Why in the News?

The Chief Executive Officer of NITI Aayog recently released a comprehensive report titled "Deepening the Corporate Bond Market in India".

About corporate bond and corporate bond Market

- Corporate bonds are debt securities where an investor lends money to a company in exchange for regular interest payments and principal repayment at maturity.

- Corporate yield measures the effective rate of return. It is not fixed, like a bond's stated interest rate.

- It changes to reflect the price movements in a bond caused by fluctuating interest rates.

- Corporate bonds tend to rise in value when interest rates fall, and they fall in value when interest rates rise.

- Corporate yield measures the effective rate of return. It is not fixed, like a bond's stated interest rate.

- Corporate bond market is a financial marketplace where public sector or private sector companies issue debt securities (bonds) to raise capital from investors on a long-term basis, rather than borrowing from banks or selling ownership stakes (equity).

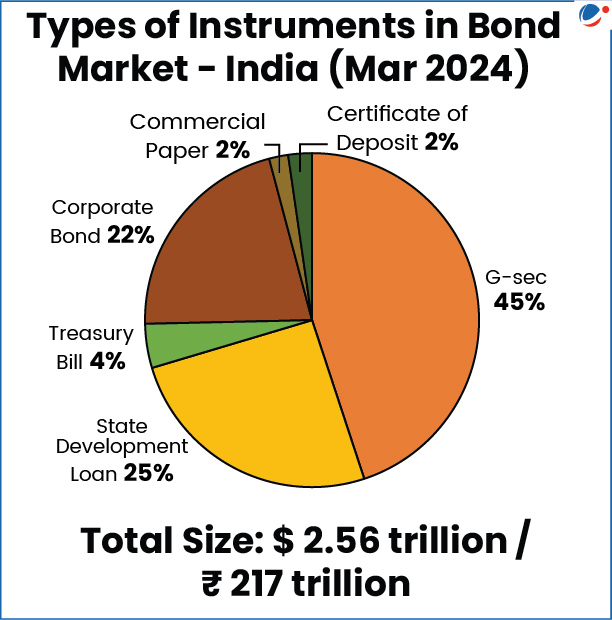

- India's corporate bond market is approximately ₹53.6 trillion (FY25), having grown at a Compound Annual Growth Rate (CAGR) of nearly 12% over the last decade.

- At approx. 15-16% of GDP, it remains much smaller compared to South Korea (79%), Malaysia (54%), and China (38%).

- Around 98% of corporate bond issuances in India are conducted via private placements, which are primarily accessed by institutional investors and are not available to the public.

Significance of a resilient Corporate Bond Market for India

- Reducing Bank Dependence: It provides a stable alternative to bank credit, reducing systemic concentration risks and allowing banks to focus on priority sectors like rural credit and MSMEs.

- A deeper bond market also reduces the need for frequent government recapitalisation of stressed banks and easing fiscal pressures.

- Long-Term Financing: Bonds are better suited for long-gestation projects like infrastructure, as they offer long-duration returns that align with the liability structures of institutional investors.

- Monetary Policy Transmission: Bond yields often respond more immediately to RBI rate cuts compared to bank lending rates, facilitating more efficient transmission of monetary policy.

- Risk Transfer Mechanisms: A deeper market supports the development of risk mitigation tools such as Credit Default Swaps (CDS), bond insurance, and securitization, allowing investors to transfer risk to others who are willing to take it.

- Financing Emerging Priorities: It is central to mobilizing capital for the green and digital transitions, bridging infrastructure gaps, and supporting technology-intensive manufacturing.

- Urban Development: A well-developed market paves the way for a robust municipal bond market, empowering local governments to raise capital for essential public services and urban infrastructure.

Structural Barriers that impede Bond Market's full potential

- Regulatory Overlap: The market is governed by multiple authorities, including SEBI, RBI, and the Ministry of Corporate Affairs (MCA), leading to coordination challenges and overlapping compliance requirements.

- Extensive Disclosure Requirements: Stringent disclosure and lengthy approval processes for public issues make them costly and unattractive, particularly for lower-rated or infrequent issuers.

- Credit Rating Concentration: The Indian market is heavily skewed toward top-rated issuers, with AAA and AA bonds accounting for 94% of total issuances in 2023.

- Conversely, in the US and EU, AAA issuances make up only 1% and 2% of the market.

- Investor Constraints: Insurance companies and pension funds face regulatory restrictions preventing investment in bonds rated below 'AA', restricting capital flow to lower-rated but viable projects.

- Weaknesses in Credit Rating Agency (CRA) Framework: The rating ecosystem faces challenges including potential conflicts of interest from the "issuer-pays" model, high entry barriers for new CRAs, and instances of "rating shopping."

- Limited Secondary Liquidity: India has a persistent "buy-and-hold" investment culture.

- Tax Asymmetry: Corporate bonds lack tax parity with equity and other savings instruments. Interest is taxed at slab rates, and recent changes removed indexation benefits for long-term capital gains, reducing attractiveness compared to equities.

- Weak Recovery Confidence: While the Insolvency and Bankruptcy Code (IBC) has improved recovery, procedural delays (averaging 713 days vs. the 330-day statutory limit) still weigh on investor confidence.

Key Initiatives regarding the Bond Market in IndiaBy SEBI

By RBI

By Union Government

|

Way Forward

Niti Aayog recommends a three-phased reform strategy to reach a market size of ₹100–120 trillion by 2030:

- Phase I (Short Term: 1–2 years): Focus on streamlining regulations across agencies (SEBI, RBI, MCA), standardizing disclosure norms, and refining the shelf prospectus to allow faster market access for reputed issuers.

- Phase II (Medium Term: 2–4 years): Revamping the IBC waterfall mechanism, increasing judicial capacity at the NCLT, and establishing a Unified Market Development Task Force.

- Phase III (Long Term: 4–6 years): Transitioning toward a fully integrated ecosystem with a potentially independent bond market regulator and a blockchain-enabled end-to-end digital infrastructure for issuance and settlement.

Conclusion

A strong corporate bond market is vital for mobilising long-term capital and reducing stress on banks. With regulatory coordination, wider investor participation, and faster insolvency resolution, it can become a key driver of India's sustainable and infrastructure-led growth towards a US$30 trillion economy by 2047.