Why in the News?

Developing countries have expressed disappointment with the enhanced New Collective Quantified Goal (NCQG) on climate finance.

About NCQG

- NCQG was proposed in COP21 for setting post-2025 climate finance goal (new goal).

- In 2009 parties to UNFCCC had decided to mobilise $100 billion annually by 2020 which was subsequently extended to 2025.

- However, this target is yet to be achieved reflecting significant shortfalls in it.

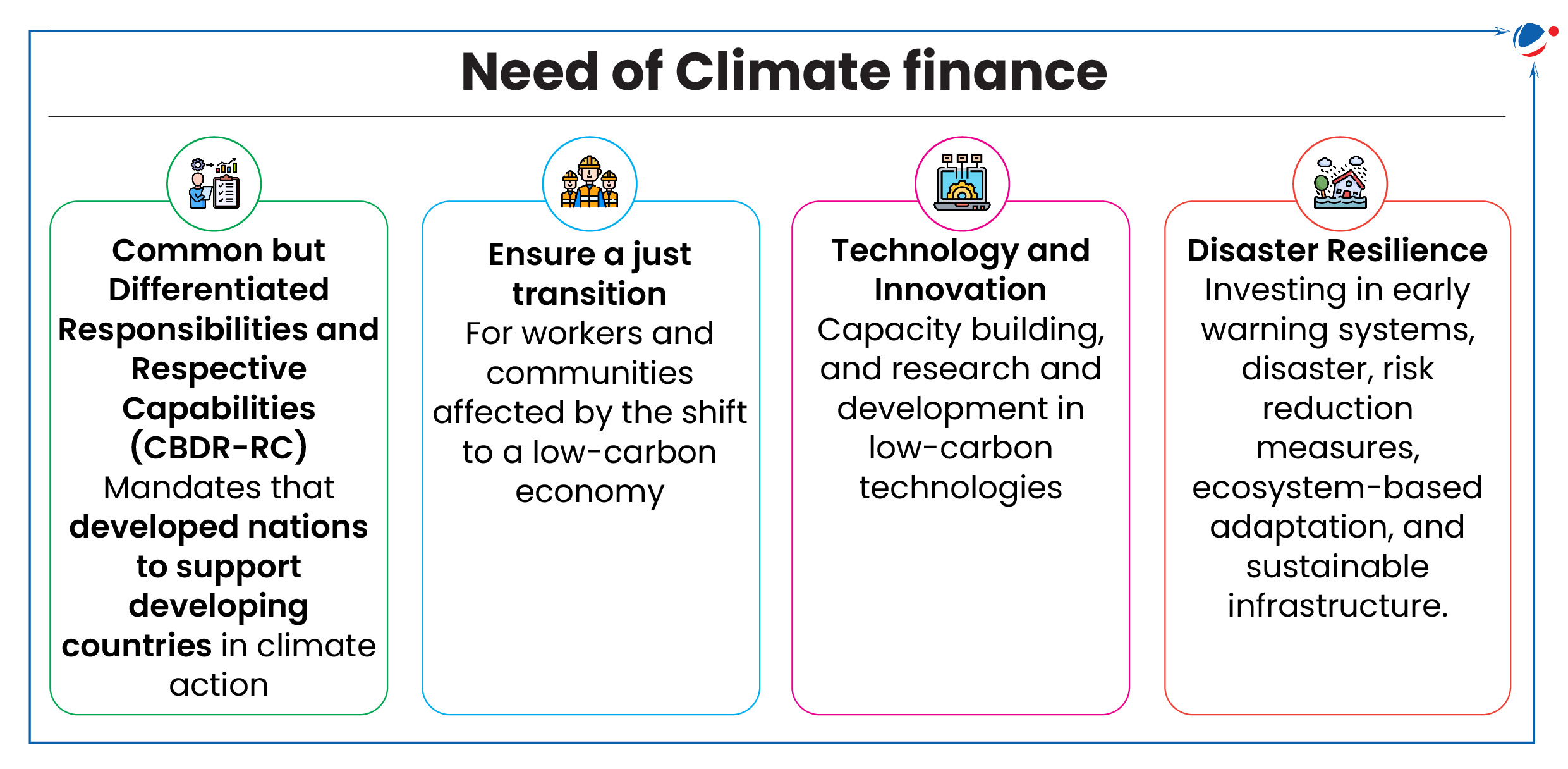

- Article 9 of the Paris Agreement stipulates that developed country Parties shall provide financial resources to assist developing country Parties.

About Climate finance

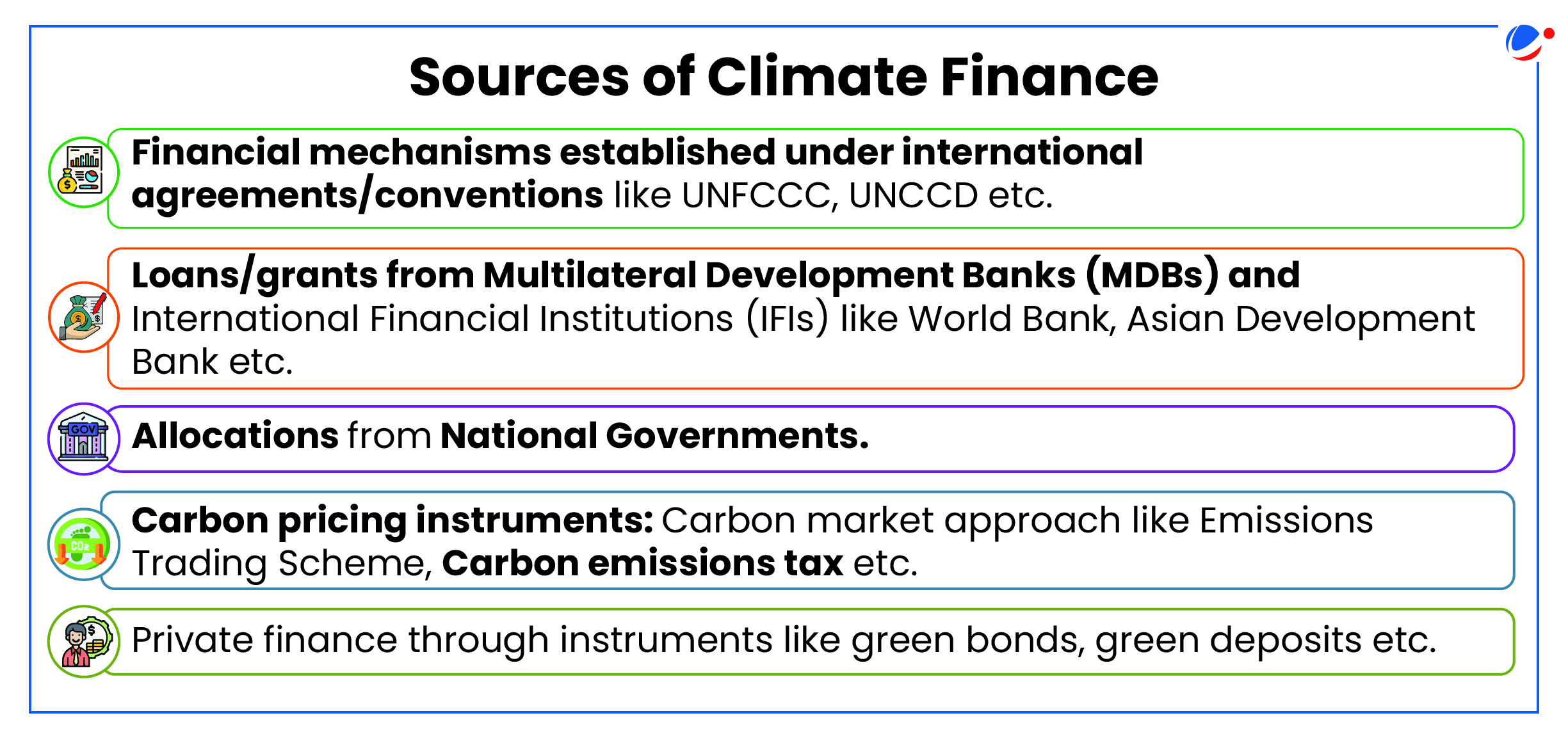

According to the UNFCCC, climate finance is local, national or transnational funding from public, private and alternative sources that seeks to support climate change mitigation and adaptation actions, particularly in developing countries that are more vulnerable to the impacts of climate change.

Global Financial mechanisms under UNFCCC | |

Loss and Damage Fund (LDF) |

|

Green Climate Fund (GCF) |

|

Adaptation Fund |

|

Special Climate Change Fund (SCCF) |

|

Least Developed Countries Fund (LDCF) |

|

Issues associated with the current climate financing

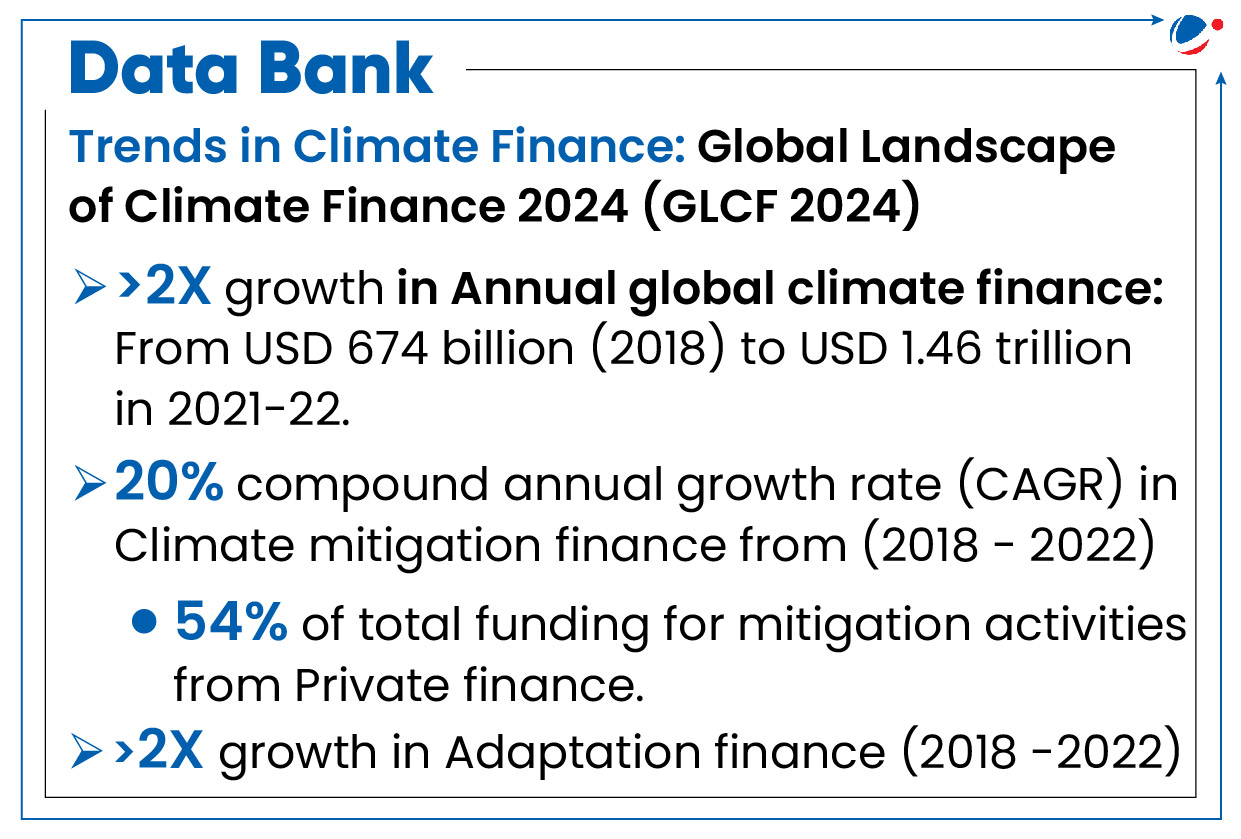

- Distributional imbalance: Advanced economies accounted for 45% of climate finance from 2018 to 2022, and least developed countries (LDCs) for only 3%. (GLCF 2024)

- Adaptation Funding Gap: Developing countries require US$215-387 billion annually against US$28 billion in 2022 (Adaptation Gap Report 2024).

- Mitigation and Adaptation imbalance: 90% of climate finance goes to mitigation actions (UNDP).

- Debt Burden: Climate finance often comes in the form of loans, increasing the debt burden of developing countries and potentially hindering their ability to invest in sustainable development.

- Nearly 94% of existing climate investment is either through debt or equity (return seeking) (Climate Policy Initiative).

- Inadequate finance: Fivefold increase needed to reach required USD 7.4tn each year through 2030 under the 1.5°C scenario (GLCF 2024).

- Other issues:

- Lack of Transparency and Accountability in how climate finance is allocated and used, raising concerns about its effectiveness and potential for misuse.

- Many developing nations struggle to access climate funds due to complex procedures, lack of technical capacity, and limited institutional frameworks.

- Inadequate Private Sector Involvement.

Climate Finance and IndiaIndia's climate finance needs

Steps taken to mobilize climate finance

|

Way Forward

- Address the Mitigation and Adaptation imbalance, ensuring resources meet immediate resilience needs.

- Explore innovative financing mechanisms like green bonds, carbon markets, and impact investing to mobilize private capital for adaptation projects.

- Adopt an Integrated approach:

- Public Funding: To manage debt and fiscal space, boost domestic resource mobilization (by carbon pricing) etc.

- Private Investment: To reduce cost of capital, expand options for concessional finance, Tapping the potential of carbon markets etc.

- Provide technical assistance to developing countries to enhance their capacity to access, manage, and effectively utilize climate finance.

- Multilateral Development Banks should work to triple lending capacity by 2030 as part of NCQG.

- Advocate principles of equity and climate justice to uphold the interests of Global south at climate negotiations.

- Use Debt-for-Climate Swaps to negotiate debt relief in exchange for investments in climate action.

- Explore Insurance for Climate Resilience, where insurers can align their climate transition plans with financing strategies, offering risk transfer tools to cover climate-related disasters and accelerating payouts for rebuilding efforts.