Why in the News?

The Securities Markets Code, 2025 has been referred to the Parliamentary Standing Committee on Finance.

More about the News

- The Bill seeks to consolidate, rationalise, and replace three major decades-old laws:

- The Securities Contracts (Regulation) Act (1956)

- The Securities and Exchange Board of India (SEBI) Act, (1992)

- The Depositories Act (1996)

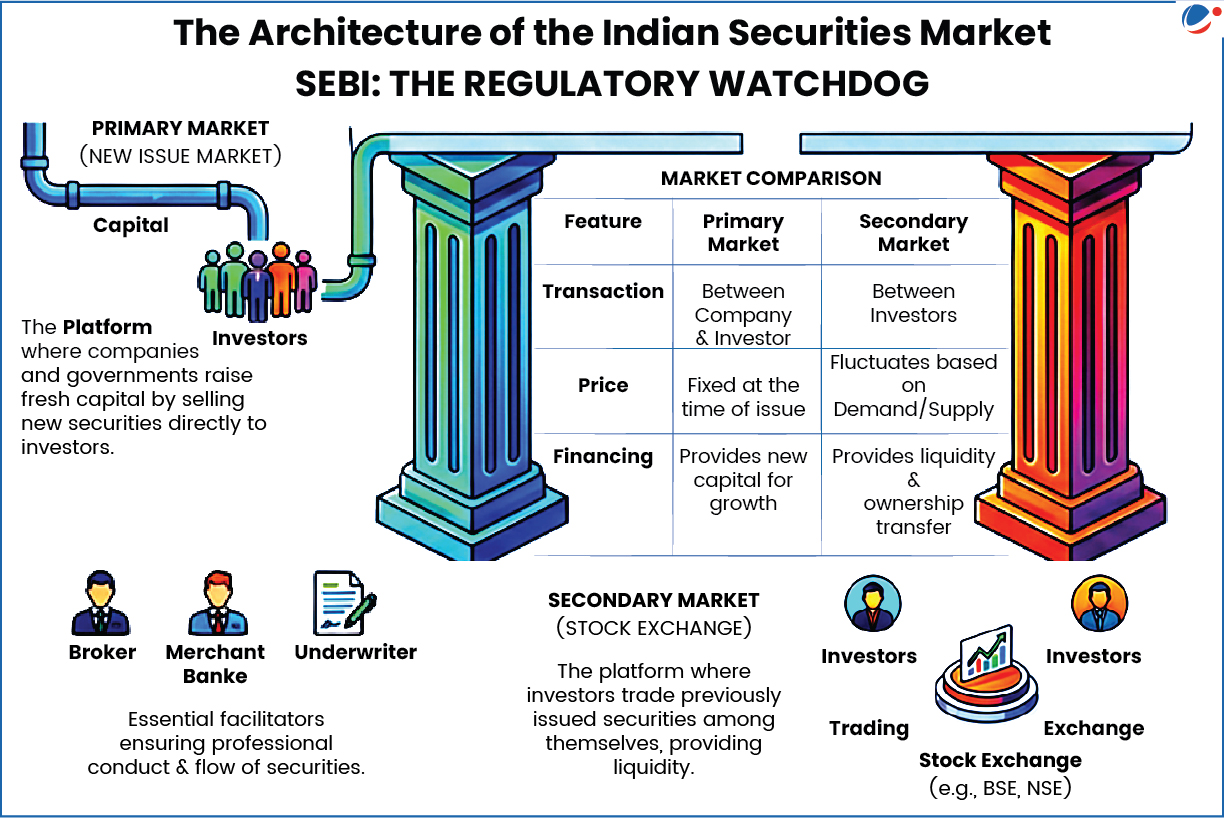

- Overall, it seeks to further streamline the role of Securities and Exchange Board of India (SEBI), ease compliance and inspire investor confidence in the Indian Securities Market.

About SEBI (HQ: Mumbai. Regional Offices: New Delhi, Kolkata, Chennai, Ahmedabad)Genesis

Objectives

Role & Functions

Powers of SEBI

|

Key Achievements of SEBI in Market Regulation

- Settlement Cycle: Implemented the T+1 settlement cycle in January 2023 (making India the second major market after China to do so) and is piloting T+0 and instant settlement.

- Dematerialization: Eliminated physical share certificates and associated risks (theft, forgery) through the Depositories Act, 1996.

- IPO Reforms: Introduced ASBA (Applications Supported by Blocked Amount), ensuring IPO funds leave the investor's account only upon allotment.

- Grievance Redressal: Launch of SCORES (SEBI Complaints Redress System), now upgraded to SCORES 2.0, to auto-route and expedite investor complaints.

- Algo Trading Rules: Established a framework requiring mandatory exchange approval for algorithms and unique "Algo IDs" to prevent market manipulation.

- Market Safety: Curbed excessive retail risk in derivatives, reducing Futures & Options volumes by over 50% through stricter norms.

Challenges facing SEBI

- Algorithmic and High-Frequency Trading: The rise of retail participation in algorithmic trading poses risks of market manipulation.

- Cryptocurrency Regulation: There is a regulatory vacuum regarding cryptocurrencies. While they are taxed (30% on gains), they are not formally regulated by SEBI, leading to issues with money laundering, offshore migration of trading volumes, and lack of investor protection.

- Surveillance and High-Profile Investigations: Recent controversies, such as the Hindenburg-Adani allegations, have tested SEBI's surveillance capabilities.

- Critics argue that SEBI has struggled to identify ultimate beneficial owners in offshore funds and detect complex market manipulations.

- Retail Risk in Derivatives: There has been an exponential rise in retail trading in Futures and Options (F&O), where retail investors lose substantial amounts (approx. ₹60,000 crore/year). Balancing market freedom with investor protection through stricter curbs remains a challenge.

- Technological Glitches: As the market relies heavily on technology, SEBI faces the challenge of managing technical glitches at Market Infrastructure Institutions (MIIs) and ensuring operational resilience.

Key Provisions of Securities Markets Code Bill, 2025

- Increased Board Strength: The SEBI Board will expand from 9 to 15 members, including the Chairperson, 1 RBI officer, 2 officials from the Central Government, and 11 other members (at least five being whole-time).

- Delegation: The Bill empowers SEBI to delegate parts of its registration functions to Market Infrastructure Institutions (MIIs) and Self-Regulatory Organisations (SROs) to facilitate more effective regulation.

- Simplified legal language: Removes obsolete and redundant provisions, avoids duplication and ensures uniform regulatory procedures.

- Expanded Definition of Securities: Definition is widened to expressly include hybrid instruments, electronic gold receipts, zero coupon zero principal instruments, and onshore rupee bonds issued by multilateral institutions.

- Conflict of Interest: All SEBI members must disclose any direct or indirect interest (including those of family members) and recuse themselves from relevant deliberations.

- The government is empowered to remove members whose financial interests might prejudice their functions.

- Arm's Length Separation: The Bill mandates a statutory separation between investigation and adjudication functions.

- Currently a long-standing criticism of the current SEBI Act is that the investigative and adjudicatory powers coexist within the same organization.

- Decriminalisation: Contraventions are classified into two categories.

- Market abuse (insider trading, defrauding investors) remains an offence attracting criminal liability,

- Minor or technical contraventions are shifted to civil penalties.

Conclusion

The Securities Markets Code Bill, 2025, represents a significant step toward modernizing India's financial legal architecture. By streamlining three major Acts into a single code, it aims to enhance ease of doing business, strengthen investor protection through the Ombudsperson, and make the Indian securities market more resilient and technology-driven.