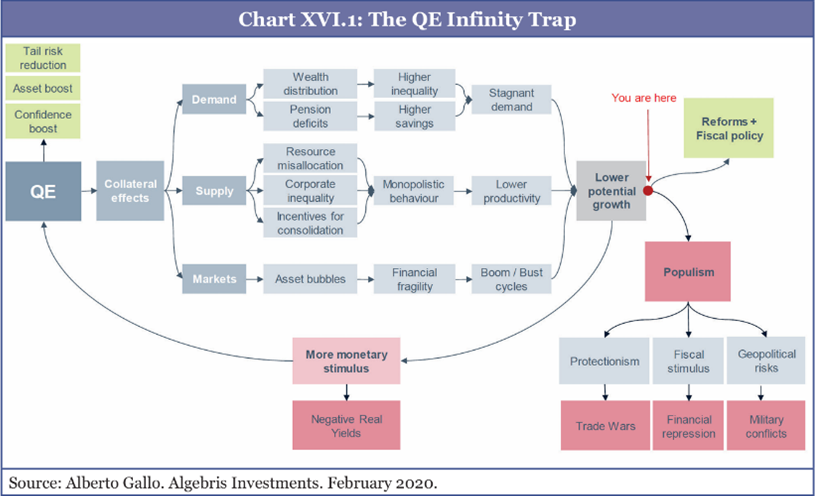

- The QE Infinity Trap

- A major critique is directed at Western monetary policy. Policymakers responded to crises with prolonged quantitative easing (QE) and near-zero interest rates.

- The Trap: Citing fund manager Alberto Gallo, the chapter warns of a QE Infinity Trap where economies become addicted to easy money to function.

- Consequences: this liquidity flowed into safe-haven assets and speculation (financial engineering), causing asset bubbles and wealth inequality while failing to generate real growth.

- Financial Repression: This has led to financial repression and negative real yields, creating a fragile environment where geopolitical tensions can easily disrupt markets.

- The Physical Costs of the AI Boom

- Energy Demand: The demand for compute (GPUs) is driving a sharp rise in electricity consumption by data centers, destabilising power grids and raising energy costs.

- Resource Nationalism: This power demand has caused a surge in prices for materials like copper. As demand for critical minerals tightens, countries are adopting beggar-thy-neighbour trade policies and restricting exports, making basic inputs harder to secure.

Narrower and narrowing alliances

The Survey argues that the global economy is moving away from multilateralism toward narrower and narrowing alliances. This shift creates specific risks for emerging economies.

Key Mechanisms of Instability

- Resource Nationalism (Pax Silica): The US has launched the Pax Silica Declaration with select allies. This initiative aims to build an exclusive AI ecosystem with select allies, potentially excluding others from high-end supply chains.

- Financial Disruption (GENIUS Act): The Survey specifically flags the US GENIUS Act as a threat. If regulated private institutions issue US dollar-backed stablecoins, it could disrupt capital flows to developing economies like India.

India's Structural Vulnerability These global shifts expose a hard constraint in India's macroeconomics:

- Reliance on Volatile Flows: Unlike nations with persistent export surpluses, India finances its trade deficit through conditional and reversible portfolio flows and debt.

- Geopolitical Sensitivity: These flows are highly sensitive to global sentiment. For instance, recent US tariffs on India caused investors to retreat, putting pressure on the Rupee.

- The Conclusion: Because India relies on these flows to fund imports, it remains vulnerable to global fragmentation. To secure true autonomy, India must transition from relying on capital inflows to generating hard currency through strong manufacturing exports.

Deepening uncertainties lie ahead

Global environment is shifting from temporary volatility to a prolonged period of structural fragility and strategic contestation.

- The Strategic Challenge of the Hainan Free Trade Port

- The Mechanism: Hainan operates with zero tariffs, a separate customs system from the mainland, and relaxed rules on investment and visas, allowing goods adding real value to enter mainland China duty-free.

- The Impact on India: This is a gradual structural development that creates a massive, low-tariff economic zone in the northern Indian Ocean and South China Sea region.

- It is expected to influence supply-chain routing, tourism flows, and corporate investment decisions in Asia, creating direct competition for India.

- End of Business as Usual and Financial Fragility

- Capital Vulnerability: India is dependent on global capital flows and must plan for liquidity and external capital buffers.

- Resource Dependence: India's resilience will be tested by its continued strategic reliance on external sources for capital, energy, and critical inputs like fertilisers.

- The Interwar Years Analogy Looking toward 2045, the Survey draws a parallel between the coming decades and the volatile interwar years of the twentieth century.

- Proactive Policy: To survive this turbulence, India requires a proactive or offensive policy framework to turn necessities into innovations.

- The Shift to Asymmetric Openness The assumptions of the post-Cold War era no longer hold.

- Trade as Dominance: Major powers, particularly China, increasingly view trade not as reciprocal exchange but as a transitional phase in a longer strategy of production dominance.

- Asymmetry: This creates a world of asymmetric openness, where some nations restrict access to their markets while others remain exposed.

- India must recognise that trade, technology, and supply chains are now shaped by strategic considerations.

- Strategic Learning:

- The Metaphor: It cites the Yuddha Kanda of the Ramayana, where Lord Rama reflects that insight can be drawn even from adversaries (Ravana) upon their defeat.

- The Lesson: India must develop the capacity to learn from competitors and adversaries without inheriting their values or methods, ensuring that learning is compatible with autonomy.

Swadeshi is inevitable and necessary

The Economic Survey 2025-26 marks a strategic pivot in India's economic approach, arguing that reliance on friction-free global markets is no longer viable.

- The End of Naïve Globalisation (Why it is Inevitable) The assumption that access to markets, technologies, and inputs will remain frictionless and permanent is no longer valid. Swadeshi has become inevitable to ensure continuity of production amidst external shocks. The world is now defined by:

- Export control regimes and technology denial.

- Carbon border mechanisms.

- Aggressive industrial policies adopted by both Western and Eastern nations.

- A Dual-Purpose Lever (Why it is Necessary) Swadeshi is framed as a dual-policy lever essential for economic sovereignty:

- Defensive: It acts as a buffer to withstand external supply chain disruptions and shocks.

- Offensive: It serves as a pathway to build enduring national capabilities that reinforce the country's strategic independence.

- Discipline over Doctrine Swadeshi is described as a disciplined strategy rather than a blanket doctrine. It advocates for intelligent import substitution based on strict conditions:

- Protection is warranted only when domestic production is feasible but hindered by coordination failures or legacy regulatory burdens, or when the good is strategically critical.

- Support must be temporary, time-bound, and strictly linked to export discipline and measurable performance benchmarks.

- Rejection of Permanent Shelter: for sectors that are already cost-competitive or for general-purpose intermediates (critical inputs). Protecting these would raise economy-wide costs and act as a tax on downstream manufacturing.

- The Ultimate Goal: Export Capability The strategy aims to move from import substitution to Strategic Resilience and finally to Strategic Indispensability.

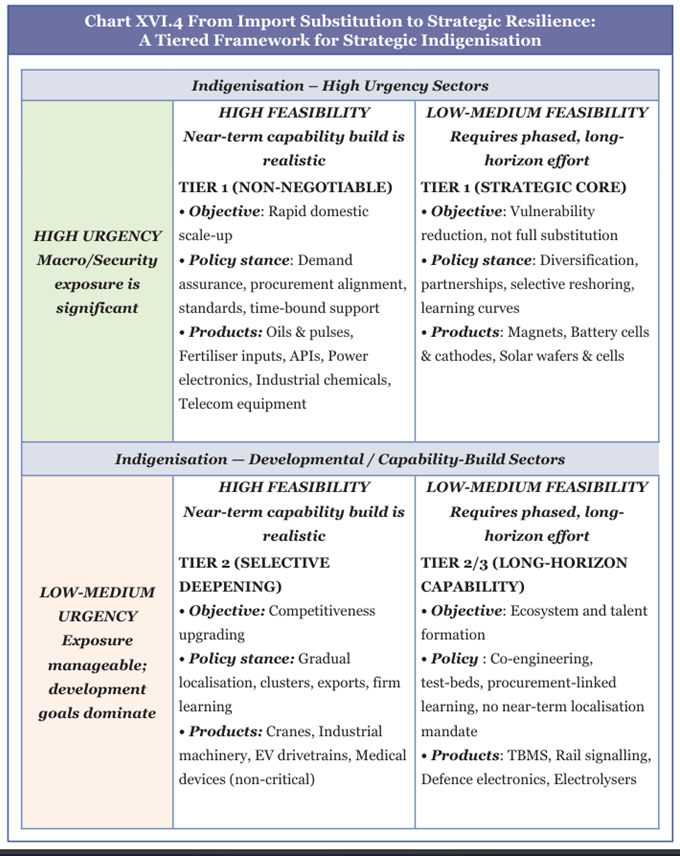

Tired Framework for Strategic Indigenisation

It is a policy tool designed to discipline the push for Swadeshi (self-reliance). Its purpose is to ensure that import substitution is not applied indiscriminately as a blanket doctrine, but rather as a targeted strategy based on specific criteria.

The framework categorises goods and sectors into three distinct tiers based on their strategic urgency and economic feasibility to determine the appropriate level of state intervention.

Tier I: Critical vulnerabilities with high strategic urgency

This tier includes items like defence systems and energy components where access denial imposes asymmetric costs. The goal here is assured availability rather than short-term efficiency.

Tier II: Economically feasible capabilities with strategic payoffs

This covers goods where domestic production is feasible but hindered by historical factors. Intervention here is justified to accelerate capability formation through scale and learning, provided it is linked to performance and export readiness.

Tier III: Low strategic urgency or high-cost substitution

For goods where import dependence does not create systemic vulnerability, indigenisation is unwarranted. Attempting to substitute these domestically would raise economy-wide costs.

A new National Input Cost Reduction Strategy: competitiveness as infrastructure

The Survey posits that resilience strategies (Swadeshi) will fail if they inadvertently raise costs across the economy. Therefore, indigenisation must be paired with systematic input-cost reduction to ensure export competitiveness is not eroded.

- Core Philosophy: Competitiveness as Infrastructure

- Input-cost reduction to preserve export competitiveness: High input costs function like infrastructure bottlenecks, imposing diffuse, persistent penalties on the entire manufacturing ecosystem.

- These costs specifically erode MSME margins and the capital required for technological upgrading.

- Input-cost reduction to preserve export competitiveness: High input costs function like infrastructure bottlenecks, imposing diffuse, persistent penalties on the entire manufacturing ecosystem.

- The Structural Distortion: Tariff Inversion

- Definition: A structure where import duties on intermediate goods are higher than those on finished goods.

- Consequence: Penalises domestic value addition and incentivises the import of assembly kits rather than genuine manufacturing.

- Correcting this is a structural necessity, not a marginal trade adjustment.

- The Solution: Rule-Based Distortion Audit

- A National Input Cost Reduction Strategy should rationalise protections via a structured audit asking four key questions:

- Is the input widely used across sectors?

- Does domestic capacity actually exist?

- Does protection materially raise costs for downstream users?

- Does the support serve a strategic purpose or merely entrenched interests?

- Balancing Protection and Efficiency

- Indigenisation and cost reduction can coexist if the scope is clearly defined:

- Targeted Support: The state can protect critical components (Tier I and II frameworks).

- Competitive Inputs: General-purpose inputs must face competitive pressure to prevent indigenisation from becoming across-the-board protectionism.

Advanced manufacturing as a disciplining system: why manufacturing shapes institutions

- A Stress Test for State Capacity: Advanced manufacturing magnifies small frictions into cost, quality, and reliability failures, exposing weaknesses in infrastructure and regulation.

- Manufacturing Cannot Exist in Enclaves: Unlike services, manufacturing depends on integrated public goods such as ports, power, transport, standards, and dispute resolution. Thus, manufacturing actively calls forth state capacity by making governance failures costly to conceal.

- From Negotiation to Execution: Advanced manufacturing demands efficiency, cost discipline, and reliable operations, compelling firms to perform and the state to ensure predictable rules and enforceable contracts.

Why East Asia Matters

The Core Argument: It's Not If, But How

The success of East Asian economies (Japan, South Korea, Taiwan, Singapore, China, and Vietnam) is often misread. Observers typically debate whether protection or openness drove their growth, missing the deeper institutional logic.

The central lesson is not that these states intervened, but how they intervened and how they exited. Their success relied on:

- Design for Failure: Systems were designed to learn from mistakes and reallocate resources when bets failed.

- Discipline: Bureaucratic autonomy was paired with performance discipline.

- Allocative Efficiency: They did not just support firms; they withdrew support when firms failed to deliver results.

East Asia - The Architecture of State CapacityThe Survey breaks down four distinct models of state capacity:

|

The Common Thread: The Entrepreneurial State

Despite their differences, these nations shared the logic of an Entrepreneurial State. This state does not replace markets but is willing to take calculated risks and, crucially, dynamically reallocate support.

"There are decades where nothing happens; and there are weeks where decades happen" -Lenin |

Three features define this success:

- Outcome-Oriented: Officials are evaluated on results, not rule-following.

- Failure Tolerance: Honest errors are acceptable; stagnation is not.

- Credible Withdrawal: Exit is as important as entry; support is not a permanent entitlement.

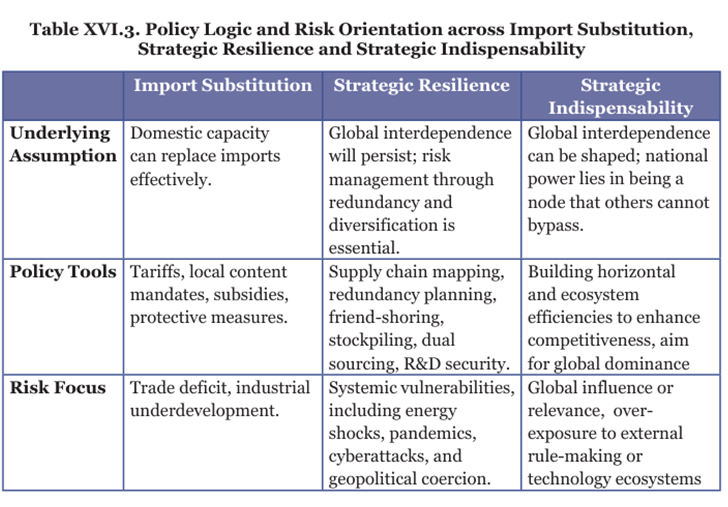

The Three Stages of National Strength

The Survey posits that India needs to build domestic capacity not just to replace imports, but to achieve investment in national strength. This journey involves three distinct concepts.

The Telescoped Challenge

India does not have the luxury of sequencing these stages over decades. The global order is in a state of rapid flux. Consequently, the stages of Aatmanirbharta (self-reliance) are telescoped into each other, forcing India to pursue import substitution, resilience, and indispensability simultaneously.

Conceptual Framework

- Core Objectives

- Import Substitution: Focuses on reducing import dependence.

- Strategic Resilience: Focuses on the continuity and security of supply chains under stress.

- Strategic Indispensability: Focuses on global leadership and enabling leverage in negotiations.

- Policy Focus and Logic

- Economic Focus: Moves from Sectoral (manufacturing/consumer goods) to Systemic (energy/data/defence) and finally to Global (embedding industries in global networks).

- Geographic Logic: Shifts from Produce at home to Diversify and secure (friend-shoring), and finally to Shape and anchor (building critical global interdependencies).

- Risk Orientation and Tools

- Assumptions: Import substitution assumes domestic capacity can replace imports. Resilience assumes global interdependence persists but requires redundancy. Indispensability assumes interdependence can be shaped by becoming a critical node.

- Tools: Evolves from tariffs and subsidies to supply chain mapping and redundancy, eventually aiming for horizontal and ecosystem efficiencies for global dominance.

- Strategic Indispensability offers the highest form of power: influence without coercion. This state is achieved when global firms rely on Indian production and cannot easily reconfigure supply chains without India.

- The Ultimate Test: As stated by the Prime Minister, true Swadeshi is achieved when the world moves from thinking about buying Indian to buying Indian without thinking due to superior quality and price.

Manufacturing, Export capability, and currency strength

The Survey argues that for India to sustain a strong currency and economic autonomy, it must transition from relying on capital inflows to generating durable trade surpluses through manufacturing exports.

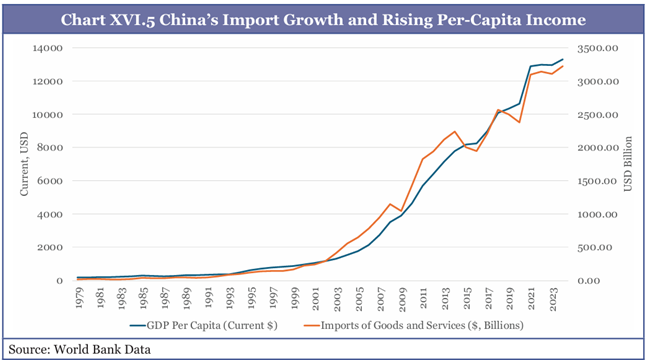

- Import Growth is Inevitable (Not a Failure) The Survey posits that as India's economy grows and incomes rise, imports will inevitably increase.

- The China Example: The text illustrates this using China's trajectory: its imports rose alongside its per-capita income, even as it became a top global producer of goods ranging from steel to drones.

From Resilience to Influence - India's Power Gap in Asia

|

- Redefining Swadeshi: From Substitution to Export Consequently, the success of Swadeshi (self-reliance) must not be judged solely by how much imports are reduced, but by the creation of export capability.

- The Rationale: In a geopolitical landscape where capital flows are shaped by national interests rather than neutral market forces, India cannot rely on volatile foreign investment to pay for its imports.

- The Definition of a Hard Currency: It challenges the notion that a strong currency is driven solely by central bank credibility or monetary orthodoxy. Instead, the exchange rate is a signal of underlying trade dynamics.

- A hard currency status emerges when markets believe a country can earn foreign exchange reliably through trade, rather than depending on borrowing or capital inflows.

- Currencies like those of Germany, Japan, and East Asian nations became hard because they rested on export capabilities.

- India's Structurally Soft Currency: The Survey describes India's currency as structurally soft, not due to policy failure, but because economic growth mechanically widens the trade deficit.

- If this deficit exists, the exchange rate acts as a buffer against external pressure, and depreciation remains the primary adjustment mechanism unless export capabilities are scaled up.

- Why Services Are Not Enough

- Limitations of Services: They are less employment-intensive at scale, generate fewer backward linkages, and do not anchor physical supply chains.

- Necessity of Manufacturing: Only manufacturing exports create supplier ecosystems and absorb large workforces.

Route to Strategic Indispensability runs through Global Value Chains

- Integration is a two-way process: Embedding Indian firms into Global Value Chains (GVCs) and simultaneously embedding global production systems within India.

- The Strategic Importance of Anchor Firms: Global trade is increasingly concentrated within a small number of multinational production networks. India needs to attract these firms not merely as sources of capital, but as anchors of export capability and currency strength.

- Foreign Direct Investment (FDI) is not homogenous. The identity of the investor is as important as the volume of investment.

- Ecosystem Orchestration (The Lesson from China): The Survey cites evidence showing that nearly half of the developed world's imports from China originate from the supply chains of roughly fifty multinational brands.

- These firms do not just assemble products; they orchestrate ecosystems. They bring with them supplier networks, logistics platforms, quality systems, and design feedback loops that shape entire industries.

- The Fastest Route to Indispensability: For India, attracting these global brands is described as the fastest route from Swadeshi as capability-building to Swadeshi as strategic indispensability.

The Role of the State

- The Three Essential Attributes: the state must simultaneously embody three distinct qualities.

- Firmness: The state must enforce discipline to ensure that protection (such as tariffs or subsidies) does not degenerate into permanent entitlement for industries.

- Flexibility: Policies must be adaptable, responding to real-world feedback rather than sticking to rigid theoretical assumptions.

- Fairness: Support must be allocated impartially to preserve legitimacy and prevent regulatory capture (where special interests dominate policy).

- Federalism as a Strategic Asset

- Specialisation: Different states possess unique geographic, demographic, and institutional endowments, allowing them to specialise in different parts of the supply chain.

- Competitive Federalism: A national Swadeshi strategy should encourage competition among states. The central government's role is limited to setting the direction, removing frictions, and providing credibility.

- Alignment for Confident Integration The journey to strategic indispensability is attainable given India's scale, talent, and democratic legitimacy. Success depends on achieving alignment:

- Between intent and execution.

- Between policy and institutions.

- Between short-term pressures and long-term goals.

Conclusion

To secure its economic future in a fragmented world, India must transition from resilience to strategic indispensability. Success relies on a state that is firm in enforcing discipline, flexible in adaptation, and fair in support. By treating manufacturing as an institutional stress test and aligning intent with execution, India can evolve from a recipient of stability to a source of global influence. Thus, Aatmanirbhar Bharat will be defined not by isolation, but as a doctrine of confident integration.

Glossary

| Term | Definition |

| Anchor Firms | Multinational firms that do not merely assemble products but orchestrate ecosystems comprising supplier networks, logistics platforms, and quality systems, thereby shaping entire industries. |

| Asymmetric Openness | A trade environment where some countries remain exposed to external markets and inputs, while others retain the ability to restrict access with limited self-inflicted cost. |

| GENIUS Act | The Guiding and Establishing National Innovation for U.S. Stablecoins Act (passed July 2025), which allows regulated private institutions to issue US dollar-backed stablecoins, potentially disrupting capital flows to developing economies. |

| Hainan Free Trade Port (FTP) | China's initiative turning the island province of Hainan into a special trade area with zero tariffs, a separate customs system from the mainland, and relaxed rules on investment and visas. |

| Hard Currency | A currency status that emerges when markets believe a country can earn foreign exchange reliably through trade rather than depending on reversible capital inflows. |

| Intelligent Import Substitution | Conditional protection justified when domestic production is feasible but hindered by non-economic factors; it must be time-bound, performance-linked, and subject to export discipline. |

| National Input Cost Reduction Strategy | A strategy to ensure that indigenisation does not erode export competitiveness by systematically reducing the costs of inputs (raw materials, energy, logistics), which function like economic infrastructure. |

| Pax Silica Declaration | An initiative announced by the United States with like-minded countries to build the AI ecosystem of the future, covering energy, critical minerals, and high-end manufacturing. |

| Power Gap | A concept from the Lowy Institute's Asia Power Index that measures the divergence between a country's resources (what it possesses) and its realised influence (how effectively it translates resources into outcomes). |

| QE Infinity Trap | A dynamic where prolonged monetary easing fails to stimulate productive investment, leading instead to financial repression and asset bubbles, making economies dependent on sustained accommodation to preserve activity. |

| Strategic Indispensability | The integration of an economy with global systems in a way that makes it fundamentally important to the global system, ensuring others are invested in its continued functioning. |

| Strategic Resilience | The capability of an economy to withstand external shocks (geopolitical, economic, technological, or environmental) and ensure the continuity and security of critical supply chains under stress. |

| Tariff Inversion | A structural distortion where import duties on intermediate goods are higher than those on finished goods, penalising domestic value addition and encouraging assembly over manufacturing. |

Mains Questions

- Advanced manufacturing acts as a disciplining system for both firms and the state. Examine this argument with reference to state capacity, regulatory credibility, and lessons from East Asian economies.

- Discuss the strategic and economic implications of the 'Pax Silica' declaration and export control regimes for India.