Why in the news?

Recently, the Reserve Bank of India (RBI) has permitted the lending and borrowing of G-Securities (G-Secs) by issuing directions called RBI (Government Securities Lending) Directions, 2023.

More on news

- Government Securities Lending (GSL) refers to lending of eligible G-Secs, for a fee, by the owner (lender) to a borrower, on collateral of other G-Secs, for a specified period.

- Under GSL transaction, G-Secs issued by the Central government excluding Treasury Bills (T-Bills) shall be eligible for lending/borrowing.

- Also, G-sec issued by the Central Government including T-Bills and State Governments bonds shall be eligible for placing as collateral under GSL transaction.

- Other directions include

- Eligible Participants in GSL transactions as lenders of securities: Entities eligible to undertake Repo transactions and those approved by RBI.

- Tenure of GSL transaction: Minimum one day and maximum period prescribed to cover short sales.

- Permitting lending and borrowing of G-Secs will-

- Add depth and liquidity to the G-sec market, aiding efficient price discovery.

- Facilitate wider participation in the securities lending market by providing investors an avenue to deploy idle securities and enhance portfolio returns.

- Enhance operational efficiency of government bonds by insurers.

About G-Securities (G-Secs)

- G-Sec is a tradeable instrument issued by Central or State Governments. It acknowledges the government’s debt obligation.

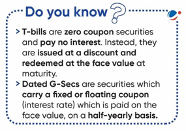

- Such securities are short-term terms usually called Treasury bills (T-Bills) with maturities of less than one year (91 days, 182 days, or 364 days) or long-term called Government bonds or dated securities with maturity of one year or more (between 5 years and 40 years).

- In India, Central Government issues both T bills and bonds or dated securities while State Governments issue only bonds or dated securities, which are called State Development Loans (SDLs).

- G-Secs carry practically no risk of default and, hence, are called risk-free gilt-edged instruments.

- Other G-Sec includes Cash Management Bills (CMBs), introduced in 2010, a new short-term instrument to meet temporary cash flow mismatches of the Government.

- CMBs have the generic character of T-bills but are issued for maturities of less than 91 days.

- G-Secs are issued through auctions conducted by RBI. Auctions are conducted on the electronic platform called the E-Kuber, the Core Banking Solution (CBS) platform of RBI.

Initiatives taken for Government -Securities (G-Secs)

|

What are the concerns associated with government securities?

- Captive investor base: A diversified investor base for fixed-income securities is important for ensuring high liquidity and stable demand in the market. However, currently, a large portion of G-Secs are held by captive investors such as banks, and insurance companies.

- Operational challenges: RBI’s Negotiated Dealing System Order Matching (NDS-OM) platform was not able to boost retail participation as it resulted in an artificial segmentation of investors in different securities.

- Exchange rate management: Inflows of foreign funds via government bonds can lead to rupee appreciation.

- Liquidity: The G-sec market lacks liquidity due to the non-availability of buyers for the security in the secondary market. It can lead to distressed sales (selling at a lower price than its holding cost) causing loss to sellers.

- Major risks associated with holding G-Secs:

- Market risk: Market risk arises out of adverse movement of prices of the securities due to changes in interest rates. This could lead to loss if securities are sold at adverse prices.

- Reinvestment risk: Cash flows on a G-Sec include a coupon every half year and repayment of principal at maturity, which needs to be reinvested. However, it poses a risk for investors as they may not be able to reinvest due to a decrease in prevailing interest rates.

- Interest rate risk: Dated securities have a long-term maturity of 5-40 years, and thus are exposed to interest rate risk, reducing their relevance over longer tenure.

What are the techniques for mitigating G-Secs risks?

|

Way forward

- Unified market: Unifying the G-Sec and corporate bond markets would enable the seamless transmission of pricing information from G-Secs to corporate bonds. Having the same regulatory regime for trade, clearance, and settlement of corporate bonds and G-Secs will result in economies of scale and scope, leading to greater competition, efficiency, and liquidity in markets.

- Trading: To facilitate greater investor participation and achieve ease of doing business, G-Secs should be issued and traded through the stock exchange mechanism.

- Investment: The government should issue G-Secs in demat so that demat holders (currently, more than 120 million and expanding) can easily invest in G-Secs. G-Sec-based exchange-traded funds should also be developed to increase retail participation.

- Transparent fiscal framework: Fiscal Responsibility and Budget Management (FRBM) legislation should highlight a fiscal path to investors highlighting the steps to reducing government debt in a transparent and accountable manner to boost investors’ confidence.

- Tax Incentives: Providing tax incentives in the form of no tax to be paid on interest income generated from the G-Sec can boost the demand for the G-sec in the market.

Related News State Government Guarantees (SGGs)

Recommendations by RBI Report

|