Introduction

- Infrastructure-Led Growth Strategy: Infrastructure investment has become central to India's growth model, with sustained focus on public capital expenditure, integrated planning, and modern logistics.

![]](https://d2av8kbir6lh9m.cloudfront.net/uploads/UXhBxwECP2EQxF6YVqT3TIuoMxtziFd44WnN5IkQ.png)

- Expansion beyond Traditional Infrastructure: Alongside highways, railways, ports, and energy systems, India has expanded digital public infrastructure, data systems, and renewable assets to improve efficiency and connectivity.

- Surge in Public Capital Expenditure: The Government of India's capital outlay rose by nearly 89%, from ₹5.92 lakh crore in FY22 to ₹11.21 lakh crore in FY26, reflecting the strong multiplier impact of infrastructure investment.

- High Multiplier Impact on GDP: Infrastructure spending generates strong economic returns, with each rupee yielding ₹2.5–₹3.5 in GDP over the medium term.

- Institutional and Planning Reforms: PM GatiShakti has strengthened multimodal, GIS-based planning, while wider access to geospatial data supports better private investment decisions.

- Improving Logistics Efficiency: The National Logistics Policy, ULIP, and LEADS framework are enhancing predictability, digitisation, and competitiveness in logistics.

- Role of Digital Public Infrastructure: Platforms like BharatNet, 5G, UPI, Aadhaar, DigiYatra, and FASTag form the digital backbone for inclusive and efficient infrastructure services.

Chapter Precap

Public Investment & Planning

| Transport & Logistics Infrastructure

|

Energy & Digital Infrastructure

| Water, Space & Emerging Sectors

|

Financing: The Shift from Banks to Markets

- Rise of NBFCs: Credit from NBFCs to the commercial sector grew at a CAGR of 43.3% (FY20–FY25), significantly outpacing bank credit.

- Asset Monetisation (InvITs & REITs): These instruments are mobilizing long-term institutional capital.

- New Reform: SEBI introduced Small and Medium REITs (SM REITs) with a minimum asset size of ₹50 crore (down from ₹500 crore) to allow participation in smaller real estate assets.

Public-Private Partnerships

- Role in Infrastructure Development: PPPs enable the government to leverage private sector expertise and resources to bridge infrastructure gaps and improve service delivery.

- Diverse PPP Models in India: India's infrastructure programmes support multiple PPP models, including Build-Operate-Transfer (BOT), Design-Build-Finance-Operate-Transfer (DBFOT), Hybrid Annuity Model (HAM), and Toll-Operate-Transfer (TOT).

- Strong Global Position in Private Investment: According to the World Bank's Private Participation in Infrastructure (PPI) Report 2024, India consistently ranks among the top five countries globally in private infrastructure investment among low- and middle-income economies.

PPPs – Strengthening the Partnership Paradigm

|

Core Physical Infrastructure

Roadways & Highways

- Expansion of National Highway Network: NH network increased by about 60% from 91,287 km in FY14 to 1,46,572 km by December 2025.

- Growth of High-Speed Corridors: High-speed corridors expanded nearly tenfold, from 550 km in 2014 to 5,364 km by December 2025, with a long-term target of 26,000 km by FY33.

- Rising Capital Investment: Capital expenditure on roads and highways increased nearly six times, from ₹0.53 lakh crore in FY15 to ₹3.06 lakh crore in FY26 (BE).

- Strengthening Rural Connectivity (PMGSY): PMGSY has connected over 99.7% of eligible rural habitations by December 2025, ensuring near-universal rural road access.

Railways

- Electrification: Electrification reached 99.1 per cent of the network by October 2025.

- Investment: Capital expenditure increased to ₹2.65 lakh crore in FY26 (BE) compared to an average of ₹0.99 lakh crore during 2014-19.

- Dedicated Freight Corridors (DFCs): About 96.4% network has been commissioned by October 2025, with the Eastern DFC fully completed and most of the Western DFC operational

- Safety and Technology Upgradation: Large-scale deployment of Kavach, electronic interlocking, automatic signalling, and track renewal is enhancing safety and network efficiency.

- Track Upgradation: Over 78% of railway tracks have been upgraded for sectional speeds of 110 kmph and above.

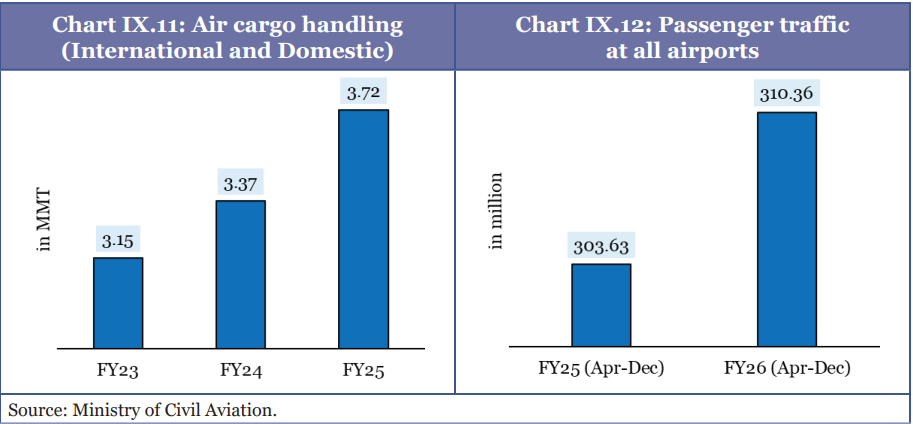

Civil Aviation

- Rapid Market Expansion: India has emerged as the world's third-largest domestic aviation market, with the number of airports rising from 74 in 2014 to 164 in 2025.

- Regional Connectivity through UDAN: Under RCS-UDAN, 657 routes connecting 93 airports have been operationalised, improving access to remote and aspirational regions.

- Expansion of Greenfield Airports: 24 Greenfield airports have received in-principle approval, with 13 already operational, strengthening regional and urban capacity.

- Supportive Legislative Framework: Bharatiya Vayuyan Vidheyak, 2024 and the Protection of Interests in Aircraft Objects Act, 2025 aim to improve safety, innovation, and leasing conditions.

- Low Airport Density and Growth Potential: With only 0.11 airports per million people, India has significant scope for infrastructure expansion compared to global benchmarks.

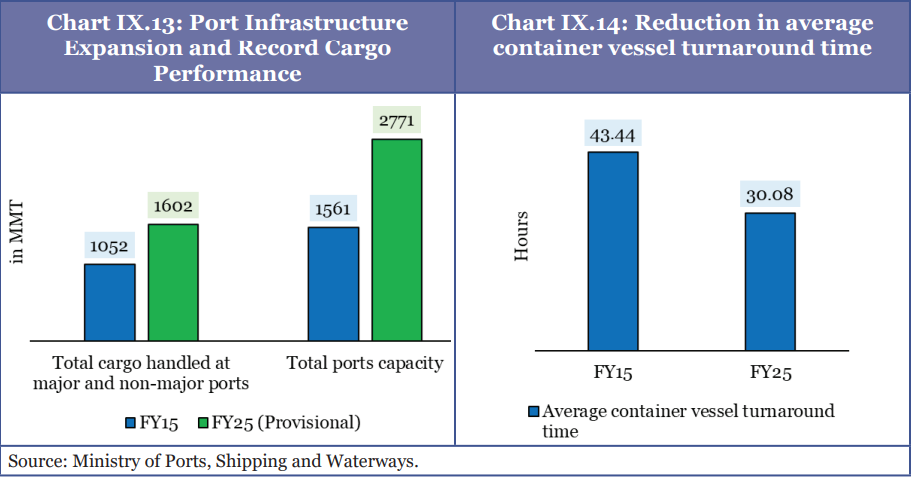

Ports and Shipping

- Port Infrastructure Expansion and Efficiency: Between FY15 and FY25, cargo handling rose from 1,052 MMT to 1,602 MMT and vessel turnaround time fell from 43.44 to 30.08 hours

- Global Competitiveness and Rankings: India's performance has improved globally, with two ports among the top 30 and seven among the top 100 in the World Bank's Container Port Performance Index 2024.

- Expansion of PPP Projects: PPP projects increased from 37 in FY15 to 87 in FY25, with project value rising by 377%.

- Growing Role of Private Operators: By 2030, PPP and captive operators are expected to handle about 80% of cargo at major ports.

- Comprehensive Legislative Reforms: Merchant Shipping Act, 2025; Coastal Shipping Act, 2025; Indian Ports Act, 2025; Bills of Lading Act, 2025; Carriage of Goods by Sea Act, 2025 etc.

Inland Water Transport

- Expansion of National Waterways Network: As of November 2025, 32 National Waterways covering 5,155 km are operational.

- Sharp Rise in Cargo and Passenger Movement: Cargo traffic increased from 18 MMT in 2013–14 to 146 MMT in 2024–25, while passenger movement rose to 7.6 crore in 2024–25.

- Growth of River Cruise Tourism: Cruise vessels increased from 3 to 25 between 2013–14 and 2024–25

- Future Outlook: India aims to raise IWT's modal share from 2% to 5% and increase cargo to over 200 MMT by 2030 and 500 MMT by 2047.

Energy Sector

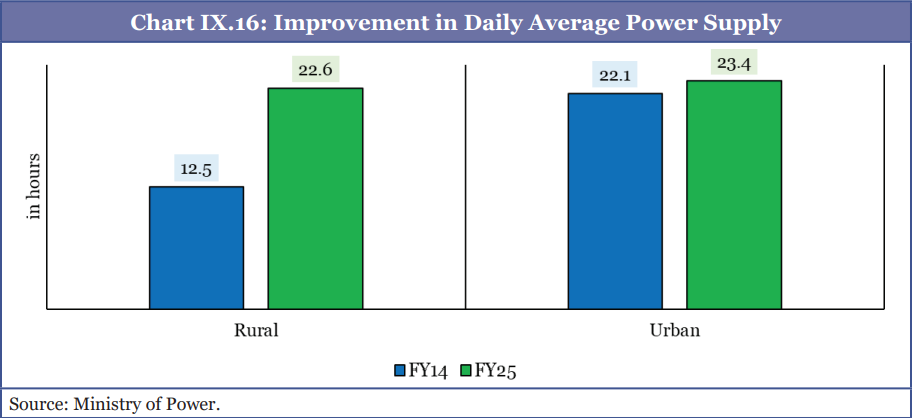

Power Sector

- Rising Installed Capacity: Installed power capacity increased by 11.6% year-on-year to 509.74 GW by November 2025, reflecting steady sector expansion.

- Strengthening Distribution Infrastructure: Schemes such as Deen Dayal Upadhyaya Gram Jyoti Yojana (DDUGJY), Integrated Power Development Scheme (IPDS), SAUBHAGYA and Revamped Distribution Sector Scheme RDSS have improved household electrification and rural supply

- Improved Power Availability: The demand–supply gap declined from 4.2% in FY14 to zero by November 2025 ensuring reliable electricity supply.

- Reduction in Technical and Commercial Losses: AT&C losses declined from 22.62% in FY14 to 15.04% in FY25 indicating better operational efficiency.

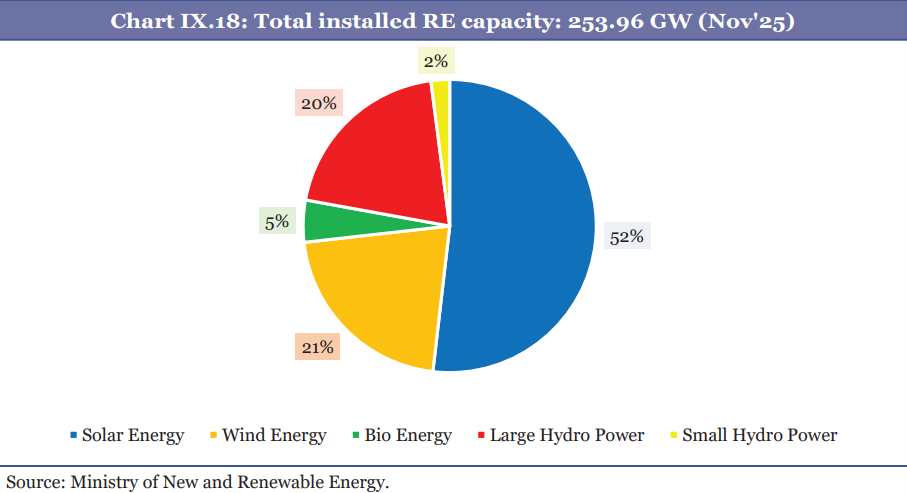

Renewable Energy

- Rising Share in Installed Capacity: Renewable energy accounts for about 49.83% of total installed power capacity as of November 2025

- Strong Global Position: India ranks third globally in overall renewable and solar capacity and fourth in wind capacity, indicating a strong international presence.

- Dominance of Solar and Wind Energy: Solar and wind together form the largest share of renewable capacity, supported by bio-energy and hydro power.

- Key Challenges: High capital costs, land acquisition issues, and grid constraints remain major obstacles to faster expansion.

Key Concept: India Energy Stack (IES)

|

Future-Ready Digital Infrastructure

Telecommunications

- Four Core Principles of Telecom Ecosystem: India's telecom development is guided by: Samaveshit, ensuring universal connectivity for inclusive growth; Viksit, promoting a developed India through performance, reform, and transformation; Tvarit, enabling faster development and swift decision-making; and Surakshit, ensuring a safe and secure digital environment.

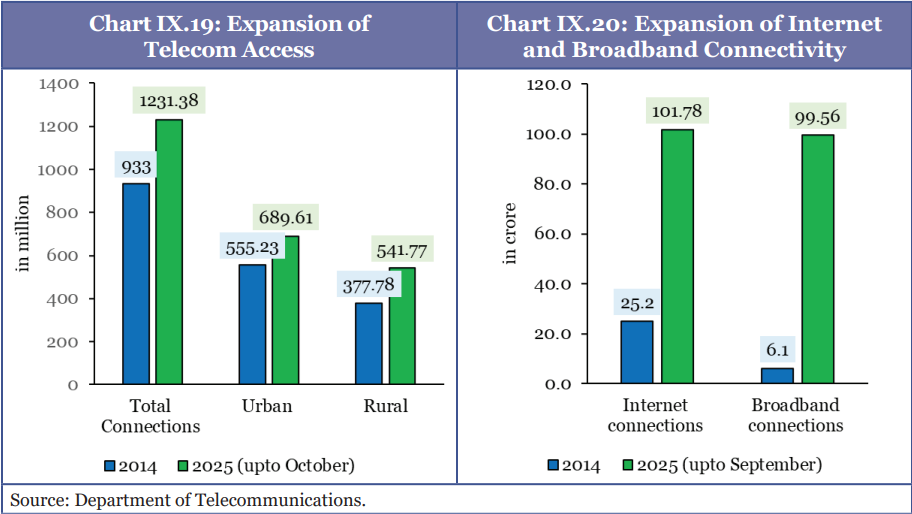

- Improved Connectivity and Teledensity: Teledensity increased from 75.23% to 86.76%, with faster growth in rural connections narrowing the digital divide.

- Expansion of Internet and Broadband Connectivity: Between 2014 and September 2025, internet connections rose from 25.2 crore to 101.78 crore, and broadband connections increased from 6.1 crore to 99.56 crore, indicating rapid expansion in digital access.

- Nationwide 5G Deployment: 5G services cover 99.9% of districts

- Enhanced Cybersecurity and Fraud Prevention: Platforms like Sanchar Saathi and ASTR have strengthened telecom security and reduced financial fraud.

Information Technology

- Growth of Data Centre Infrastructure: India's data centre capacity reached about 1,280 MW by June 2025 and is projected to rise to around 4 GW by 2030.

- Private-Led Digital Ecosystem: The sector is largely private-driven, supported by Make in India and Atmanirbhar Bharat initiatives.

- Support for Emerging Technologies: Rising data centre capacity is enabling cloud computing, AI, IoT, and 5G-based applications.

- Government Cloud Platform (MeghRaj): The GI Cloud (MeghRaj) provides secure and scalable ICT services for government departments, supporting e-governance.

Water Resources Management

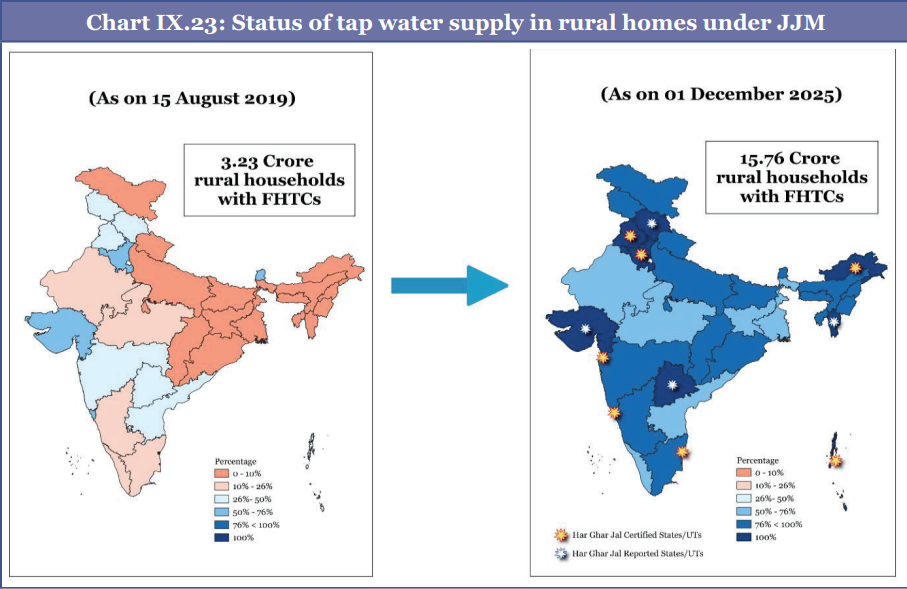

- Jal Jeevan Mission (Har Ghar Jal): Over 81% of rural households have access to tap water, with more than 15.76 crore homes connected by December 2025.

- Namami Gange Programme: Focused on ensuring clean and continuous flow of the Ganga, restoring biodiversity, and promoting sustainable water governance.

- Gangetic Dolphin population increased from about 3,500 (2015) to 6,327 (2021–23)

- Advanced Flood Forecasting: The C-Flood platform provides village-level flood forecasts for major river basins.

- River-Sensitive Urban Planning: The River Cities Alliance has expanded to 145 cities, promoting sustainable urban river management.

Space Sector

- Strong Satellite Infrastructure: India operates 56 active space assets including communication, navigation, scientific, earth observation and technology demonstration satellites.

- Growing Start-up Ecosystem: Over 300 space start-ups are contributing to innovation across space technologies and services.

- Liberalised Investment Policy: FDI has been liberalised up to 100% in non-sensitive segments, encouraging global investment.

- Strengthening Launch Infrastructure:A new launch pad and integration facility at Kulasekarapattinam is under development.

- Long-Term Space Vision 2047: India aims to establish the Bharatiya Antariksh Station by 2035 and undertake a manned lunar mission by 2040.

- Major Upcoming Missions: Key projects include Gaganyaan follow-on, Chandrayaan-4 and Chandrayaan-5/LUPEX, Venus Orbiter Mission and the Next Generation Launch Vehicle.

Conclusion

- Shift towards Scale, Integration, and Quality: India's infrastructure strategy now emphasises large-scale, integrated, and high-quality development, supported by sustained public capital expenditure.

- Efficiency Gains across Sectors: Coordinated investments in transport, energy, digital, and rural infrastructure have improved travel times, freight movement, logistics performance, and service delivery.

- Strengthened Planning and Financing Framework: PM GatiShakti, along with reforms in financing, asset monetisation, and PPPs, has enhanced project preparation, execution, and private investment participation.

- Improved Connectivity and Market Access: Better transport and multimodal integration have reduced transaction costs, expanded market access, and strengthened regional and global value chain participation.

- Broadening of Infrastructure Scope: Infrastructure now includes digital systems, clean energy, water management, and advanced technologies, boosting productivity and sustainability.

- Focus on Future Priorities: Alignment with decarbonisation, digitalisation, and resilience is becoming central to infrastructure planning.

- Infrastructure as a Growth Pillar: Sustained investment and deeper private participation position infrastructure as a key driver of medium-term growth and long-term development under Viksit Bharat @2047.

What does the Budget Say?

- Infrastructure Investment Push: Public capital expenditure is proposed to increase to ₹12.2 lakh crore for FY2026-27 to sustain growth momentum.

- Risk Mitigation for Developers: An Infrastructure Risk Guarantee Fund will be established to provide prudently calibrated partial credit guarantees to lenders, strengthening confidence during the development and construction phases.

- Asset Monetization: To accelerate the recycling of assets, dedicated Real Estate Investment Trusts (REITs) will be set up for significant real estate assets belonging to Central Public Sector Enterprises (CPSEs).

- Logistics and Freight:

- Dedicated Freight Corridors (DFCs): New corridors will be established connecting Dankuni in the East to Surat in the West.

- Inland Waterways: 20 new National Waterways will be operationalized over the next 5 years, starting with NW-5 in Odisha to connect mineral-rich areas to ports.

- Coastal Cargo: A Coastal Cargo Promotion Scheme will be launched to incentivize a modal shift from rail/road to waterways, aiming to increase the share of inland waterways and coastal shipping to 12% by 2047.

- Urban Development: City Economic Regions (CER) will be mapped to amplify the economic potential of Tier II and Tier III cities, with an allocation of ₹5,000 crore per CER over 5 years for implementation.

- High-Speed Connectivity: Seven High-Speed Rail corridors will be developed as 'growth connectors' between major hubs, including Mumbai-Pune, Delhi-Varanasi, and Hyderabad-Bengaluru.

- Aviation and Tourism: A Seaplane VGF (Viability Gap Funding) Scheme and manufacturing incentives will be introduced to enhance last-mile connectivity and tourism.

- Digital Investment: To boost investment in digital infrastructure, a tax holiday until 2047 is proposed for foreign companies providing global cloud services using data centers located in India

Glossary

Terms | Meanings |

|---|---|

| Public Capital Expenditure (CAPEX) | Government spending on long-term assets such as roads, railways, power, and digital networks. |

| Public-Private Partnership (PPP) | Collaboration between government and private sector for infrastructure development and service delivery. |

| Dedicated Freight Corridor (DFC) | High-capacity railway corridors designed exclusively for freight movement. |

| AT&C Losses | Aggregate Technical and Commercial losses indicating inefficiency in power distribution. |

| Digital Public Infrastructure (DPI) | Public digital platforms such as UPI, Aadhaar, FASTag, and DigiYatra enabling service delivery. |

| Data Centre Infrastructure | Facilities that store and process digital data for cloud and IT services. |

| River Cities Alliance | A network promoting sustainable urban river management. |

| MeghRaj (GI Cloud) | Government cloud platform supporting digital governance. |

| Hybrid Annuity Model (HAM) | A PPP model where government and private players share project costs and risks. |

Mains Questions

1. "India's infrastructure strategy has evolved from asset creation to integrated, technology-driven development." Discuss this statement in the context of PM GatiShakti, digital public infrastructure, and rising public capital expenditure.

2. Examine the role of transport, energy, digital, and water infrastructure in enhancing India's competitiveness and achieving the goals of Viksit Bharat@2047. Highlight the challenges and policy responses.