Alternative Investment Fund

RBI has issued revised guidelines capping investment by Regulated Entities at 20% of the corpus of an AIF scheme.

About Alternative Investment Fund (AIF)

- Any fund established or incorporated in India which is a privately pooled investment vehicle which collects funds from sophisticated investors, whether Indian or foreign, for investing it in accordance with a defined investment policy for the benefit of its investors.

- AIFs are regulated by the SEBI, as per the SEBI (Alternative Investment Funds) Regulations, 2012.

Categories of AIFs

- Category I AIF: Invest in start-ups, early-stage ventures or sectors considered socially or economically beneficial.

- E.g. Venture Capital Funds, Angel funds, SME Funds, Infrastructure Funds

- Category II AIF: They do not use leverage or debts other than to cover their day-to-day operational expenses.

- E.g. Private Equity Funds, Debt Funds, Real Estate Funds.

- Category III AIF: It may use leverage including through investment in listed or unlisted derivatives.

- E.g. Hedge Funds, Private investment in public equity (PIPE).

- Tags :

- Alternative Investment Fund

Digital Payments Index (DPI)

The Indian digital payment landscape has witnessed over 65,000 crore digital transactions amounting to more than Rs. 12,000 lakh crores in the last 6 Financial years.

About DPI

- RBI has developed the DPI (published Semi-annually) to measure the extent of digital payment adoption across India.

- DPI comprises these broad parameters: Payment Enablers; Payment Infrastructure – Demand-side factors & Supply-side-factors; Payment Performance; Consumer Centricity.

- The latest RBI-DPI indicates over fourfold growth in digital payment penetration since 2018.

- Tags :

- Digital Payments Index

Financial Conditions Index (FCI)

A study of RBI has proposed the construction of a FCI for India to track market trends with daily frequency.

About Financial Conditions Index (FCI)

- It assesses the degree of relatively tight or easy financial market conditions with reference to its historical average since 2012.

- The chosen indicators represent five market segments: money market, G-sec market, corporate bond market, forex market, and equity market.

- A higher positive value of the FCI indicates tighter financial conditions.

- Tags :

- Financial Conditions Index (FCI)

Global Findex 2025

The World Bank report titled ‘Global Findex 2025’ released reflecting achievements in digital and financial inclusion.

India specific Highlights

- India has account ownership at or close to 90 percent.

- 16 percent of account owners do not have an active account, the average for all other low- and middle-income economies is 4 percent.

- The share of both women and men with only inactive accounts decreased between 2021 and 2024.

- The primary barrier to mobile phone ownership is the cost of the device, and lack of reliable mobile network coverage.

- Tags :

- Global Findex 2025

Articles Sources

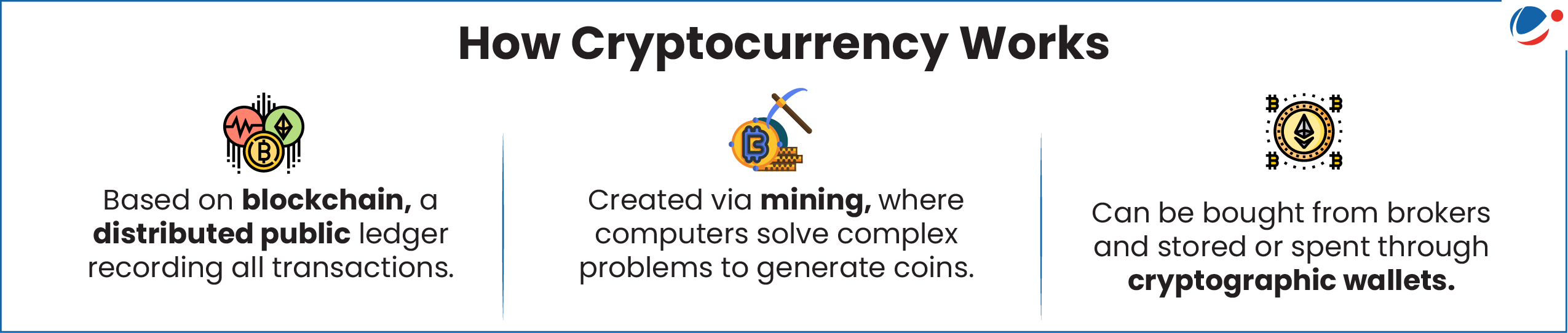

Stablecoins

GENIUS Act has been enacted in the US to establish a regulatory framework for stablecoins.

- Stablecoins are a type of cryptocurrency whose value is linked to that of another currency, commodity, or financial instrument. E.g., Tether (USDT), is pegged to the US dollar

- They have the potential to bring efficiencies to payments.

Why has the use of Stablecoins increased?

- Linked to an underlying asset: Due to this, they can maintain a steadier value, making them a more reliable medium of exchange than other volatile cryptocurrencies like bitcoins.

- Underlying assets are backed by an identifiable issuer, unlike many unbacked crypto assets.

- Issuers could be banks, nonbank financial entities, and large technology conglomerates.

- Regulation: Decisions for stablecoin arrangements are usually taken by a governance body.

Regulation of Cryptocurrency or Cyrpto Assets in India

- Currently, Crypto Assets are unregulated in India.

- However, Government, through the Finance Act, 2022, brought a comprehensive taxation regime for the transfer of Virtual Digital Assets (VDAs).

- It imposed a 30% tax on capital gains from VDAs.

- The Income Tax Act 1961 defines VDA as any information or code or number or token, generated through cryptographic means or otherwise; transferred, stored, or traded electronically. E.g. cryptocurrencies, Non-fungible token (NFT), etc.

- In 2023, VDAs were brought under the purview of the Prevention and Money-laundering Act, 2002.

- Tags :

- Stablecoins

Agricultural Outlook 2025-2034 Released by OECD-FAO

- Released By: OECD and FAO.

- Provides a comprehensive assessment of the ten-year prospects for agricultural commodities (Including fish) and their markets at national, regional, and global levels.

- Global Market Trends (2024) according to the report

- Biofuels: Its demand is projected to grow at 0.9% annually, led by India, Brazil and Indonesia.

- Cotton: Global use increased; India is set to overtake China as the top producer.

- Tags :

- Agricultural Outlook 2025-2034