Why in the News?

The Parliamentary Standing Committee on Finance recently tabled its Report titled "Review of Working of Insolvency and Bankruptcy Code (IBC) and Emerging Issues".

More on the News?

- The report evaluates the evolution of the IBC since 2016, noting that while it has improved India's "Resolving Insolvency" rank from 136 to 52, it currently faces significant systemic hurdles.

- Concurrently, a Lok Sabha Select Committee also submitted its recommendations on the Insolvency and Bankruptcy Code (Amendment) Bill, 2025, highlighting the need for critical reforms.

About the Insolvency and Bankruptcy Code, 2016 (IBC)

|

Successes and Behavioral changes due to IBC

- Post-Resolution Revival: Resolved firms demonstrated significant operational and financial turnarounds, with average sales increasing by 76% in the three years following resolution and total assets growing by approximately 50%.

- Improved Credit Culture: Substantial reduction in the average number of days loan accounts remain "Overdue," dropping from a range of 248–344 days to 30–87 days post-IBC.

- Debt Settlement outside the Code: The IBC's deterrent effect has led to the settlement of significant debt before formal admission.

- Liquidity Improvement: Liquidity improved by about 80% in the post resolution period.

Key Issues Identified by the Committee include:

- Low Recovery Rates and Asset Valuation

- Excessive Haircuts: While creditors realise approximately 170% of the liquidation value, the overall recovery against total admitted claims is only 32.8%.

- Timing of Admission: Firms often enter the IBC process when their assets are already heavily stressed or eroded, leading to lower realisations.

- Valuation Inconsistency: There is a lack of transparency and uniform standards in asset valuation.

- Statutory Overlaps and Legal Conflicts

- Conflict with PMLA: The Enforcement Directorate's authority to attach assets under the Prevention of Money Laundering Act (PMLA) often conflicts with the IBC's "clean slate" principle, deterring potential bidders.

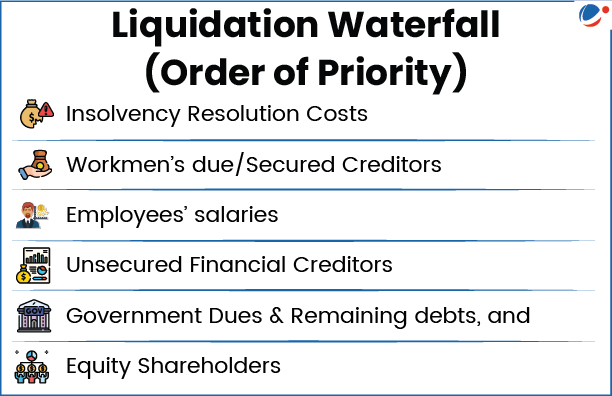

- Government Dues: There is ongoing ambiguity regarding the status of government and statutory dues in the "waterfall mechanism" (the order of priority for payments), particularly following conflicting judicial pronouncements.

- Delays & Backlogs: CIRP takes 713 days on average vs the 330-day limit, Frequent appeals and frivolous litigation delay resolution.

- MSME Related Issues: PPIRP has low uptake (only 14 cases by March 2025). There is a misuse of MSME registration to gain concessions.

- Governance Concerns: Concerns exist regarding excessive powers and possible conflicts of interest of Resolution Professionals (RPs). Also, there is no enforceable Code of Conduct for the Committee of Creditors (CoC).

- Cross-Border Insolvency: India currently lacks a robust framework for handling insolvency where assets are spread across multiple international jurisdictions.

- Implementation Gaps

- Insolvency and Bankruptcy Fund: Although provided for in the original Code, this fund remains unoperationalised, which could otherwise support resource-strapped proceedings or capacity building.

- Technological Deficit: The committee noted that while e-courts exist, there is a lack of technological fluency among some judges and a need for a dedicated cadre of IT professionals to support the NCLT.

Key Recommendations by Report:

- Strengthening Judicial and Institutional Capacity: Expansion of NCLT/NCLAT Benches to clear backlog. Consider establishing special fast-track courts for to handle high-value accounts and ensure expeditious disposal.

- Immediate operationalisation of the Insolvency and Bankruptcy Fund & notify dedicated Rules of Procedure specifically tailored for IBC matters, providing fixed timelines for filing and enhancing the role of the Registry.

- Reducing Delays & Frivolous Litigation: Deterring Frivolous Litigation by imposing mandatory deposits for unsuccessful bidders filing appeals.

- Use a compliance checklist for RPs and CoC and introduce advance rulings and promote mediation.

- Improving Recovery Rates & Asset Valuation: Shift from liquidation value to enterprise value to better reflect a company's potential and reduce the "haircuts" taken by creditors.

- Encourage global competitive bidding & Strengthen oversight of valuers with SOPs and audits.

- Enhancing Accountability: Introduce RP monitoring mechanisms and specialised training. Empower the CoC in RP appointment/removal. Enable time-bound forensic audits with inter-agency coordination.

- Stakeholder Reforms: Simplify PPIRP for MSMEs. Review the waterfall mechanism for fairer distribution.

- A transparent online mechanism should be established for issuing "no dues" certificates and statutory clearances immediately upon completion of a resolution plan.

- Cross-Border Insolvency: The committee recommends the selective adoption of the UNCITRAL Model Law on Cross-Border Insolvency, with modifications suited to India's financial and legal framework.

- Technological Integration: The Ministry of Corporate Affairs should accelerate the Integrated Technology Platform (iPIE) for centralised case management and train judges to improve technological fluency.

Conclusion

The committee's recommendations represent a significant shift towards viewing insolvency and liquidation as a seamless continuum. While the IBC improved GNPA ratios, it must evolve from a liquidation tool into a rescue mechanism. Restoring its time-bound mandate requires strengthening judicial infrastructure, closing loopholes, and enforcing stakeholder discipline to prioritize business revival over terminal liquidation.