Why in the News?

Rules for carbon trading under Article 6 of the Paris Agreement were finalized after a decade of negotiations.

About Article 6 of the Paris Agreement

- It details a set of tools and mechanisms of carbon market, that allows countries to voluntarily cooperate to achieve their Nationally Determined Contribution (NDC).

- It has 3 main mechanisms: 2 Market-based and 1 Non-market based.

Mechanisms under Article 6 | ||

Market based approaches | Non-Market based approach | |

Article 6.2 | Article 6.4 | Article 6.8 |

|

|

|

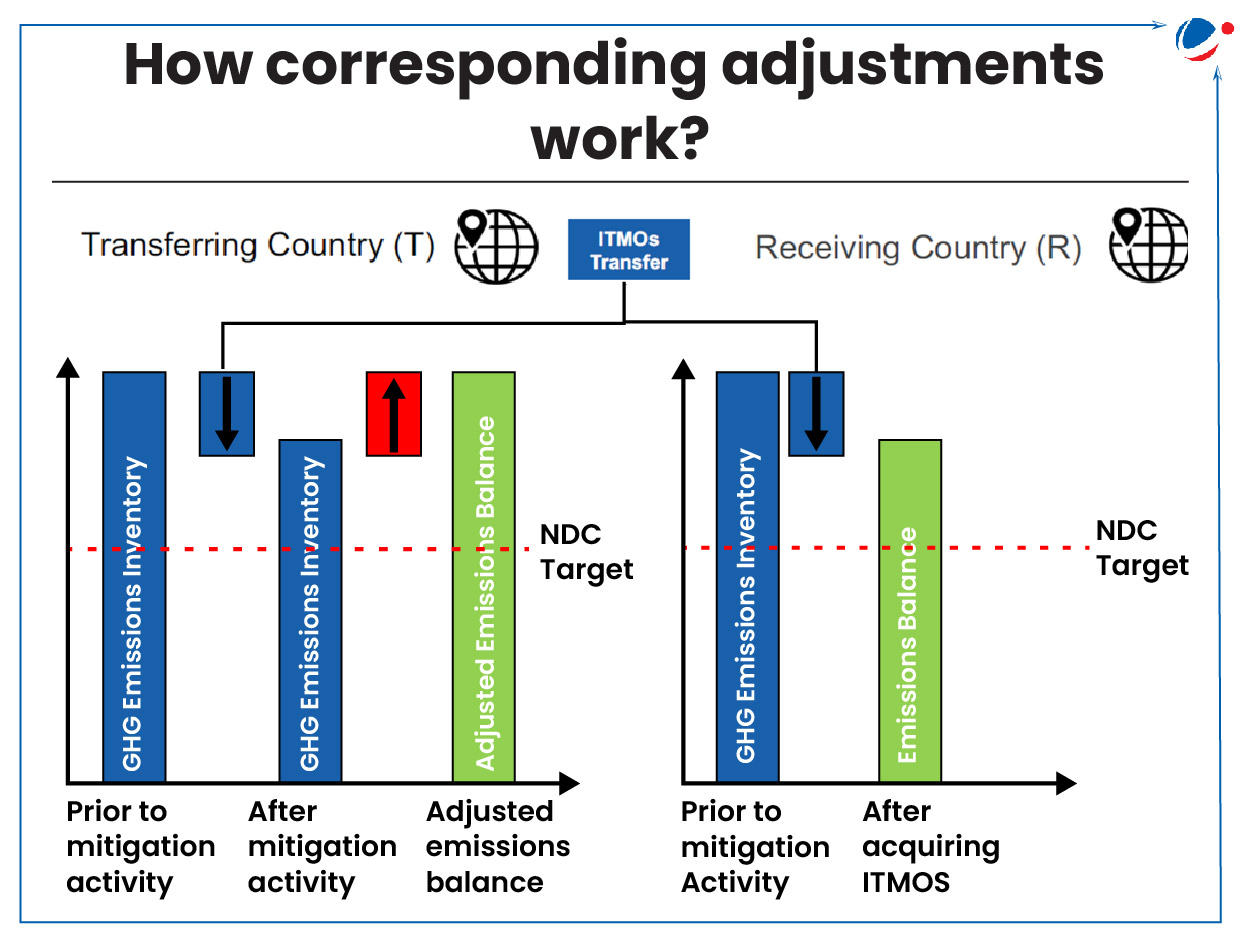

About Corresponding adjustment (Article 6.2)

|

About Carbon Market

- Carbon markets are trading systems where entities buy carbon credits to offset their greenhouse gas emissions by supporting projects that reduce or remove emissions.

- One tradable carbon credit generally equals one metric tonne of carbon dioxide or the equivalent amount of a different greenhouse gas reduced, sequestered or avoided.

Difference between Carbon trading of Kyoto Protocol and Paris Agreement | ||

Aspect | Kyoto Protocol | Paris Agreement (Article 6) |

Scope of Participation | Limited to developed countries (Annex I) with project hosting by developing countries. | Inclusive of all countries. |

Adaptation Funding | Share of proceeds from CDM projects directed to the Adaptation Fund. | 5% of proceeds from Article 6.4 transactions allocated to the Global Adaptation Fund. |

Market Scope |

| Combines market-based and non-market-based approaches. |

Legacy Credits | Allowed use of older credits from inactive projects, causing oversupply concerns. | Restricts legacy credit use; only post-2013 credits. |

Significance of Carbon trading

- Economic Efficiency: Carbon trading under Article 6 could cut costs for NDCs by over 50%, potentially saving $250 billion annually by 2030 (World Bank).

- Support developing Countries: in climate mitigation efforts by mobilizing significant financial resources.

- Potential for Broader Impact: Use of non-market approaches (Article 6.8), such as capacity-building platforms, enabling diverse pathways for sustainable development.

- Revenues for Governments: In 2023, carbon pricing revenues reached a record $104 billion (World Bank's State and Trends of Carbon Pricing 2024 report).

Issues related to carbon markets

- Double Counting: Countries under Article 6.2 are not strictly required to fix or avoid inconsistencies in their emission reduction calculations, creating potential for counting of same emissions reduction by more than one country.

- Limited coverage and scope: Only 24% of global emissions are covered under carbon taxes and Emission Trading Systems (ETS). (World bank)

- Inadequate Quantification Standards: The draft rules of Article 6 do not require countries to monitor reversals, such as CO₂ escaping from failed sequestration projects.

- Delayed Operationalization: E.g., Article 6.4 is unlikely to become operational until 2025-2026.

- Carbon Colonialism: Indigenous rights and local community impacts are not adequately addressed, raising concerns about exploitation under carbon market projects.

- Diverging National Interests: Tensions exist between developed and developing nations on key issues such as transparency, equitable access, and the level of flexibility allowed in carbon market rules.

- Other issues:

- Lack of clear guidelines and implementation frameworks for Non-Market Mechanism.

- Greenwashing concerns

- Oversaturation of carbon credit market with impact on price.

Way Forward

- Implement uniform and binding guidelines for reporting emission reductions to prevent double counting and ensure reliable carbon accounting.

- Independent third-party verification to ensure credits are genuine and consistent across projects.

- Develop and enforce stronger safeguards to address reversal risks, such as forest fires or changes in land-use that could negate carbon sequestration efforts.

- Establish safeguards to protect the interests of indigenous and local communities.

- Implement measures to prevent market oversaturation by controlling the issuance of carbon credits based on verified demand and quality.

Carbon Market and Carbon Trading Mechanisms in India

|