Introduction

- India's monetary and financial system showed strong resilience in FY26 (Apr–Dec 2025), supported by calibrated RBI actions and improving balance sheets of financial institutions.

- Reserve Bank of India's Monetary Policy Committee reduced the repo rate, while injecting durable liquidity through cash reserve ratio cuts and open market operations.

- Banking fundamentals strengthened, as gross non-performing asset (GNPA) ratios fell to multi-decadal lows, profitability improved, and capital buffers remained robust.

- Household financial savings increasingly shifted towards equities and mutual funds, indicating deeper financialisation. Digital public infrastructure (UPI, Aadhaar, fintech) expanded financial inclusion.

Chapter Precap

Global Financial Markets – Uncertainty and Other Emerging Risks

| Monetary Developments

|

Financial Intermediation

| Developments in Capital and Debt Market

|

Global Financial Markets – Uncertainty and Other Emerging Risks

- Global financial markets in 2025 were shaped by heightened policy uncertainty, especially after US tariff announcements, which triggered-

- Investors to reduce their exposure to US Dollar (USD) and seek safe-haven assets such as gold.

- Declines in global equity markets.

- Rise in risk premiums across asset classes.

- Prolonged periods of uncertainty can affect financial sector through at least three key channels-

- "Wait-and-see" behaviour i.e. delaying investment and capital formation.

- Higher cost of finance via wider credit spreads and financial intermediation costs, further impeding the credit flows.

- Increase the possibility of sharper market corrections across asset classes.

- New technologies such as AI impacts global financial markets:

- As investors increasingly rely on similar AI models, financial markets face a higher risk of herding behaviour and prolonged amplified shocks.

- Since November 2022, AI-related stocks have dominated US markets, contributing roughly 75% of S&P 500 returns, 80% of earnings growth, and 90% of capital spending growth, raising concerns of asset bubbles.

- Growing market capitalisation of stablecoins (USD 305.4 billion (up ~50% in 2025)) and their deeper links with the traditional financial system have increased the risk of spillovers.

Monetary Developments

- RBI's monetary policy acted as a key enabler of sustainable development and economic prosperity by maintaining price stability, supporting financial stability and promoting inclusive growth.

- Monetary Policy Committee (MPC) stance shifted from accommodative to neutral in June 2025 to retain flexibility.

- RBI undertook several key monetary policy actions in FY26 (April-December 2025) to support economic growth:

- Repo rate: Reduced to 5.25% to boost credit flows, investment and economic activity.

- Cash Reserve Ratio (CRR): Cut by 100 bps to 3.0% of net demand and time liabilities, releasing about ₹2.5 lakh crore in banking system by December 2025.

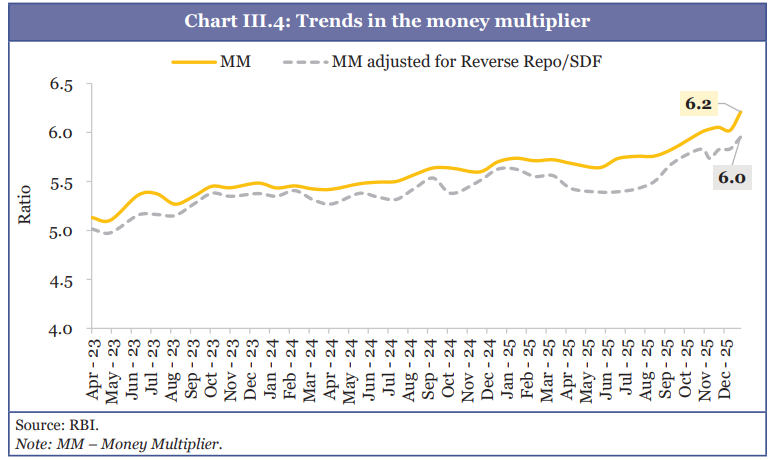

- As of 31 December 2025, money multiplier (MM), i.e., the ratio of M3 (Broad Money) to M0 (Reverse Money), stood at 6.21.

- When adjusted for reverse repo/standing deposit facility (SDF), the adjusted MM stood at 6.0.

- Upward trajectory of MM indicates improved financial intermediation by the banking system, thereby ensuring adequate systemic liquidity.

- Sources of Broad Money = Net Bank Credit to Government + Bank Credit to Commercial Sector + Net Foreign Exchange Assets of Banking Sector + Government's Currency Liabilities to the Public - Net Non-Monetary Liabilities of the Banking Sector.

Liquidity Conditions

- RBI injected liquidity of ₹2.39 lakh crore through Open Market Operations (OMO) purchases during April-May 2025.

- In response to evolving liquidity conditions, RBI undertook OMO purchases of ₹1 lakh crore and a 3-year USD/INR buy-sell swap of USD 5 billion in December to inject durable liquidity into system.

- System liquidity, as measured by net position under liquidity adjustment facility (net LAF), was on average in surplus during FY26 (up to 8 January 2026), significantly higher than FY25.

- Reflecting surplus liquidity conditions, banks' recourse to the marginal standing facility (MSF) declined while their deployment of surplus funds under the SDF increased.

- Borrowings under MSF declined in FY26 (as of 8 January 2026) from FY25.

- Weighted average lending rates (WALR) of scheduled commercial banks (SCBs) declined.

Financial Intermediation

- Financial intermediaries implement monetary policy by transmitting the central bank's decisions on interest rates, liquidity management, and credit supply to real economy.

- Financial intermediation in India is undertaken by diverse set of institutions—banks, non-banking financial companies (NBFCs), microfinance institutions (MFIs), capital markets, and fintech platforms—that mobilise savings, channel credit, manage risk, and facilitate efficient transactions between savers and borrowers.

- India's financial intermediation landscape has been rapidly digitised, with innovations such as UPI, Aadhaar-enabled services, and AI-based credit scoring expanding financial access, especially in rural and underserved areas.

Performance of the Banking Sector

- Improvement observed in asset quality of SCBs, as evidenced by their GNPA ratio and net NPA ratio standing at 2.2% and 0.5% respectively in September 2025, having reached a multi-decadal low level and record low level, respectively.

- Capital to-risk-weighted-asset ratio (CRAR) of SCBs: It remained strong at 17.2% as of September 2025.

- Recovery rate in NPAs in SCBs: It has approximately doubled from 13.2% in FY18 to 26.2% in FY25.

- Return on equity for SCBs: It has experienced a marginal decline (13.6% in March 2025). However, it has maintained a steady upward trend since March 2020.

- Return on assets has remained stable at 1.4% in March 2025.

- As of 31 December 2025, Y-o-Y growth in outstanding credit by SCBs increased to 14.5% compared to 11.2% in December 2024.

- Among agriculture and allied activities, industry, services and personal loans sectors, personal loans recorded the highest YoY growth in non-food credit at 12.8% in November 2025.

- Factor contributing to this growth is a substantial rise in loans against gold jewellery, due to increasing prices of gold.

- Regulatory measures, such as revised guidelines on voluntary pledge of gold and silver jewellery as collateral for small business loans, have helped in improving credit flow to the MSME segment.

- Between FY20 and FY25, there has been an increase in overall flow of resources to commercial sector, demonstrating a compounded annual growth rate (CAGR) of 20.9%.

- Within non-bank sources, foreign sources have experienced a greater YoY increase as compared to domestic sources.

- Increase in foreign sources is driven primarily by rise in external commercial borrowings by non-financial entities (Rs.27.7 thousand crore), and FDI to India which increased by 67% (YoY).

Performance of regional rural banks

- In rural and semi-urban areas, financial intermediation is primarily conducted through Regional Rural Banks (RRBs) which provides an alternative channel for credit distribution to small and marginal farmers, agricultural labourers, and socioeconomically disadvantaged groups.

- Their main focus areas include agriculture, trade, commerce, and small-scale industries in rural regions.

- Measures undertaken by Government to optimise resources and enhance RRBs performance:

- Under One State One RRB policy, RRBs were consolidated from 196 to 28 (as of 1 May 2025).

- Integration of Core Banking Solution and other IT systems of amalgamated RRBs into unified platforms.

- Common logo has been adopted for all 28 RRBs to establish a unified brand and national identity of RRBs.

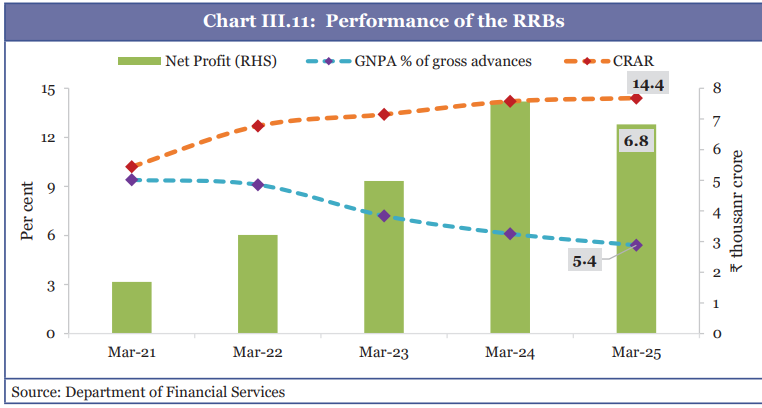

- RRBs performance improved significantly.

- RRBs achieved record consolidated net profit of ₹6.8 thousand crore during FY25.

- GNPA ratio decreased to 5.4% in FY25, reflecting the lowest level in the past 13 years.

- Consolidated CRAR of all RRBs reached an all-time high of 14.4% at the end of FY25.

Major policy actions in the banking sector

- By Reserve Bank of India

- Introduced Framework for Formulation of Regulations to standardise the process of making regulations in a transparent and consultative manner.

- Constituted regulatory review cell to review every regulation in a comprehensive, objective, and systematic manner, at least once every 5-7 years.

- Established an independent Advisory Group on Regulation comprising external experts to strengthen stakeholder engagement in the regulatory process and leverage industry expertise.

- Introduced Free AI framework for responsible AI, enabling innovation while strengthening risk management.

- The framework supports the India AI Mission, enhancing national AI capabilities, and aligns with Digital Personal Data Protection Act, ensuring consistency in data governance.

- It outlines six strategic pillars i.e. Infrastructure, Policy, Capacity, Governance, Protection, Assurance. These pillars are designed to balance innovation with risk mitigation.

- Public Sector Banks (PSBs) have launched Credit Assessment Model (CAM) for MSMEs in 2025 to improve ease of doing business for MSMEs and integrate credit guarantee schemes, such as Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE).

Artificial Intelligence in financial services: Global trends and India's approachAs per the World Economic Forum's white paper on AI in Financial Services (January 2025), AI investments across banking, insurance, capital markets, and payments are projected to reach USD 97 billion by 2027. Central banks broadly converge on using AI to enhance decision-making, operational efficiency, and risk management, though they differ in the specific AI initiatives adopted.

|

Microfinance and Financial Inclusion

- India's microfinance sector serves women (95%) and rural borrowers (80%), filling longstanding credit gaps in underserved regions.

- As of March 2025, loan outstanding is led by NBFC-MFIs (39%), followed by banks (32%), small finance banks (16%), and NBFCs (12%).

- In microfinance sector, active borrowers nearly doubled from 330 lakh (FY14) to 627 lakh (FY25).

- In FY 25, microfinance sector experienced a reversal in growth in FY25, with loan outstanding declining by 14% on a YoY basis.

- Operational challenges faced by Microfinance Institutions (MFIs)

- Limited availability of a primary and standardised approach to assess household income. In absence of alternative cash flow information, household income assessment may not always be fully accurate.

- Little visibility over certain types of loans, such as gold loans, agricultural loans, and cooperative society credit.

- Lack of risk-based differentiated pricing, sometimes leading to aggressive or overlapping lending.

Financial inclusion – trends and structural drivers

- Number of adults possessing a bank account: It doubled between 2011 (35%) and 2021 (89%) and sharp reductions in financial access gap across income and gender over the past decade.

- This is driven by digital regulatory innovations and government-led microfinance initiatives.

- Government-led microfinance initiatives

- Pradhan Mantri Jan Dhan Yojana (PMJDY), launched in 2014, has opened 55.02 crore accounts as of March 2025, with 36.63 crore in rural and semi-urban areas, establishing foundational savings and transaction infrastructure for previously unbanked populations.

- Stand-Up India Scheme offers bank loans ranging from ₹10 lakh to ₹1 crore to SC, ST, and women entrepreneurs for establishing Greenfield enterprises.

- PM Street Vendor's Aatmanirbhar Nidhi (PM SVANidhi) scheme provides collateral-free working capital loans to street vendors.

- Pradhan Mantri Mudra Yojana (PMMY) is financing micro and small enterprises in manufacturing, trading, services, and allied agricultural activities. By October 2025, the scheme had disbursed over ₹36.18 lakh crore across 55.45 crore loan accounts.

- Digital Regulatory innovations

- Account Aggregator framework, a key DPI pillar, supplies lenders with verified data like bank transactions and GST records, enabling lending to underserved and first-time credit users.

- DPI payment interfaces, such as UPI, provide transaction data to assess creditworthiness.

- RBI's Financial Inclusion (FI) Index captures data on 97 indicators related to banking, investments, insurance, postal, and pension sectors across three dimensions i.e. access, usage, and quality.

- These dimensions are represented through three sub-indices, viz., FI-access, FI-usage, and FI-quality.

Can payment infrastructure improve overall financial deepening?

|

Performance of the Insolvency and Bankruptcy Code (IBC)

- IBC has contributed to improved credit discipline, a reduction in banking sector NPAs, and greater predictability in insolvency outcomes.

- Bankruptcy system faces major delays due to institutional constraints despite reforms under IBC Code.

- Despite Corporate Insolvency Resolution Process (CIRP) timeline of 330 days, insolvency cases take an average 713 days overall and 853 days for those closed in FY25—exceeding statutory limit by over 150%.

- National Company Law Tribunal (NCLT) holds pendency of nearly 30,600 cases (as of March 2025) with an estimated clearance time of nearly 10 years at current disposal rates.

- This triggers value erosion - assets deteriorate, employees depart, customers shift to competitors, and supplier relationships break down.

- Pre-Packaged Insolvency Resolution Process (PPIRP) introduced in 2021 to enable faster and cheaper resolutions.

- However, PPRIP has seen only 14 admissions in four years due to procedural complexity, limited awareness among MSMEs and lenders, trust deficits in debtor-led processes, and funding constraints faced by small enterprises.

Development in the capital markets

- India's equity markets showed measured resilience, supported by favourable macroeconomic conditions, policy support, and strong domestic investor participation.

- India's primary markets continued to attract both domestic and international investors, reinforcing the country's position as a key driver of global capital formation.

- India leading in Initial Public Offers (IPOs) issuances (IPO volumes in FY26 (up to December 2025) were 20% higher than FY25).

- As capital market activity expands, strong regulatory governance becomes crucial, with Securities Markets Code, 2025 marking a key step in consolidating and strengthening securities regulation.

- Securities Markets Code (SMC), 2025 (announced in the Union Budget 2021-22) repeals and replaces the Securities Contracts (Regulation) Act, 1956, SEBI Act, 1992, and Depositories Act, 1996 through key provisions like:

- Rule-making: SEBI's wide-ranging quasi-legislative, executive, and quasi-judicial powers, the SMC seeks to make rule-making transparent, consultative, and accountable.

- Adjudication: Historically, SEBI's interim orders lingered for years, effectively penalising individuals longer than warranted. The SMC caps the validity of interim orders at 180 days, extendable only by reasoned decisions of designated board members, with a maximum limit of two years.

- Board Composition: SEBI board currently comprises nine members; however, under SMC, the number of members appointed by the central government increases to 15, with at least five full-time members.

- Independence: The Code safeguards SEBI's autonomy over rulemaking, inspections, and enforcement, free from executive interference.

- Market Infrastructure Institutions (MIIs): For the first time, the Code brings MIIs, stock exchanges, clearing corporations, depositories, onto a clear statutory footing, formally recognising them as entities performing vital public functions.

- Securities Markets Code (SMC), 2025 (announced in the Union Budget 2021-22) repeals and replaces the Securities Contracts (Regulation) Act, 1956, SEBI Act, 1992, and Depositories Act, 1996 through key provisions like:

Broadening retail participation in capital markets

- Retail participation has surged post-pandemic via both direct (trading in markets through their demat accounts) and indirect (mutual funds) channels.

- During FY26 (till December 2025), 235 lakh demat accounts were added, taking the total beyond 21.6 crore.

- Mutual fund industry expanded, with 5.9 crore unique investors as of the end of December 2025, of which 3.5 crore (as of November 2025) were from non-tier-I and tier-II cities.

SEBI's recent initiatives: Advancing regulatory excellence, market growth, and investor protectionInvestor protection and empowerment

Strengthening the bond market and expanding access

Strengthening the regulatory framework and improving operational efficiency

Fostering market development and improving product depth

Measures to strengthen equity derivatives markets

|

Debt market

- India's corporate bond market expanded rapidly (growing with an annual rate of about 12%).

- As of March 2025, corporate bond market accounted for about 15–16% of GDP, complementing bank credit, reflecting rising investor confidence and a gradual shift towards market-based financing.

- Despite progress, India's corporate bond market remains underdeveloped compared to global peers (79% of GDP in South Korea, 54% in Malaysia, and 38% in China).

- In FY26, debt market accounted for over 63% of total resource mobilisation from primary market in April-December 2025.

- Major issuers in corporate debt market include Public Sector Undertakings, Public Financial Institutions, and banks.

- Constraints in corporate bond market's growth and development

- Regulatory overlaps among SEBI, RBI and Ministry of Corporate Affairs (MCA),

- Stringent disclosure norms that discourage lower-rated issuers,

- Restrictive investment mandates confining institutional investors to high-grade securities,

- Weak risk-management infrastructure.

- Poor debt recovery mechanisms, high transaction costs, and tax asymmetries, which reduces investor interest and restrict long-term capital flows.

- Reforms undertaken by regulatory authorities to develop bond market

- SEBI's Request for Quote platform strengthens governance standards for credit rating agencies.

- RBI's strengthening of settlement systems through tri-party repos and credit default swap guidelines.

- Government support for InvITs and REITs.

- Coordinated reforms such as streamlining inter-agency alignment, establishing single-window systems for issuers, faster insolvency resolution, upgraded market infrastructure etc.

Foreign Portfolio Investment (FPI)

- India's FPI trends in FY26 are unstable.

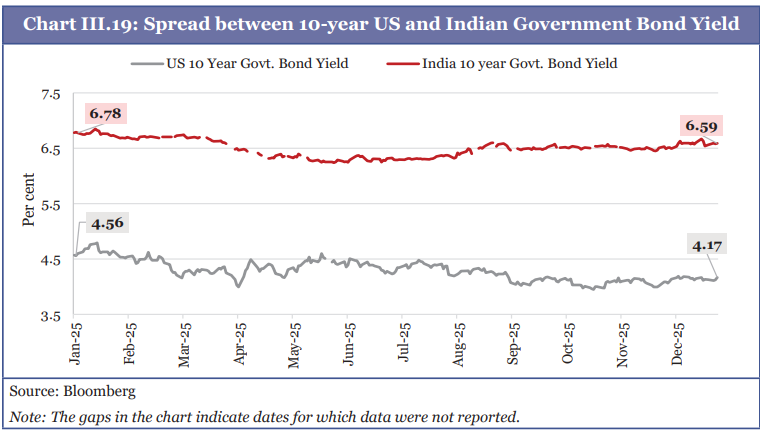

- Overall, FPIs were net sellers of Indian securities from April to December 2025. This is driven by global risk aversion, high U.S bond yields, rupee depreciation, and trade and policy uncertainties.

- India–U.S. 10 Year bond yield spread narrowed in May 2025 amid a stronger US dollar and falling Indian yields.

- By end-2025, rising Indian yields and a weaker dollar widened the yield spread, thus improving the attractiveness of Indian bonds.

- Along with SEBI's easing of FPI norms and ongoing India–US trade talks, the outlook for FPI inflows into India's debt market remains positive.

Domestic Institutional Investors: Counterbalancing FPIs

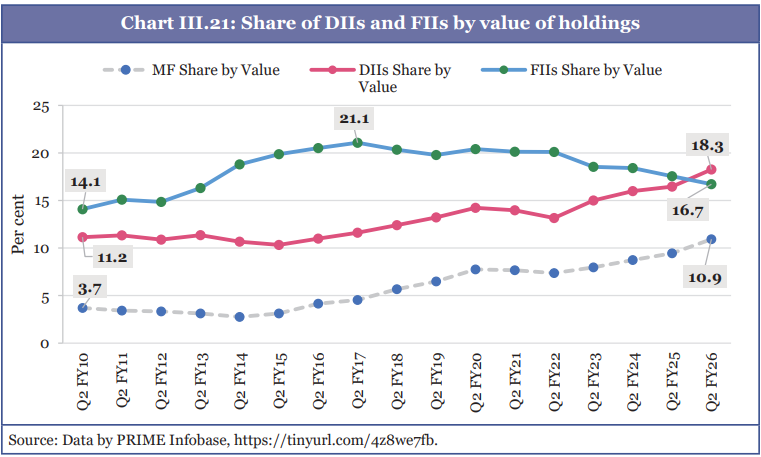

- Domestic Institutional Investors (DIIs) — particularly mutual funds and insurance companies—have counterbalanced volatility of foreign investment outflows and supported market stability.

- As of September 2025, DIIs held 18.7% of NSE-listed equities.

- Share of DIIs (by value of holdings) stands at 18.3% while that of the FIIs stands at 16.7%, a 13-year low.

- Domestic Mutual Funds (MFs) have significantly contributed to the trend of share of DIIs surpassing that of FIIs.

- DIIs include domestic MFs, Insurance Companies, Banks, Financial Institutions, Pension Funds, NBFCs, Domestic Sovereign Wealth Funds (SWFs), Asset Reconstruction Companies (ARCs), etc.

- Foreign Institutional Investors (FII) includes FPIs, FDI, Foreign SWFs and ownership through Depositary Receipts (DRs) held by custodians.

GIFT City

- International Financial Services Centres Authority (IFSCA), established in April 2020 under IFSCA Act 2019, serves as GIFT City's unified regulator with a mandate to develop and regulate financial products, services, and institutions within the IFSCs.

- Within a year, GIFT City has moved up nine places in Global Financial Centres Index (GFCI), reaching a rank of 43 out of 120 financial centres. Within the fintech specific ranking, GIFT City improved by ten places.

- Two Australian universities have established operational International Branch Campuses in GIFT IFSC, offering master's programs in business analytics, cybersecurity, fintech, and computing.

- Two UK universities have received in-principle approvals to establish similar campuses.

- Sri Lanka's DFCC Bank listed Sri Lankan Rupee 2.5 billion in green bonds on NSE International Exchange—first listing by a foreign corporation on a GIFT IFSC exchange, signalling centre's emergence as a regional capital-raising hub.

Performance of the pensions sector

- Between 2021 and 2036,

- Proportion of old-age population (60+) in total population is expected to increase from 10.1% to 14.9%.

- Proportion of working-age population (15-59) is projected to increase marginally from 64.2% to 64.9%.

- India's pension landscape dominated by-

- Market-linked National Pension System (NPS): Caters central and state government employees, private sector workers, corporate entities, minors under NPS Vatsalya and individuals from unorganised sector.

- Government-backed Unified Pension Scheme (UPS) launched in 2025.

- Other schemes like Employees' Provident Fund (EPF) and Atal Pension Yojana (APY) for broader coverage. Since 2016, APY subscriptions have grown at CAGR of 43.7%.

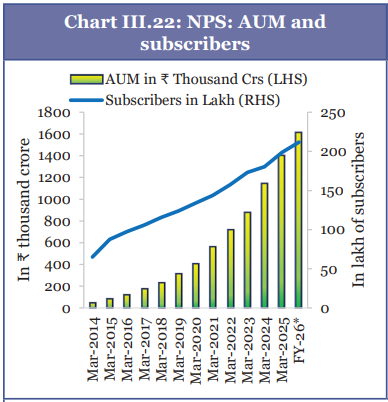

- From FY15 to FY25, NPS subscribers have grown at a CAGR of 9.5%, and assets under management (AUM) have rapidly increased at a CAGR of 37.3%.

- PFRDA is partnering with Farmer-Producer Organisations (FPOs) and MSMEs to bring pension coverage to more workers in agriculture sector, including farmers, FPO members, and participants of self-help groups.

- India's pension system has expanded steadily, yet overall coverage remains modest relative to the size of workforce.

- Challenges in pension sector

- Persistent awareness gaps prevail, with low-income and rural households maintaining limited exposure to long-term retirement products.

- Widespread informality remains main barrier to pension inclusion, as households with irregular incomes struggle to commit to long-term, locked-in savings.

- Way forward for India's Pension Ecosystem-

- Simplifying enrolment through Aadhaar-based authentication, enabling frictionless micro-contributions via digital payments, and synchronising pension outreach with broader financial inclusion drives can deepen penetration.

- Expanding interoperability across NPS, APY and other schemes will support seamless portability as workers shift sectors or migrate.

Performance of the Insurance Sector

- India's insurance sector is scaling up under "Insurance for All by 2047" vision led by Insurance Regulatory and Development Authority of India.

- Total premium income rose to ₹11.9 lakh crore in FY25.

- Life insurance segment dominates the insurance landscape. Health insurance has overtaken motor insurance as the leading business in non-life insurance segment.

- Despite strong growth and wider distribution (83 lakh+ agents/sales persons/partners) in FY25, insurance penetration remains low- leaving households and MSMEs uninsured- amid rising health, climate and cyber risks.

- Introduction of GST exemption on life and individual health insurance policies from September 2025 insurance services more affordable.

- Enactment of Sabka Bima Sabki Raksha (Amendment of Insurance Laws) Act, 2025 (FDI limit raised to 100%) address the protection gap for individuals and businesses.

- Act promotes ease of doing business, and ensures uninterrupted service and support to policyholders. For this, one-time registration of insurance intermediaries has been provided.

- Amendment provides for creation of a Policyholders' Education and Protection Fund, to increase citizens' awareness towards risk protection and promote education for policyholders.

- It aligns with Digital Personal Data Protection Act 2023 by creating a legal anchor for effective use of DPI in insurance sector to ensure that policyholders' information is duly secured and protected.

- Two social security schemes in the insurance sector i.e. Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) and Pradhan Mantri Suraksha Bima Yojana (PMSBY) offered by public sector insurers and other insurers for creating a universal social security system for all Indians, especially under-privileged.

Structural Challenges: High operating costs

- Rising acquisition and administrative costs, driven by reliance on costly intermediary networks, have pushed up operating expenses across life and non-life insurance, limiting the benefits of digitalisation.

- While insurance density has risen steadily to USD 97 in FY25, insurance penetration has stagnated and declined to 3.7%, indicating revenue deepening from existing customers without wider coverage.

- High acquisition costs poses risk to insurers' financial strength, with private life insurers facing stagnant profits despite strong growth and non-life insurers relying heavily on investment income.

- Rationalising these costs would improve pricing efficiency, affordability, and customer value.

- Digitising distribution and rationalising acquisition costs is critical to increase value to customers, making products and prices more affordable.

Conclusion

- Amid rising global uncertainty and rapid technological change, India has strengthened its regulatory framework, through RBI's May 2025 regulation-making framework that emphasises transparency, stakeholder consultation, and periodic review, marking a shift towards proactive and forward-looking governance.

- Insurance and pension regulators—IRDAI and PFRDA—have advanced reforms to expand financial inclusion and social protection.

- IRDAI's shift to a principle-based, consolidated regulatory framework and insurance law amendments reduces compliance burdens; promote digitisation of insurance ecosystem, and provide insurers with flexibility to innovate.

- Meanwhile, PFRDA has broadened pension access for informal workers through initiatives such as NPS e-Shramik and partnerships with MSMEs, FPOs, and self-help groups.

- India's financial sector regulators must balance growth with stability, manage exposure to volatile global capital flows, and apply differentiated supervision to address risks across India's diverse and heterogeneous financial landscape.

What does the Budget say?

- Mutual Funds/Dividends: No deduction will be allowed for interest expenditure incurred in relation to dividend or mutual fund income.

- Government to setup a "High Level Committee on Banking for Viksit Bharat", to comprehensively review the sector and safeguarding financial stability, inclusion and consumer protection.

- Government to restructure the Power Finance Corporation and Rural Electrification Corporation to achieve scale and improve efficiency in the Public Sector NBFCs.

- A comprehensive review of the Foreign Exchange Management (Non-debt Instruments) Rules is proposed, to create a more contemporary, user-friendly framework for foreign investments, consistent with India's evolving economic priorities.

- To enhance liquidity and accessibility, the government proposes introducing a market-making framework with access to funds.

- Additionally, they plan to introduce derivatives on corporate bond indices and total return swaps on corporate bonds.

- Budget focuses heavily on maximizing the potential of the TReDS (Trade Receivables Discounting System) platform. Four specific measures are proposed to enhance this mechanism:

- Mandatory TReDS Use: All CPSE purchases from MSMEs to be settled via TReDS, setting a benchmark for other corporates.

- Credit Guarantee Support: CGTMSE to provide guarantees for invoice discounting on TReDS, reducing lender risk.

- GeM–TReDS Integration: Linking GeM with TReDS to share government purchase data with financiers, enabling faster and cheaper MSME credit.

- Secondary Market Development: Introduction of TReDS receivables as asset-backed securities to boost liquidity.

Glossary

Terms | Meanings |

| Capital to-risk-weighted-asset ratio (CRAR) | CRAR is the ratio of a bank's capital in relation to its risk weighted assets and current liabilities. |

| Money Multiplier | The money multiplier describes how much the money supply can increase given the amount of reserves held by banks. |

| Standing Deposit Facility (SDF) | Financial tool that allows banks to deposit excess liquidity with the RBI without any security or collateral. |

| Broad Money | Overall supply of money in the economy, including various forms of liquid assets held by the public. |

| Liquidity Adjustment Facility (LAF) | LAF refers to the Reserve Bank's operations through which it injects/absorbs liquidity into/from banking system. |

| Marginal Standing Facility (MSF) | MSF is a window for banks to borrow from RBI in emergency situation when inter-bank liquidity dries up completely. |

| Scheduled Commercial Banks (SCBs) | SCB is a commercial bank which has been included in the Second Schedule of the Reserve Bank of India Act, 1934 (RBI Act). |

| Initial Public Offers (IPOs) | IPO is the selling of securities to the public in the primary market. |

| Insurance penetration | Percentage of insurance premiums paid in a country relative to its gross domestic product (GDP). |

| Insurance density | Ratio of insurance premiums collected in a country to its population. |