The FSAP report has urged India to accelerate financial sector reforms to achieve its long-term goal of becoming a USD 30 trillion economy by 2047.

Key Highlights of the Report

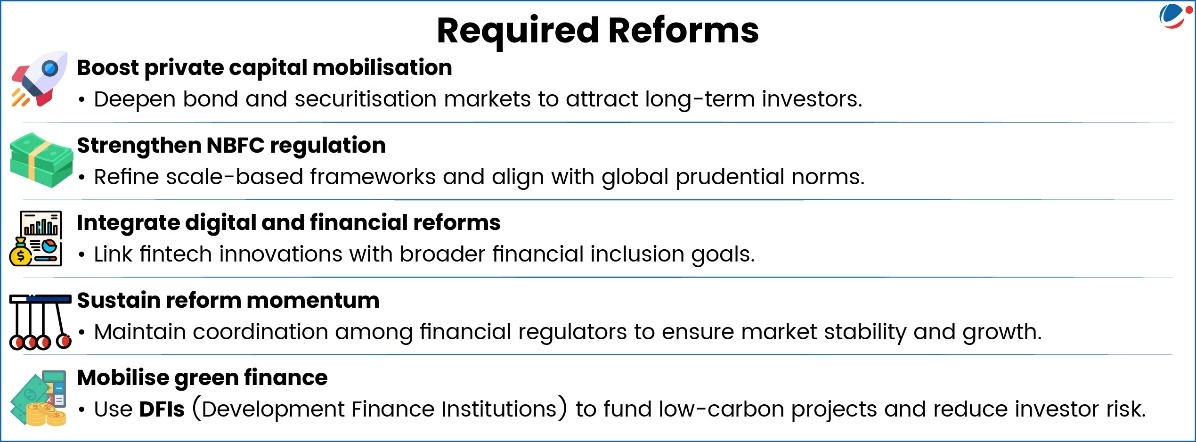

- Resilient system: Financial system is stronger and more diversified, with assets rising to about 175% of GDP (from 144% in 2017) with the state playing a dominant role.

- Digital strength: Digital public infrastructure has improved access, efficiency, and financial inclusion.

- Regulatory progress: Reforms by the RBI and SEBI have enhanced supervision, though challenges persist in NBFC oversight and risk management.

- India’s expansion of regulatory authority on cooperative banks, tightening of key prudential rules has been appreciated.

- Market development: Corporate bond and infrastructure financing remain shallow, with investors preferring government securities.

- Tax disparities: Uneven tax treatment between debt and equity discourages bond market participation.

About FSAP

|

India’s Chief Economic Advisor raised concerns regarding use of Initial Public Offering (IPO) as an exit route for early-stage investors rather than an instrument for raising long-term capital.

About Initial Public Offer (IPO)

- An IPO is the selling of securities of private companies to the public in the primary market (for the first time).

- IPO transforms a privately-held company into a public company.

- It is the largest source of funds with long or indefinite maturity for the company.

- Types of IPO: Fixed Price Issue and Book Building Issue (no fixed price, but a price band).

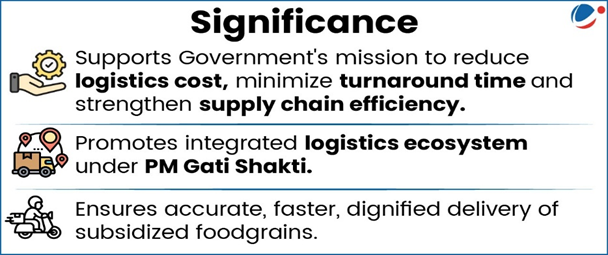

Union Minister of Consumer Affairs, Food & Public Distribution launched major digital initiatives to modernize warehousing operations, improve supply chain efficiency and enhance transparency across the Public Distribution System (PDS).

Initiative | Details |

Bhandaran 360 |

|

Smart EXIM Warehouse System |

|

ANNA DARPAN |

|

ASHA Platform |

|

Article Sources

1 sourceReleased by MoSPI the NIC is a fundamental tool for statistical surveys, censuses, economic research, and policy formulation.

National Industrial Classification (NIC) – 2025

- NIC 2025 updates the previous NIC 2008. (It was first introduced in 1962).

- It was prepared by MoSPI in alignment with the International Standard Industrial Classification of All Economic Activities (ISIC) Revision 5 developed by the United Nations Statistics Division (UNSD).

Major Changes

- Structural Change: It moves from the 5-digit coding structure of NIC 2008 to a new 6-digit coding structre. It allows for greater granularity and flexibility, enabling better representation of emerging activities.

- Recognition of indigenous sectors such as Ayush-based healthcare and the handloom industry.

- It also includes sectors like renewable energy, fintech, e-commerce, and digital intermediation.

Salient Features of NIC 2025

- Enhanced Classification of Intermediation Services: New classes have been created to reflect the growing role of intermediaries in sectors such as power, retail, logistics, healthcare, and education.

- Representation of Digital Economy: Cloud infrastructure, blockchain, platform-based services, and web search portals are distinctly classified.

- Integration of Environmental and Green Economy: Expanded coverage includes activities related to carbon capture, waste management, and environmental remediation, better aligning with SDGs.

- Classification is technology agnostic: It means distinctions of activities are not made based on whether an activity is carried out by means of traditional or modern production techniques.